Megacap tech has been the leader this year, with just a handful of stocks responsible for a bulk of the gains in the S&P 500.

To shareholders’ delight, Google parent Alphabet (GOOGL) (GOOG) has been a part of that cohort.

With the S&P 500 recently entering a new bull market (on a technical basis), megacap tech's performance has become all the more important.

When one looks at the immense gains of FAANG, it’s not hard to see how this group has powered the indexes back into the bulls’ favor.

Don't Miss: Tesla Stock: Buy the Dip but Use Caution

Meta (META) has more than doubled (up 125%) this year, while Netflix (NFLX) and Amazon (AMZN) are each up 50%. Apple (AAPL) shares are up 42% so far in 2023 and are at new all-time highs.

That leaves Alphabet as the so-called laggard, even though the stock is up about 40% on the year.

On the one hand, that creates some concern for investors to own the weakest name in the bunch. On the other hand — and much as things have panned out with Netflix — Alphabet stock could be a catchup play among the group.

Trading Alphabet Stock

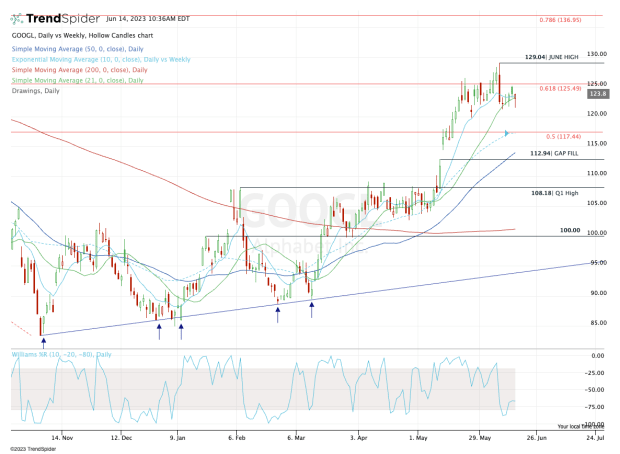

Chart courtesy of TrendSpider.com

After a volatile first quarter, Alphabet stock finally broke out in May. The shares quickly vaulted from the $105 area up to the 61.8% retracement near $125.50.

Amid the rally, the shares were able to grind up to a 52-week high of $129.04. Now they're wobbling a bit, and Alphabet is gyrating around its 10-day and 21-day moving averages.

Can it continue its upside push?

Don't Miss: Upstart Stock Has Almost Tripled; Here's the Trade

Given how responsible megacap tech has been for the stock market’s gains this year, Alphabet likely needs the S&P 500 to continue higher — or at the very least to consolidate without giving up much ground.

Dip buyers should look for a pullback to the rising 10-week moving average near $117. A further dip would put the gap-fill and rising 50-day moving average in play near $113.

Below that and a full retest of the $108 breakout area (and first-quarter high) could be in the cards.

Among the three choices, the 50-day moving average and gap-fill combination would be an attractive opportunity for bullish traders.

On the upside, a move over $125 could put the June high back in play at $129. Above that and Alphabet stock could continue to push higher to the 78.6% retracement near $137.

Receive full access to real-time market analysis along with stock, commodities, and options trading recommendations. Sign up for Real Money Pro now.