President Donald Trump rocked the auto industry when he announced 25% imports on vehicles and car parts, and then followed up the blow with “reciprocal” tariffs on U.S. trading partners.

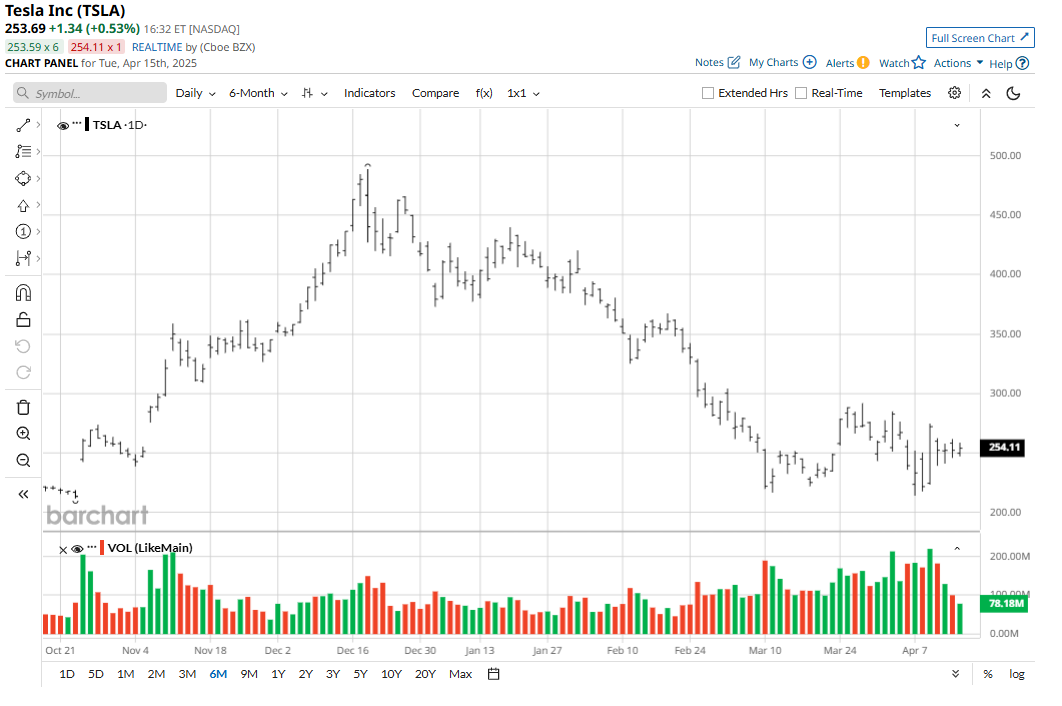

Electric vehicle makers like Tesla (TSLA) have not been immune from the pain. Tesla, led by CEO Elon Musk, has seen its stock unravel in 2025 amid sluggish sales, brand backlash, and mounting macroeconomic pressures. The broad-based market selloff triggered by tariff announcements has only worsened the blow for TSLA investors.

Also hurting matters is the fact that one of Tesla’s biggest bulls has sounded the alarm. Dan Ives of Wedbush slashed his price target for Tesla, citing the “double whammy” of tariff fallout and intensifying brand damage. With a future customer base already shrinking and confidence wobbling, is it time to hang on to the EV stock or let go before darker clouds roll in? Let’s dig in.

About Tesla Stock

Texas-based Tesla (TSLA) has redefined mobility, automation, and energy, evolving beyond an automaker into a technological force. With a market cap of $811 billion, the automaker stands among the elite Magnificent Seven.

Tesla just logged its worst quarter since 2022, tumbling 32% in the first three months of 2025. It has been the hardest hit among the Mag 7 this year as post-election hype fades, fundamentals weaken, vehicle sales decline, tariff worries under Trump grow, and backlash over Musk’s political ties intensifies.

Still, zoom out, and TSLA is up 57.4% over the past 52 weeks.

Tesla’s Q4 Results Falls Short of Projections

Tesla posted a sluggish Q4 earnings report on Jan. 29, missin full-year 2024 delivery targets and falling short of top- and bottom-line forecasts. Revenue crept up just 2% year over year to $25.7 billion, falling below expectations, while auto sales dropped 8% despite aggressive price cuts. Adjusted EPS rose 3% to $0.73 but still disappointed.

Skipping firm fiscal 2025 guidance, the company called the year “seminal,” putting Full Self-Driving tech in the spotlight. Tesla is chasing unsupervised autonomy and robotaxis in select U.S. markets, with plans to bring FSD (Supervised) to Europe and China. Musk envisions an “epic” 2026 and a “ridiculously good” road ahead, fueled by AI, autonomy, and the Optimus humanoid robot.

Tesla’s Q1 vehicle sales story was another disappointment. It delivered just 336,681 vehicles, down 13% year-over-year, marking its weakest quarter in nearly three years. Sales slipped as global competition heated up, Model Y fatigue set in, and backlash over Musk’s political moves took a toll on the brand’s shine.

Tesla is anticipated to unveil its fiscal Q1 earnings report on Tuesday, April 22, after the market close. Analysts tracking Tesla predict its bottom line for the quarter to surge 2.9% year over year to $0.36 per share, while revenue is anticipated to be around $21.9 billion.

Looking ahead to fiscal 2025, EPS is expected to be around $2.18, up 6.9% year-over-year, before surging by another 41.7% annually to $3.09 in fiscal 2026.

What Do Analysts Expect for Tesla Stock?

Wedbush’s Dan Ives rates TSLA “Outperform” but just cut his price target nearly in half - from $550 to $315. The reason is a mounting “double whammy” of Trump’s tariff threats and Tesla’s deepening brand crisis.

Ives warns that rising costs and political backlash are slamming margins while eroding consumer trust, especially in China, where Musk’s alignment with the Trump campaign could drive buyers toward local EV giants like BYD (BYDDY). Tesla, once the face of innovation, is now a polarizing symbol.

Wedbush estimates the company has already lost at least 10% of its future customer base due to “self-created” brand issues, stemming largely from Elon Musk’s controversial public behavior and political associations. Ives urges Musk to “read the room” and lead through the storm - or face even darker days ahead.

TSLA stock has a consensus “Hold” rating overall, but bullish sentiment is rising. Among 41 analysts covering TSLA stock, 16 stand firm with a “Strong Buy,” up from 15 analysts a month back. Meanwhile, three advocate a “Moderate Buy,” 12 advise a “Hold,” and 10 suggest a “Strong Sell.”

Tesla has a mean target price of $306.39, implying 20% upside could be in play. However, the Street-high target of $488 suggests the stock could rally as much as 92% from the current level.

Tesla navigates a shifting landscape of falling sales, rising rivals, and backlash from Musk’s political entanglements, all of which have been intensified by Trump-era tariff shocks. With momentum fading and uncertainty growing, the brand’s grip on the EV crown feels shakier.