Perhaps you’ve heard of QLACs and want to learn more about how you might incorporate one into your plan for retirement income, but you feel like you don’t have quite enough information.

No wonder.

A well-written and thoughtful op-ed in the New York Times about reducing risk in retirement did mention annuities, but to my chagrin, it didn’t bring up the value of QLACs, despite:

- Government endorsement of QLACs’ significant retirement benefits

- A competitive QLAC marketplace, with top-rated insurance carriers

- Flexible planning software that can show you how to integrate a QLAC into your retirement plans

- QLAC rates are at an all-time high ─ for a new retiree, an average of 80% better than three years ago

Check out the rates for yourself by visiting our QLAC Calculator.

Unique tax benefits plus more

Happily, you might have read my article This Underused IRA Option Offers Both Tax Benefits and Income Security to quickly learn about the basic aspects of QLACs and how they provide guaranteed income later in retirement while deferring RMD payments for a decade or more. That tax benefit can be worth $50,000 or more for a retiree who elects a maximum QLAC.

The most important uses of a QLAC, however, involve the ways you can integrate it into your retirement plan with other asset classes, including your IRA account value and home equity.

In those cases, not only does a QLAC provide income, but it also can help pay for costs like long-term health care.

This article lists multiple ways to take full advantage of a QLAC to manage retirement risk and create income for specific retirement needs and wants.

Managing retirement risks with a QLAC

We are often surprised when visitors to our site focus solely on the QLAC tax benefits and less on what these high amounts of lifetime guaranteed income can be used for.

We’re surprised because Sally, the 70-year-old woman we use as an example consumer, has a 50% chance of living to age 85 and beyond — and should need income possibly into her 90s.

She also has a similar probability of needing to cover long-term care costs occurring late in retirement. It’s better to manage risk ahead of those potential needs and create future income to address them.

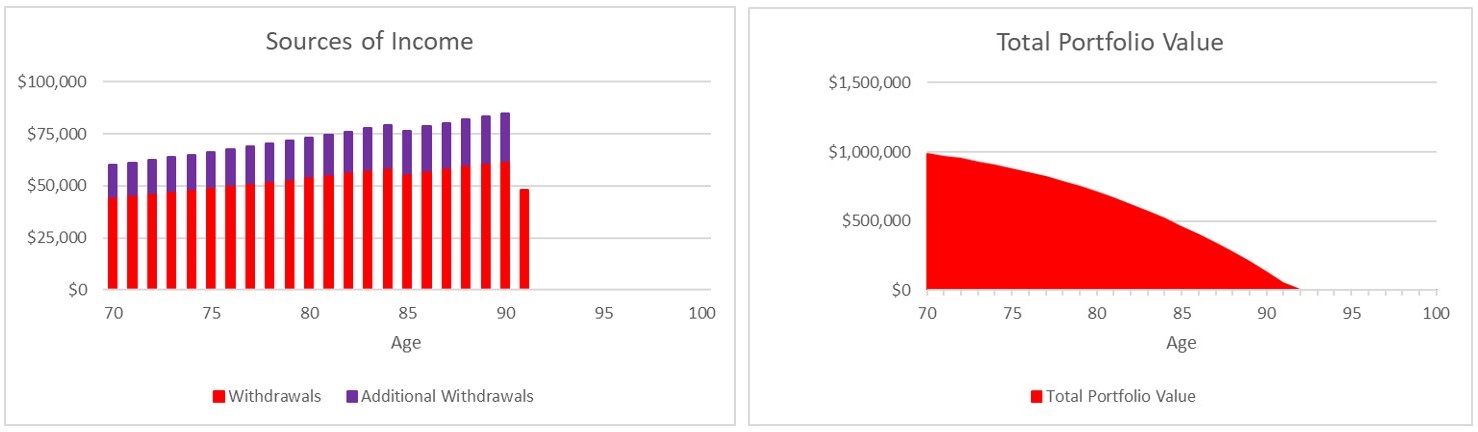

Sally’s original plan. In Sally’s case, with the $1 million in her IRA account, she wants income of $60,000 per year (growing with 2% inflation) and not just the $40,000 she would take if she followed the well-known but tired 4% rule.

If she adopts a retirement plan without a QLAC and allocates 30% of her savings to equities ($300,000), with the balance to fixed income ($700,000), her starting income could be $60,000.

However, assuming a blended portfolio return of between 4% and 4.5%, she runs out of money at age 90, a scary fact that is illustrated in the charts below.

Even with the relatively low 30% allocation to stocks, she still has investment risk, and because of that will likely invest more in short-term funds with lower returns as her account begins to run low.

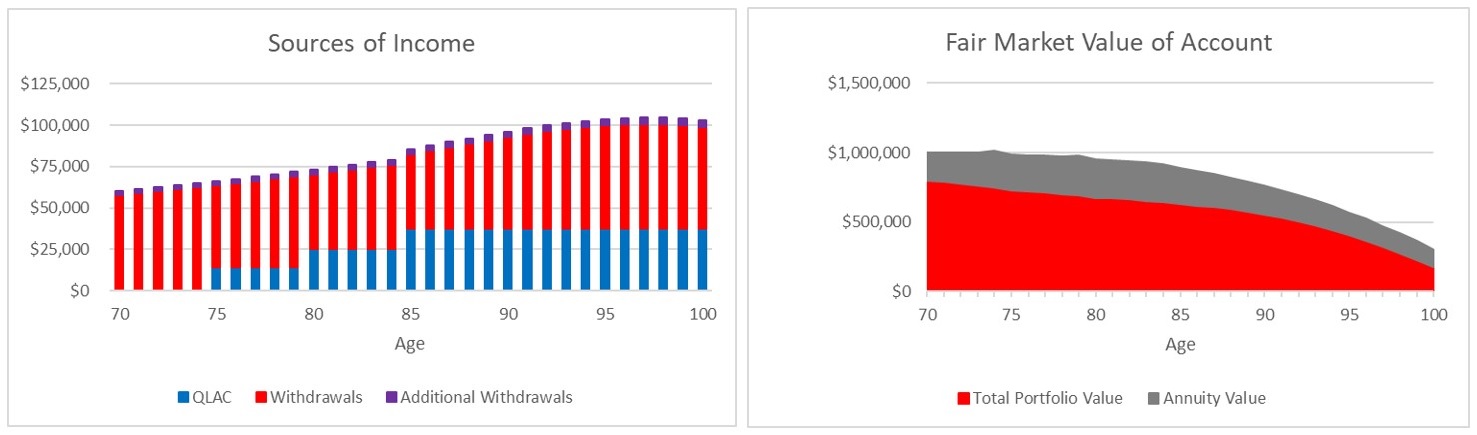

Sally’s plan with a QLAC. When Sally instead allocates $200,000 to a QLAC in a “laddering” strategy that adds more guaranteed income at her age 75, 80 and 85, and with $400,000 allocated to equities and $400,000 to fixed income, she does not run out.

Her IRA account decreases with RMDs she can’t escape after 85, but she still leaves a legacy because the QLAC is the source for nearly one-third of her late-in-retirement income.

To those who ask why Sally needs all that income late in retirement, we’d point to the health-related costs that she could face.

Other specific uses for her QLAC income

Once you understand the power of QLACs as evidenced above, there are multiple applications:

Provide a hedge against a reduction in Social Security benefits. Most pundits think the government will bail out the Social Security system, but the possibility remains that without government action, benefits could be cut significantly around 2033.

For those impacted, by shifting some of your IRA account value to a QLAC, you can guarantee yourself a large increase in income starting at, say, age 80 or 85. The new payments could bolster your capacity to cover bills and even splurge on the grandkids.

Charitable contributions. You’d like to continue to be charitable late in retirement, so you can earmark a portion of your QLAC payment to give to your favorite non-profit each year. The gifts are deductible, another tax benefit.

Payment of premiums on life insurance or long-term care insurance. Regular recurring insurance premiums can increase every year (and in any event can represent a large percentage of your budget), but if you stop paying these premiums, you could lose the benefit.

QLAC annuity payments are an effective way to protect your legacy for the next generation.

For instance, your QLAC income can cover the rising cost of your LTC insurance premiums, and instead of relying on savings to pay for a stay in a rehabilitation facility, let your LTC policy pay for it.

Payment of recurring caregiver expenses. The same is true for costs you may incur for a home health aide. Even when you don’t need to go to a nursing home, you may require special help at home to get over an illness or take care of your daily needs.

The extra QLAC income could pay a professional caregiver or a family member who gives up a job to provide support in this way. Again, the difference in outlay could amount to tens of thousands of dollars a year.

Payment of interest on a forward or reverse mortgage. Perhaps you are paying off a mortgage you took out at 60 for a new house or an addition to your existing house. Or you could have set up a reverse mortgage to pay other expenses.

A QLAC could pay the interest on the reverse mortgage, which means the money owed when the house is sold will not include the cumulative interest paid by a QLAC. This has the same effect on the reverse mortgage’s net line of credit. See my article A Different Way to Approach Your Mortgage in Retirement for more information on this. I will share more about QLACs and home equity in my next article.

The unexplored benefit of a QLAC

I like to say, “A QLAC doesn’t make your retirement. It makes it better.” Consumers can build a more efficient plan to free up income and increase liquidity to help them take care of the big stuff that might come up in retirement. One of the benefits of a QLAC is the most important to remember: In all cases, the QLAC income is guaranteed and continues for life.

Especially now, as the stock market has lost as much as 20% for certain indices and retirees are worried about their 401(k)/IRA account balances and resulting income, the value of a plan like Sally’s makes even more sense. You can build a version here, suited to your specific needs.