Phreesia (NYSE:PHR) will release its quarterly earnings report on Monday, 2024-12-09. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Phreesia to report an earnings per share (EPS) of $-0.27.

The market awaits Phreesia's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

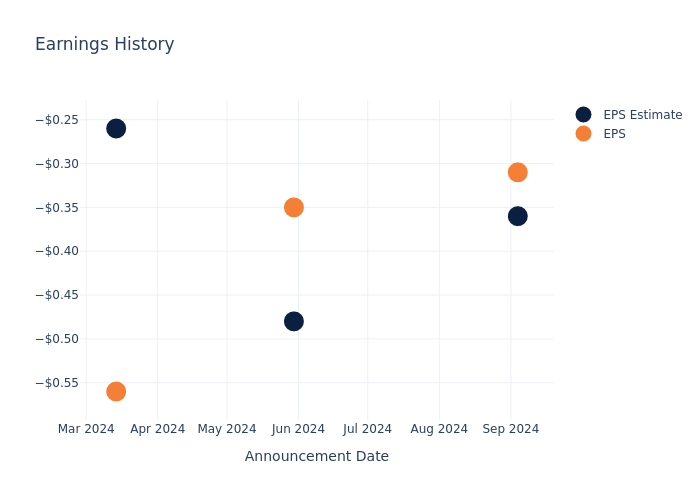

Past Earnings Performance

Last quarter the company beat EPS by $0.05, which was followed by a 6.29% increase in the share price the next day.

Here's a look at Phreesia's past performance and the resulting price change:

| Quarter | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 |

|---|---|---|---|---|

| EPS Estimate | -0.36 | -0.48 | -0.26 | -0.36 |

| EPS Actual | -0.31 | -0.35 | -0.56 | -0.58 |

| Price Change % | 6.0% | -11.0% | 5.0% | 21.0% |

Analyst Insights on Phreesia

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Phreesia.

Phreesia has received a total of 2 ratings from analysts, with the consensus rating as Neutral. With an average one-year price target of $25.5, the consensus suggests a potential 20.68% upside.

Peer Ratings Overview

In this comparison, we explore the analyst ratings and average 1-year price targets of Evolent Health, HealthStream and Schrodinger, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- As per analysts' assessments, Evolent Health is favoring an Outperform trajectory, with an average 1-year price target of $26.3, suggesting a potential 24.47% upside.

- As per analysts' assessments, HealthStream is favoring an Neutral trajectory, with an average 1-year price target of $31.5, suggesting a potential 49.08% upside.

- For Schrodinger, analysts project an Outperform trajectory, with an average 1-year price target of $26.5, indicating a potential 25.41% upside.

Peer Metrics Summary

The peer analysis summary presents essential metrics for Evolent Health, HealthStream and Schrodinger, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Phreesia | Neutral | 18.97% | $69.30M | -7.15% |

| Evolent Health | Outperform | 21.60% | $80.69M | -2.99% |

| HealthStream | Neutral | 3.92% | $48.62M | 1.62% |

| Schrodinger | Outperform | -17.10% | $17.73M | -8.26% |

Key Takeaway:

Phreesia ranks at the top for Revenue Growth among its peers, showing the highest percentage increase. It is at the bottom for Gross Profit, indicating the lowest profit margin. In terms of Return on Equity, Phreesia is also at the bottom, reflecting a negative percentage. Overall, Phreesia's performance is mixed compared to its peers, excelling in revenue growth but lagging in profitability and return on equity.

Discovering Phreesia: A Closer Look

Phreesia Inc is a provider of comprehensive software solutions that improves the operational and financial performance of healthcare organizations by activating patients in their care to optimize patient health outcomes. Through its SaaS-based technology platform, it offers healthcare services clients a robust suite of integrated solutions that manage patient access, registration, payments, and clinical support. The Phreesia Platform encompasses a comprehensive range of technologies and services, including, but not limited to, initial patient contact, registration, appointment scheduling, payments, and post-appointment patient surveys.

Breaking Down Phreesia's Financial Performance

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Phreesia displayed positive results in 3 months. As of 31 July, 2024, the company achieved a solid revenue growth rate of approximately 18.97%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Health Care sector.

Net Margin: Phreesia's net margin is impressive, surpassing industry averages. With a net margin of -17.64%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of -7.15%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Phreesia's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of -4.91%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Phreesia's debt-to-equity ratio is below the industry average at 0.07, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for Phreesia visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.