Chip giant Nvidia (NVDA) , the dominant player in the development of artificial intelligence, beat analyst estimates on revenue and earnings in its second-quarter earnings and guided higher for the third quarter and the full year.

But the stock sold off after hours on Wednesday and was affecting tech stocks generally.

Related: Analysts overhaul Nvidia stock price targets after Q2 earnings

The shares closed down 2.1% to $125.61 in regular trading, the worst percentage loss of the stocks in the Magnificent Seven list. Nvidia dropped an additional 6.9% to $116.95 in after-hours trading.

At last check in regular trading Thursday, the stock was off 1.6% at $123.55.

Here are the top 7 takeaways from the report and the company's conference call.

The earnings were good, very good. But not good enough

Nvidia earned 68 cents a share in the quarter, ahead of the consensus estimate of 64 cents and up 152% from the year-earlier period. Revenue was up 122% to $30 billion. Both were records. But the whisper revenue estimates, nonpublished ones that float around ahead of earnings reports, were closer to $32 billion.

Data-center revenue, the heart of Nvidia's business, was $26.3 billion, up 154% from a year earlier.

Related: Analysts revise Dell stock price target ahead of earnings

But the results, great as they were, proved a disappointment for many investors.

Third-quarter revenue guidance was less robust: $32.5 billion, plus or minus 2%. The sin: probably that Wall Street was looking for something over $34 billion. And the gain would be "only" 79.4% from the fiscal 2024's third-quarter tally of $18.1 billion.

The Blackwell GPU is delayed

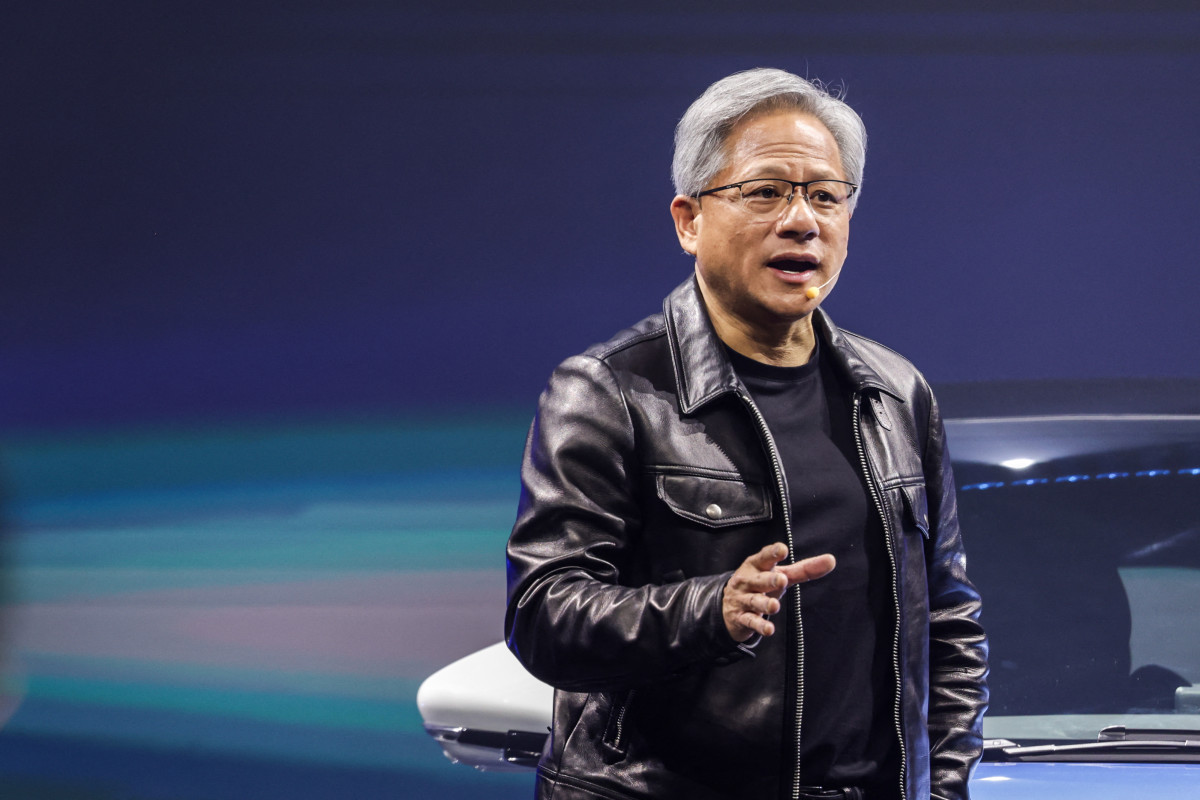

Deliveries of the Blackwell GPU, short for graphical processing units, Nvidia's blockbuster new product, will be delayed until the fourth quarter of the current fiscal year. There's been some redesign work done on the incredibly complex product. Samples are being shared now among customers. CEO Jensen Huang said demand has been "incredible."

The company expects to generate several billion dollars in revenue from the Blackwell products in the fourth quarter, said Colette Kress, Nvidia's chief financial officer.

There wasn't much discussion of exactly what the problems were. But analysts shrugged off the concern, noting just how complex the Blackwell product is.

The issue is not a big one, analysts said. It takes time to fill orders for Blackwell chips. In the meantime, Nvidia's Hopper family of GPUs is enjoying robust sales and will be growing through the second half of the fiscal year.

Nvidia CEO: AI is a new industrial revolution

CEO Huang continues to push the idea that artificial intelligence is critical to lowering the cost of information processing.

Computing in recent years has basically been adding programming to standard computers to get the most out of them, he said on the earnings call.

"CPU scaling has been known to be slowing for some time, and it has slowed to a crawl," he said, adding that computing demand "continues to grow quite significantly." Perhaps doubling annually.

AI has boosted the need for accelerated computing systems that can grab data from multiple sources to create faster solutions, he said.

More Tech Stocks:

- Analysts reset AMD stock outlooks after AI acquisition

- Analyst resets Nvidia stock price target before earnings

- Trader who predicted Palantir, SoFi, Rocket Lab rallies updates outlook

Operating expenses are expected to rise

Full-year operating expenses are expected to grow in the mid-to-upper 40% range.

The operating expenses have been growing in the lower 40% range in recent years.

Much of the expenses are the costs of getting Blackwell and other products ready for market.

Shareholders did get a little something

If you define a $50 billion stock buyback as a little something. This buyback comes as the company said it had returned $15.4 billion to shareholders in buybacks and dividends.

The dividend is a penny a share. The next dividend is payable Oct. 3 to holders of record on Sept. 12.

Nvidia remains far and away the AI giant . . .

Nvidia's dominance of AI is reflected in Its $3 trillion market cap, the biggest of any pure chip company.

Among the other players:

- Taiwan Semiconductor (TSM) . Its factories make the chips that most everyone else designs including Nvidia. Market cap: $877 billion.

- Broadcom (AVGO) . A multinational maker of semiconductors. Market cap: $736 billion.

- Advance Micro Devices (AMD) . Long a rival of Intel (INTC) , it has been investing heavily in AI. Market cap: $236.9 billion.

. . . but Nvidia could lose its membership in the $3 trillion club

With Wednesday's close of $125.61, Nvidia's market capitalization stood at $3.09 trillion, second most valuable among U.S. stocks after Apple (AAPL) .

But if the after-hours price of $116.95 holds on Thursday, the market cap will fall to $2.88 trillion.

On June 18, the market cap was $3.34 trillion, just ahead of Microsoft's (MSFT) $3.34 trillion. It fell below $3 trillion before the Aug. 5 market selloff. It was back above $3 trillion by Aug. 15.

Related: Veteran fund manager sees world of pain coming for stocks