There are a handful of stocks that investors simply don’t know what to do with, and Zoom Video (ZM), down about 90% from its all-time high, is one of them.

Other such stocks — like PayPal (PYPL) and Meta (META) — are stuck in this strange limbo where investors don’t seem to know how to classify them. They don't really fit as growth stocks, nor as value stocks.

Of course, in the case of Meta, the shares have been rocketing this year and are doing so again on its earnings report. That hasn’t been the case for PayPal and Zoom, though.

Don't Miss: Microsoft Stock Pops on Earnings. Is $320 the Next Level?

Going into the pandemic and then coming out of it, Zoom has been one of the few growth stocks that were profitable, with real net income and tangible free cash flow. In fact, the firm generated more than $1.1 billion in free cash flow last year.

But if there was ever a pandemic stock to shine in the spotlight, it was Zoom Video. With growth stocks unable to fetch a meaningful bid and with anything attached to the pandemic being tossed out the window, it’s no surprise Zoom Video stock can’t find buyers.

The shares trade at less than 14 times earnings, which is cheap, but the growth rate has slowed considerably.

Analysts expect less than 2% revenue growth this year and just 5% growth next year. On the earnings front, consensus estimates call for a 3.5% decline this year and a 3.3% rebound next year.

Can the Technicals Help With Zoom Video Stock?

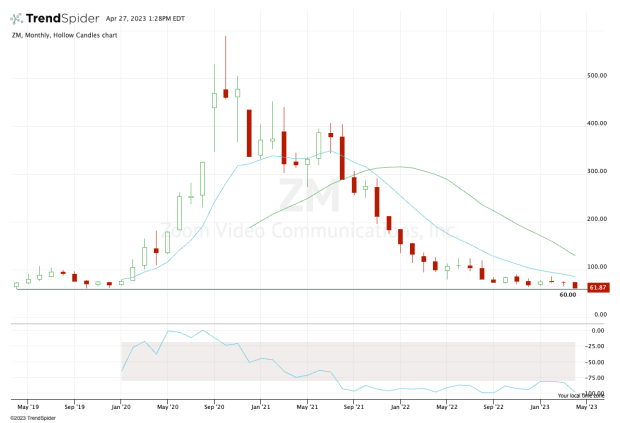

Chart courtesy of TrendSpider.com

Zoom Video stock has lagged the indexes this year, down about 8.5% so far in 2023. On the monthly chart above, you’ll notice that the shares are currently down in three straight months, five of the past six months and eight of the past 10.

Prepandemic, the $60 level was a significant support level for Zoom Video stock. Now that the stock is pulling back to this area, no one seems to want to own this name. In fact, it touched 52-week low just this week.

My thought is: If Zoom Video can stay above $60, is it a worthwhile long?

Don't Miss: Alphabet Faces AI Challenge, Trades Flat. Here's the Chart Setup.

If we start to get broader participation outside megacap tech stocks or if growth stocks find a sustained bid, Zoom Video could be a candidate for a nice rally. If not and $60 fails as support, the bulls have a well-defined line in the sand to respect.

Year-to-date highs (near $85) are a tough expectation at this point, but if Zoom were to hold the $60 level and make a trip back to this zone, it represents about 40% upside from current levels.

Again, investors shouldn’t set their expectations too high, but if Zoom Video is a name they have been circling, it may be worth buying if it can hold $60. Particularly as its earnings report is still about a month away.

Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.