Our series on identity theft protection apps will evaluate the features, pricing options, competition, and also the overall value of using each app. However, these are not full hands-on reviews since evaluating identity theft protection apps is almost impossible. It would require several months of testing, purposefully hacking accounts to see if the protection app works, handing over personally identifiable information, performing multiple credit checks, and risking exposure of the reviewer’s personally identifiable information.

In the digital age, identity theft often goes unnoticed amidst our carefree use of social media, internet platforms, and credit card-based services. However, once you fall victim to this crime, it can quickly transform into a harrowing ordeal. Victims find themselves grappling with the frustration and confusion of having their bank accounts or credit cards fraudulently used, leaving them with the daunting task of repairing their credit.

Zander Identity Theft Protection prioritizes loss prevention and notifications due to Zander's primary role as an insurance provider. This is a key differentiator from other identity theft products like Norton LifeLock or Complete ID. The backing of an insurance company provides added peace of mind in the unfortunate event of identity theft, a significant benefit not typically found in most other identity theft products.

Zander Identity Theft Protection's emphasis on cost-effectiveness comes at the expense of distinctive features and thorough identity protection measures. The website provides minimal information about the program, giving the impression that identity protection is merely a tactic to draw attention to Zander Insurance's other prominent offerings like disability, vehicle, and health insurance. While Zander Identity Theft Protection may offer basic protection at a low cost, it lacks the extensive features, user-friendly interface, and robust identity theft safeguards found in competing products. Without these essential elements, it's challenging to recommend Zander Identity Theft Protection for anything beyond fundamental protection.

Zander Identity Theft Protection: Plans and pricing

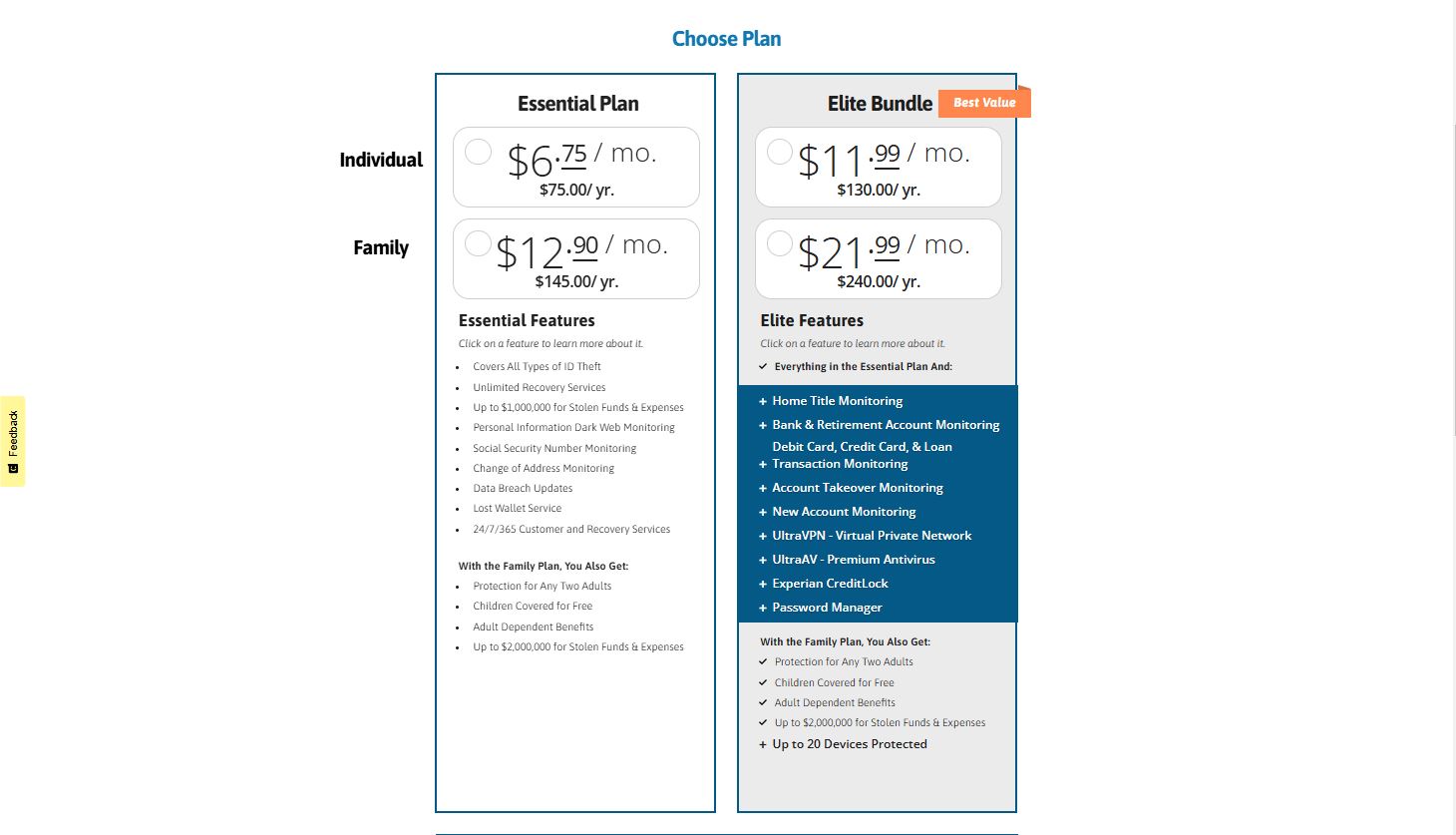

The main selling point here is the price. For just $6.75 per month, this app provides essential features like fraud alerts, bank compromise notifications, and social security theft protection. Opting for an annual plan at $75—equivalent to $6.25 per month—offers additional savings. You also get access to phone-based customer support for resolving any issues.

While the features aren't groundbreaking, the app does offer coverage for Home Title Fraud and Dark Web monitoring. It includes protection for up to $1,000,000 in Stolen Funds & Expenses. The lost wallet service stands out by quickly deactivating credit cards and replacing items lost from your wallet or handbag.

This combination of affordability and comprehensive basic coverage makes it a practical choice for those looking to protect their identity without breaking the bank.

The family plan offered is a supplementary option that comes with a monthly fee of $12.90 (which translates to an annual cost of $145). This plan is designed to cater to families, providing coverage for two adults and an unlimited number of children.

A key advantage of the family plan is the enhanced coverage for Stolen Funds & Expenses, which is increased to a substantial $2,000,000. However, it's important to note that each participant in the plan has a coverage cap of $1 million.

By opting for the family plan, individuals can enjoy the peace of mind that comes with knowing that their family's financial well-being is protected in the event of unauthorized transactions or fraudulent activities. The coverage offered can help mitigate the impact of financial losses resulting from stolen funds or unexpected expenses, providing families with a safety net in challenging situations.

For families who value comprehensive financial protection and want to safeguard their finances against potential threats, the family plan is a valuable consideration. It offers an expanded level of coverage at an affordable monthly or annual cost, ensuring that all family members are covered under a single plan.

The Elite Plan is a premium-tier option that offers similar minor savings when paid annually. It is accessible at $11.99 per month for an individual or $21.99 per month for a family. This plan encompasses all the features of the lower-tier plan, along with notable additions. These include UltraVPN, which supports up to 20 devices and normally costs $2.99 per month when paid annually, UltraAV Antivirus, Experian Credit Lock, monitoring for new accounts, and account takeover monitoring. This combination of features makes it an attractive package for individuals seeking both a VPN and an antivirus solution.

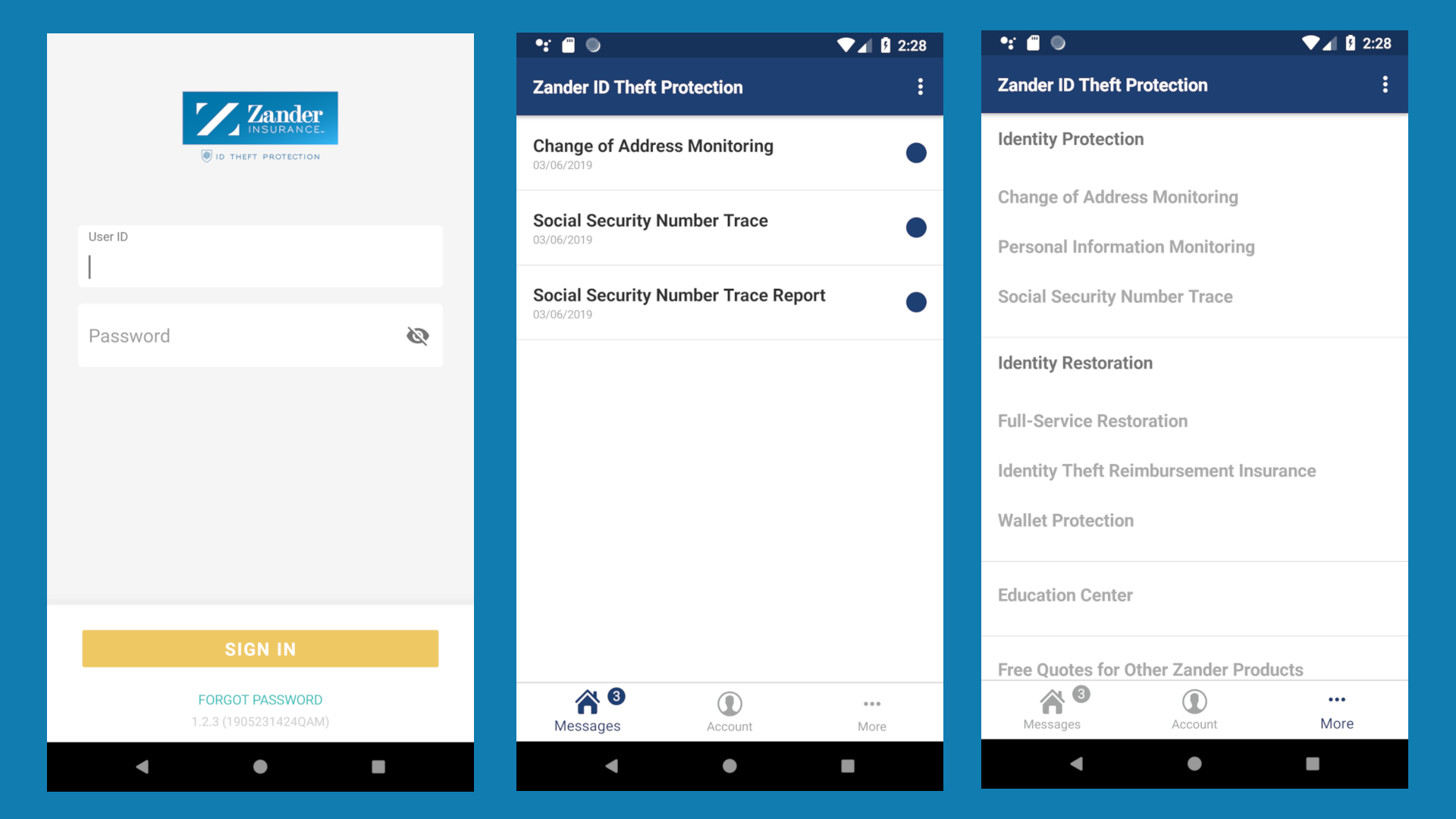

Zander Identity Theft Protection: Interface

Zander Identity Theft Protection's straightforward, white interface is a testament to its dedication to the basics. The app presents alerts related to your identity protection, such as suspicious activity on your bank account or credit card. While it excels in terms of interface and design, falling short when compared to our top choice, Norton LifeLock, which offers a more refined appearance.

Unlike Norton LifeLock, Zander Identity Theft Protection lacks engaging wizards that provide detailed explanations of various aspects of identity protection. It also falls short in providing frequent status updates, leaving users uncertain about their progress in safeguarding their identity. This lack of guidance can be particularly frustrating for those unfamiliar with identity theft protection measures.

Furthermore, Zander Identity Theft Protection's limited features may not cater to users seeking comprehensive identity protection. It lacks certain essential tools, such as credit monitoring, which is a crucial component of identity theft protection. Without credit monitoring, users are unable to track changes in their credit reports and may miss out on potential indicators of identity theft.

While Zander Identity Theft Protection offers a simple and easy-to-use interface, its lack of robust features and user guidance may leave users wanting more. For a more comprehensive identity theft protection solution, it may be advisable to consider alternatives such as Norton LifeLock or other providers that offer a wider range of features and a more engaging user experience.

The Zander Identity Theft software for iOS smartphones has faced criticism from users who have expressed their dissatisfaction through negative reviews. The app, which aims to protect users from identity theft, has received an overall score of 2.4 out of 5 stars, with a significant number of 1-star reviews.

One of the main issues highlighted by users is the app's account creation process, which is described as challenging and confusing. The process reportedly involves multiple steps, including providing personal information and setting up passwords, which can be frustrating for users.

Furthermore, users have expressed concerns about the requirement for online logins to view phone alerts. This means that in order to access important security notifications and alerts related to potential identity theft attempts, users must log in to their account on the Zander Identity Theft app. This additional step can be inconvenient and time-consuming, especially in situations where users need to respond quickly to potential threats.

Another significant problem mentioned in user reviews is the difficulty of canceling the app's subscription. Users have reported encountering obstacles when attempting to cancel their subscription, such as complex cancellation procedures, lack of clear instructions, and unresponsive customer support. This can lead to frustration and difficulty in discontinuing the service.

The negative reviews received by the Zander Identity Theft software reflect the challenges users have faced with the app's account creation, online login requirements, and cancellation process. These issues undermine the app's intended purpose of providing identity theft protection and highlight the need for improvements to enhance the user experience.

Zander Identity Theft Protection: Features

The primary takeaway from Zander Identity Theft Protection is that its features are fairly ordinary. This suggests that while you may be paying a lower price, you are not receiving exceptional features. The app provides standard fraud warnings and safeguards similar to those found in other identity theft protection applications. Additionally, most of these applications offer a hotline number to speak with an agent, which is not a unique feature of Zander.

Concerning theft protection insurance, Zander Identity Theft Protection offers reimbursement for stolen funds and related expenses. The base-level plan provides coverage up to $1 million, while the higher-tier plan covers up to $2 million.

Zander Identity Theft Protection: Support

Zander Identity Theft Protection offers support services to help use its service. Included is 24/7/365 support that provides round-the-clock support from U.S.-based recovery specialists who can assist with various identity theft issues. Their customer support team can be reached by phone at 1(888) 210-32743.

Unfortunately, individuals seeking alternative support resources, such as a comprehensive support portal, informative videos, interactive chat support, or an engaging community forum, may be left wanting. Our evaluation did not uncover the presence of any of these options within the platform. A support portal serves as a centralized hub where users can find a wealth of documentation, tutorials, FAQs, and troubleshooting guides, enabling them to resolve issues independently. Helpful videos, on the other hand, provide visual demonstrations and step-by-step instructions, catering to various learning preferences. An interactive chat feature allows users to connect with support representatives in real-time, offering immediate assistance and resolving complex queries efficiently. Moreover, an interactive forum, where users can interact, share experiences, and seek advice from peers and experts, fosters a collaborative problem-solving environment. The absence of these features limits the platform's ability to cater to users who prefer alternative support channels, potentially hindering their experience and satisfaction.

Zander Identity Theft Protection: The competition

Of all the identity theft protection services we reviewed, Zander offered the most affordable option. However, its feature set was limited. While Zander's pricing might seem low, a Costco membership is required to access their lowest-priced package. If you have the Costco Exec plan, which costs $120 per year, Complete ID is more expensive at $8.99 per month.

At its core, Zander's coverage serves as a platform for monitoring fraud alerts and facilitating collaboration with customer service to resolve issues. While it may not directly compete with established identity theft protection companies such as Equifax, Experian, or Norton, Complete ID emerges as the closest rival solely due to comparable pricing.

Zander's higher tier offering includes a VPN and antivirus software, making it a more comprehensive choice for those seeking a bundled solution. The inclusion of a VPN from a reputable provider like UltraVPN is a significant advantage, as many ID theft protection services offering VPNs don't specify the provider or whether essential features like a kill switch are included.

Zander Identity Theft Protection: Final verdict

Zander's basic Identity Theft Protection plan, while affordable, may not provide the same level of comprehensive support and features as more specialized options like IDNotify, Complete ID, Norton LifeLock, or IdentityForce. Its generic nature might not be as appealing to those seeking a highly customized or advanced solution.

Choosing an identity theft protection service based solely on price leaves you at risk for insufficient protection. While the service offers basic alerts and protections, the website lacks detailed information about its features. A more comprehensive explanation of the alerts and customer service hotline would enhance transparency. Identity theft is a serious issue, and selecting a product based solely on low cost may not be the best course of action to provide adequate security for you and your family.