Wynn Resorts (WYNN) stock is up more than 10% on Monday. It’s a great way to start the week for Wynn, which has had a tough year.

The shares are down 24% this year, 35% from the one-year high and 55% from its post-covid high.

Wynn Resorts is one of the few well-known stocks that has failed to recover its precovid 2020 high. That’s as casino companies were disproportionately hurt compared to other businesses.

On Monday, the shares are rocketing higher as “billionaire investor and restaurant owner Tilman Fertitta has built a passive 6.1% stake in the casino operator.”

That’s according to a Form 13-G filing with the Securities and Exchange Commission.

With today’s rally, Wynn stock is approaching a key area on the chart.

Trading Wynn Stock

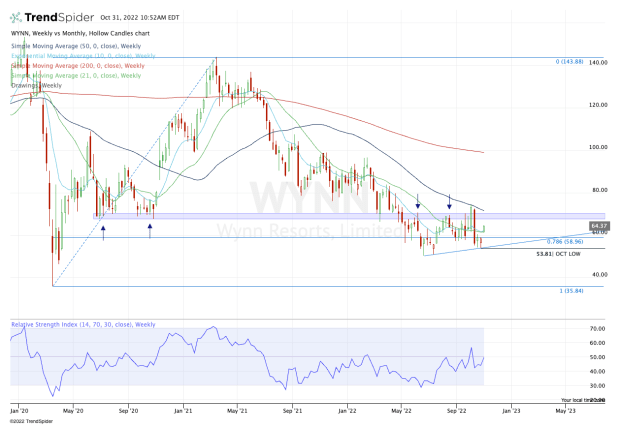

Chart courtesy of TrendSpider.com

Amid the recent decline, Wynn stock found support in the low $50s. With an October low of $53.81, Wynn stock is rallying hard and reclaiming the 10-week and 21-week moving averages.

Assuming shares of Wynn can close above these measures, that opens the door up to the $67.50 to $70 zone.

There the stock finds a key pivot that has acted as both support and resistance over the past two years. Most recently, it was resistance from May through September.

That zone has been significant, but it also aligns with the 50-week moving average. For the first time in more than a year, this measure was tested last month and quickly rejected Wynn stock.

Roughly translated, that’s also the 200-day moving average and it’s no surprise it was resistance given the trend of Wynn and of the overall market.

Investors should respect this zone as resistance. But if Wynn stock can clear this $67.50 to $70 area, it could see a move to $80 or possibly higher.

On the downside, Monday’s gap-up rally leaves an unfilled gap near $59. So if Wynn stock begins to fade from this move and loses today’s low at $61.22 — and thus, the 10-week and 21-week moving averages — then this gap-fill is possible.

Below that puts the October low in play, a break of which could put the 2022 low in play near $50.