WorldRemit is just one of many different money transfer services that have become increasingly popular, especially since coronavirus has taken hold. Money transfer services are perfect for moving funds around, and thanks to quite a lot of competition they're now a relatively cheap and easy way of getting the job done. WorldRemit was set up in 2010, is headquartered in London and sits in the same marketplace as the likes of Azimo, Transferwise, CurrencyFair, Lebara Money Transfer, PayPal, Zelle and other competitors.

- Want to try WorldRemit? Check out the website here

You can access the service online using a web browser or app and the company aims to provide competitive prices if you’re looking to send money overseas. This is particularly so when WorldRemit put up against traditionally major players in the money transfer marketplace, such as Western Union.

Pricing

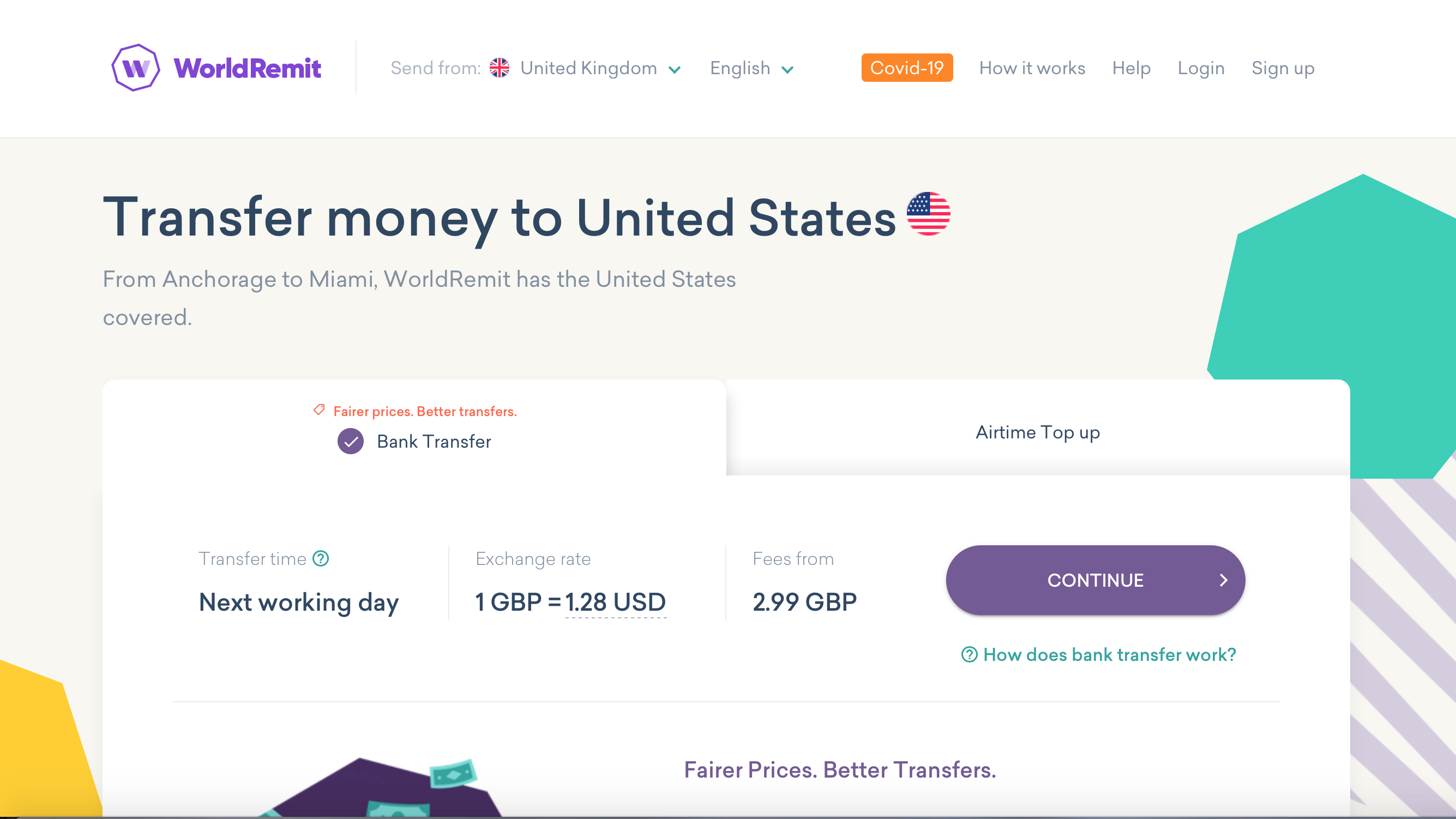

WorldRemit offers plenty of different ways to pay for your transfer such as cards, including debit, credit and prepaid options, bank transfer, Poli, Interac, iDEAL, Klarna, Apple Pay and Trustly. WorldRemit doesn’t accept Google Pay any longer though. When it comes to determining just how much you’ll pay for a transfer then a good practical way to establish this is to use the WorldRemit site to set up your transaction and then view the resulting costs that will be shown.

The pricing is not completely black and white due to the variables involved with sending cash from different countries to other locations around the globe. Costs can also fluctuate depending on the transfer method you’re employing and what the currency is. Nevertheless, WorldRemit still gets praised for its affordability levels.

Features

If you’re looking for plenty of options when it comes to transferring money then WorldRemit is a good bet. Currently the service allows you to send money from over 50 countries to more than 150. This is helped by the way that WorldRemit has partnered with the likes of M-Pesa, EcoCash, MTN, Metrobank and others.

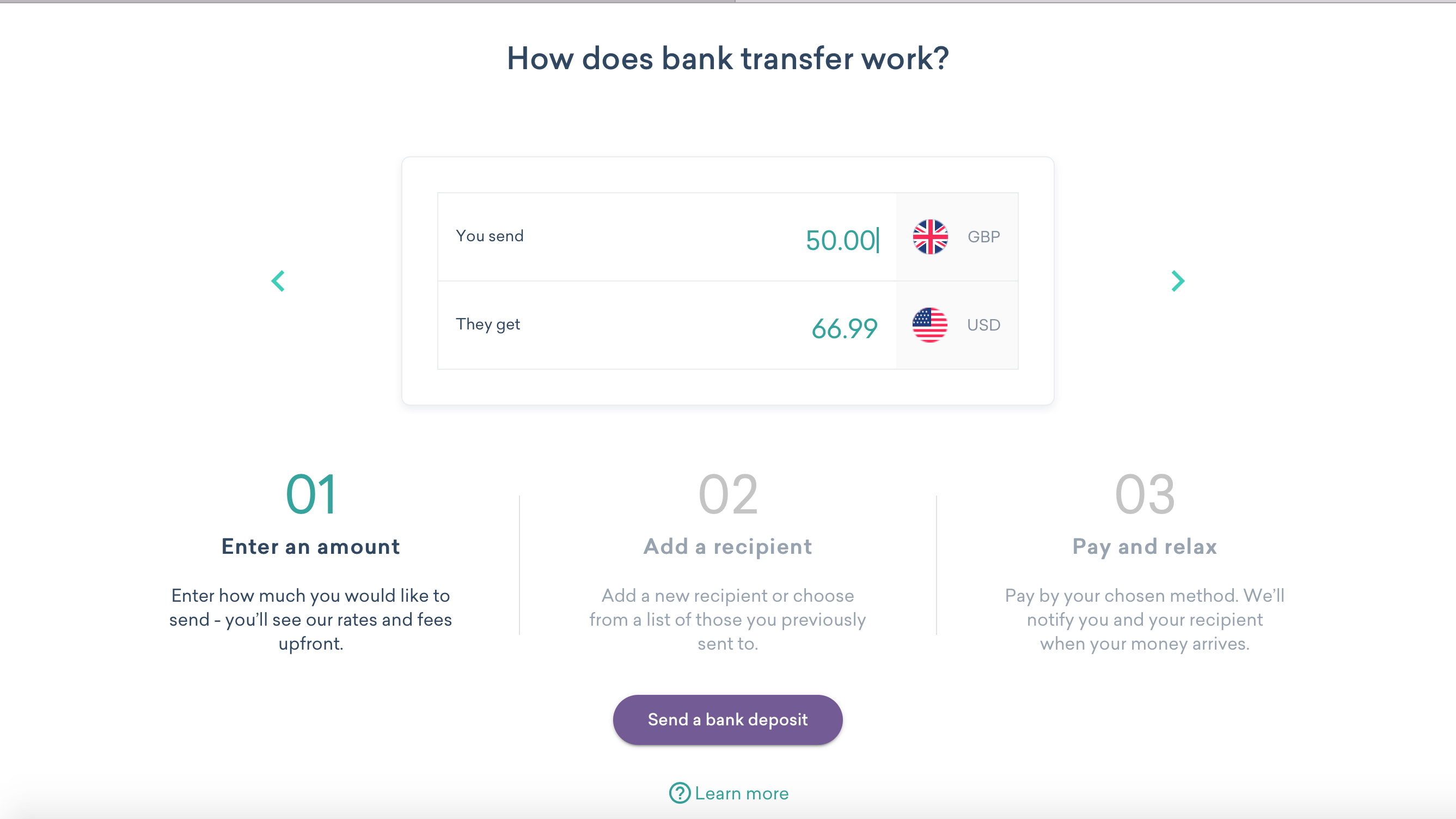

Convenience is a big part of transferring money and WorldRemit is pretty good at offering a smooth and seamless experience, with transfers that can be received as bank deposits, often within 10 minutes, a cash pickup, mobile money or even an airtime top-up. If you’re likely to send money to the same people on a regular basis then it’s possible to build up a contact list of recipients.

WorldRemit will also send both you and the recipient of the funds an SMS or email alert once a transfer has completed, while the service is FCA approved and fully licensed. In addition, WorldRemit employs the latest technology standards to protect customer transfers.

Performance

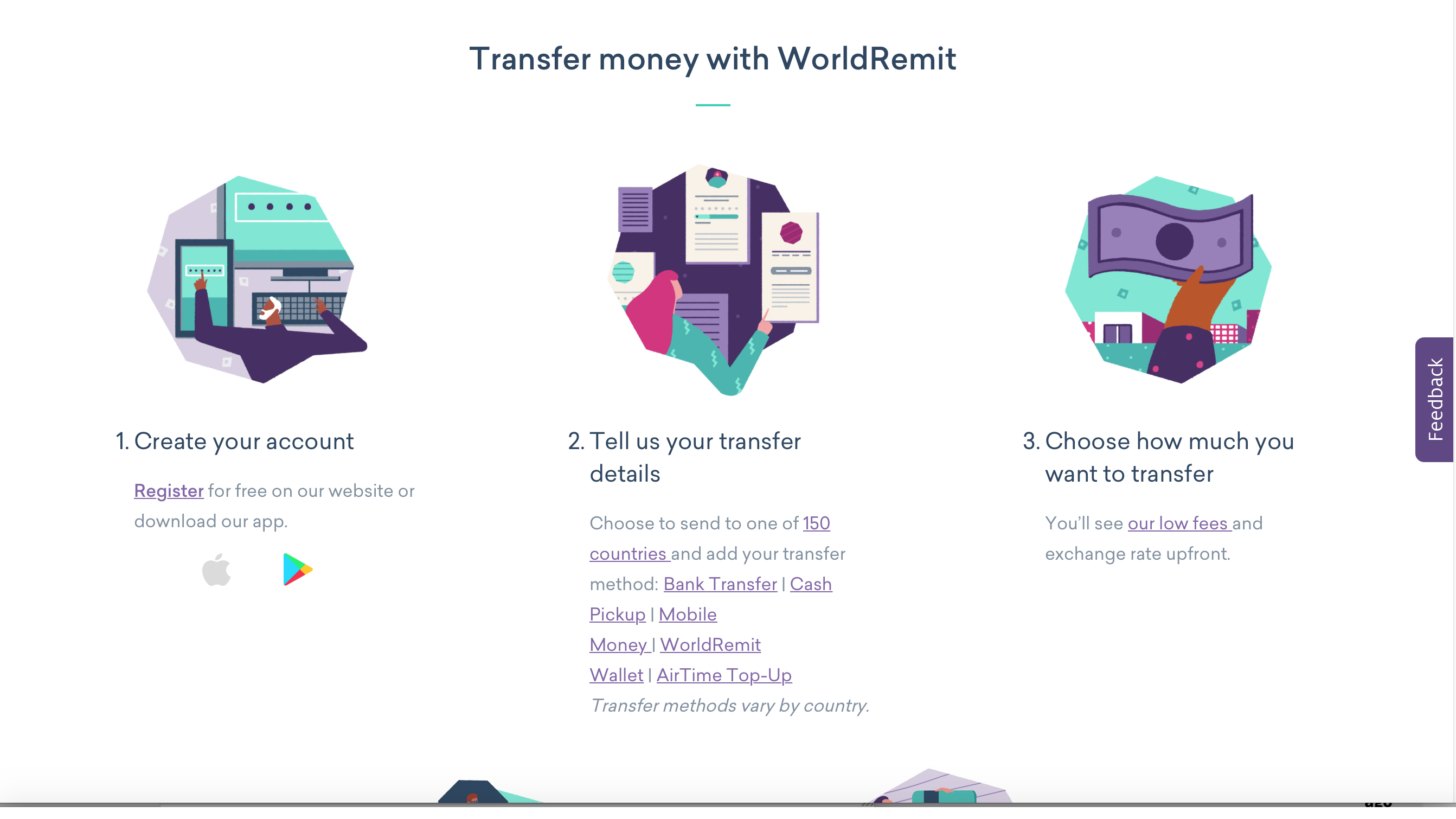

Being a web-based money transfer solution, WorldRemit offers a quick and efficient means of moving funds. All you need to do is create an account by registering on the site. Alternatively, the app for either iOS or Android makes a good option too as it offers that little bit more mobile convenience.

Considering WorldRemit offers an array of different transfer methods, including bank transfer, cash pickup, mobile money, WorldRemit Wallet and AirTime Top-Up the service has been nicely engineered to work effectively across all options.

Ease of use

Using WorldRemit is just as easy as transferring money with many of the other services in this arena. Core actions for getting the job done involve selecting a destination for the money transfer, confirming the service, choosing the amount of money that you want to move and adding a recipient for the funds. You’ll then need to specify a payment method and, once you’ve done that you should be good to go. There’s not much more to it than that.

Support

Although there’s not a huge amount of work involved with transferring money WorldRemit still offers piece of mind by having a Help Hub within its website. Inside here you can find answers to any queries you might have about the service and its capabilities.

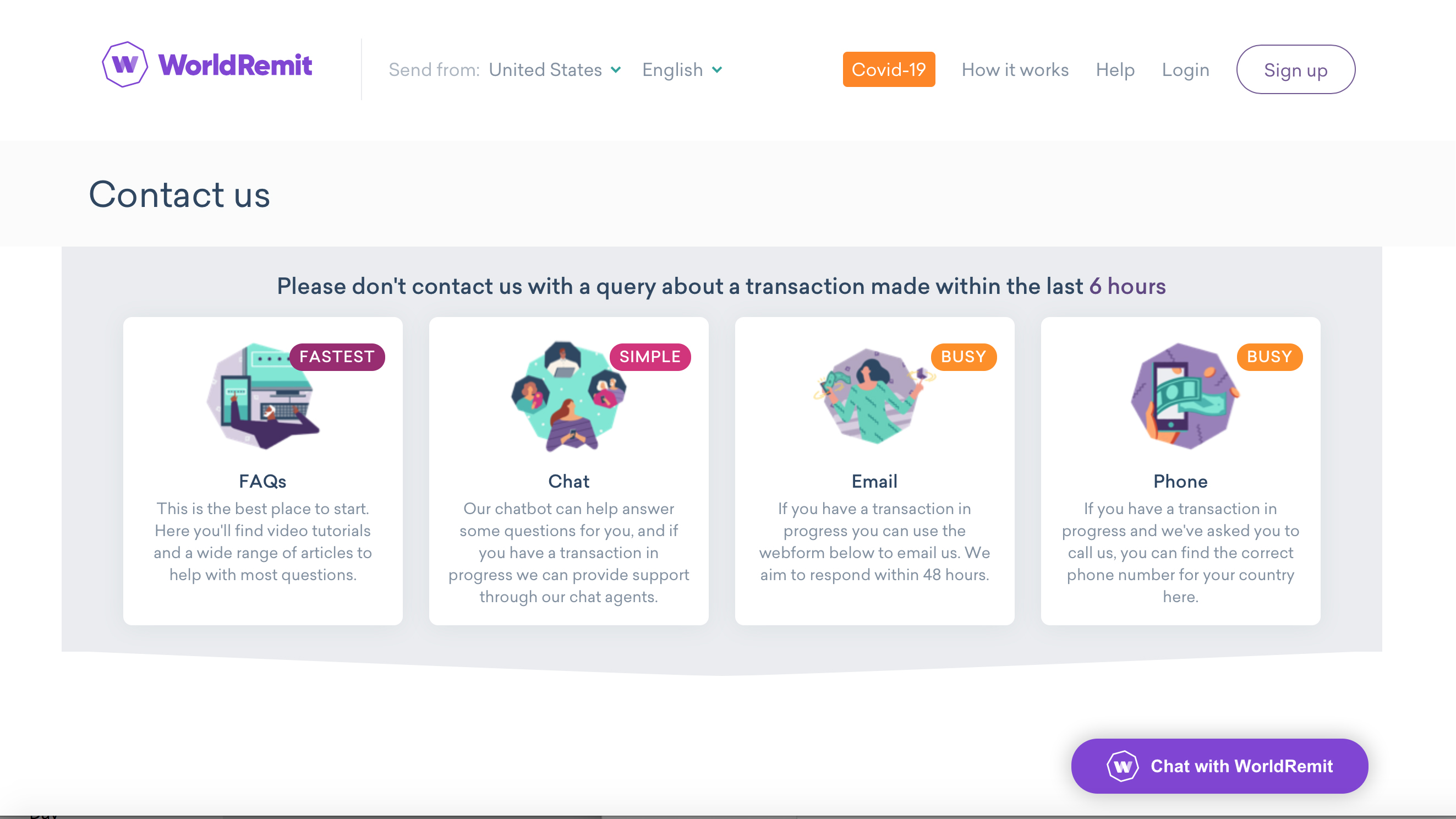

There are frequently asked questions, which cover most topics and there’s a neat little chat-style tool in the bottom left of your web browser that does a fine job of helping you with quick pointers along the way.

This virtual assistant also pings up helpful videos on core points. If the FAQs and Chat solutions don't hit the spot then there are email and phone options, with numbers available for all of the geographical regions served by WorldRemit.

Final verdict

WorldRemit is a practical money transfer solution for all kinds of users and will appeal especially to individuals who don't have easy access to everyday banking services. WorldRemit has developed a useful selection of options that make it quick and easy to transfer funds, including mobile to mobile, which adds a useful variation to the money moving theme.

Having been authorized by the UK’s Financial Conduct Authority the service is carefully regulated, while WorldRemit itself has strong connections with international partners. The benefit of this is that the transfer services it offers are competitively priced and, invariably, pretty efficient too. There’s plenty of choice in the money transfer market and WorldRemit is doing a good job of convincing many that it’s as good an option to use as any.

- We've also highlighted the best money transfer apps