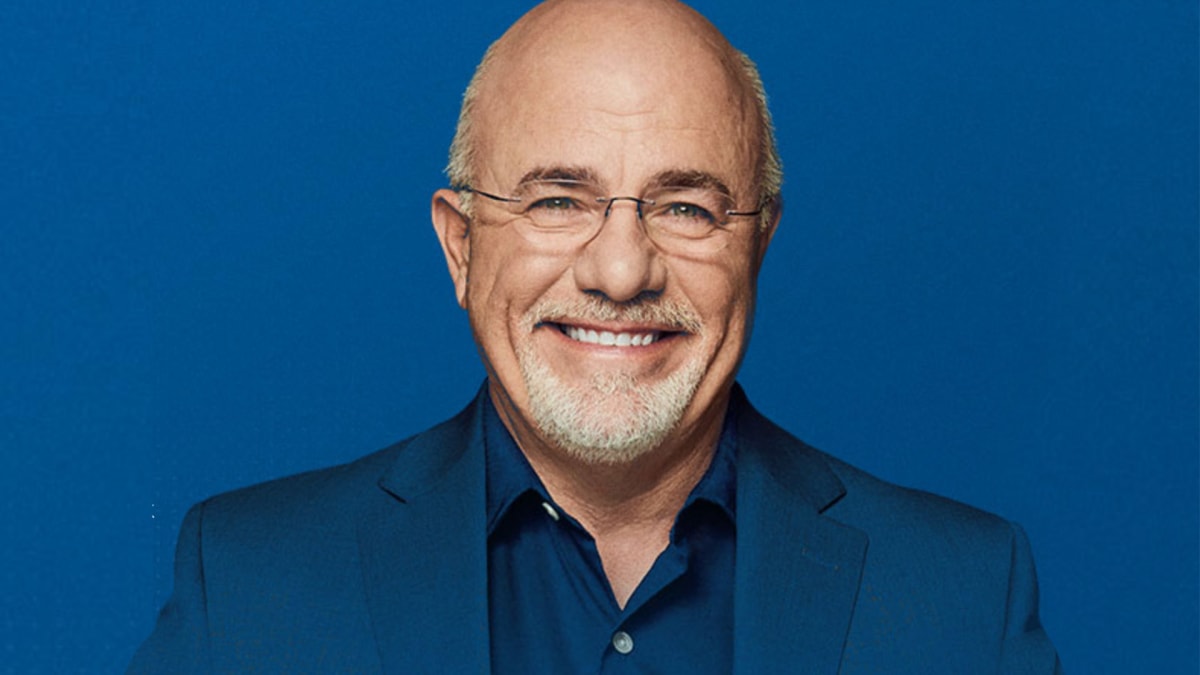

In a response to a listener's request for advice, personal finance radio host Dave Ramsey spelled out some thoughts.

The comments offered a path forward, but he didn't mince words.

DON'T MISS: Dave Ramsey Unveils Important Advice on Spending For Emergencies

"Dear Dave," the inquiring listener wrote, according to Ramsey's telling on KTAR News. "I’m thinking more seriously about buying a home in the next year or so. It seems like the housing market has cooled off a bit, so I am also planning to get a secured credit card to help me rebuild my credit score in the meantime."

"I make $60,000 a year, and I have about $15,000 in debt and $3,100 in savings," he added. "Is this a good idea and a good start toward getting my credit back on track and taking control of my finances?"

He signed his name, simply, "Martin."

"Dear Martin," Ramsey wrote back. "In a word, no. I want you to become debt-free before you buy a home. I also want you to have an emergency fund of three to six months of expenses set aside, and have a down payment -- preferably of at least 20%, so you can avoid having to pay private mortgage insurance -- before buying a home."

Ramsey then told Martin about a guaranteed way to stay broke.

"Let me tell you a couple of things," he wrote. "No. 1, your income is your most powerful wealth building tool. If you don’t have any payments, you have the ability to build wealth and be generous. When you have debt, all you do is send money out the door to make payments. So, being in debt is a guaranteed way to stay broke. That means getting a secured credit card is not a good idea, either."

Ramsey closed out the response with another bit of advice.

"Buying a house when you’re in debt and broke is a really bad idea, Martin," he wrote. "It’s the fastest way I know to turn something that should be a blessing into a financial and emotional curse."

"Just be patient, get out of debt and save up. Getting control of your finances is the smartest thing you can do before buying a home!"

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.