Moving in together is like unlocking a new level in a relationship—it’s fun, it’s exciting, but it comes with a unique set of challenges. Last week, Reddit user Throwawayl4081 made a post on r/AITAH about a dilemma he’s facing with his girlfriend.

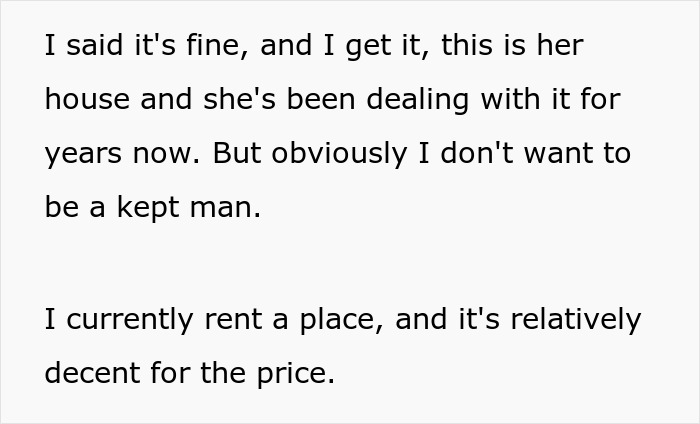

The woman owns a house and wants him to move in, but she’s uncomfortable adding him to the mortgage. While he said he understood, she asked for “rent” that’s double what he currently pays, and they got into a standoff where neither is willing to budge, and the man is growing increasingly unsure if he’s being unreasonable or if she wants too much.

A couple should progress through their relationship when both feel like taking the next step

Image credits: Monstera Production / Pexels (not the actual photo)

So after this man got into a disagreement with his girlfriend about moving in together, it cast a shadow over their entire future

Image credits: Tima Miroshnichenko / Pexels (not the actual photo)

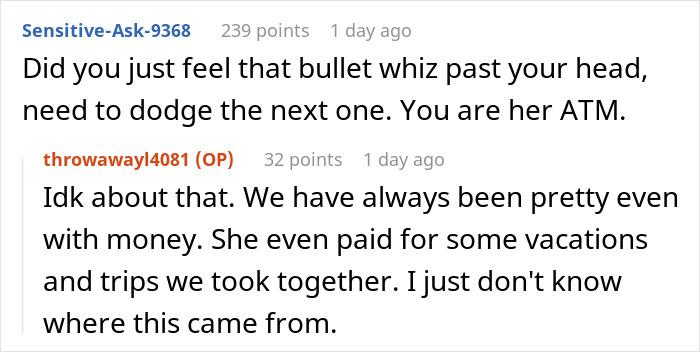

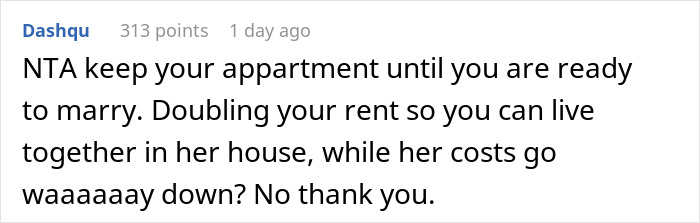

Image credits: throwawayl4081

Image credits: Kampus Production / Pexels (not the actual photo)

A “landlord/tenant” arrangement could work in this situation

On paper, the solution proposed by the girlfriend doesn’t sound bad.

“Approaching this arrangement from a landlord/tenant perspective may seem cold, but it is objective, straightforward, and meets the interests of both parties,” said Sarah Asebedo, the president of the Financial Therapy Association and a professor at Texas Tech University.

The bottom line is that if the girlfriend owns the house, she bears all of the associated risks. These include a decline in the property’s value, any expenses associated with its future sale, as well as the required maintenance and upkeep. If a dog-walker happens to slip and fall in the icy driveway, she’s the one who is liable. But that means the guy shouldn’t be paying for a snowplow service, either.

In return for shouldering these risks and expenses, the girlfriend would build equity and perhaps one day sell the house for more than what she bought. But for the time being, that doesn’t really concern the author of the post. “It’s not fair to expect to receive these returns if you are not bearing any of the risks,” Asebedo explained. “To justify asking for part of those returns, then you would need to become a joint owner and borrower of the property.”

However, since the woman said she doesn’t want to add him to her mortgage, that option is out of the window.

Asebedo said another possibility is to become a “tenant-in-common,” which would give him a percentage stake in the property, but again, that seems like more trouble than they want.

The tricky part is deciding how much to pay the girlfriend for his “rent.”

It’s reasonable to think that a 50-50 split of the mortgage payment would be fair, but according to Asebedo, the situation is more nuanced.

As an owner, his girlfriend should cover the costs associated with ownership — property improvements, repairs, insurance — like any landlord would. To determine the monthly payments, the couple could check out current rental rates for similar properties nearby. “Either pay half the mortgage or a fair rental rate for a similar property, whichever is less,” she suggested. Then, of course, you can divide the rest of your living expenses — utilities, groceries, etc. — the same way you would if you were both renting together.

Some context is missing from this particular case, but if what the guy said in the comments is true and his girlfriend is demanding he pays the price for what an entire proper would go for, that sounds unreasonable.

The reactions to the story are mixed—some people said the man is being perfectly reasonable

While others believe both the man and woman could approach the argument with more empathy

A few also said the man is the one who is in the wrong