While historically people often save more when times get tough, current younger generations are flipping that around.

With a high cost of living, hefty student loan debt, and a tough labor market, many no longer believe they will ever afford a home or kids, so they are “doom spending” instead.

It’s defined as an act of spending money to cope with stress despite concerns about the economy and foreign affairs

According to a recent study conducted by Qualtrics on behalf of Intuit Credit Karma, more than a quarter of Americans (27%) engage in it, including 35% of Gen Z and 43% of millennials.

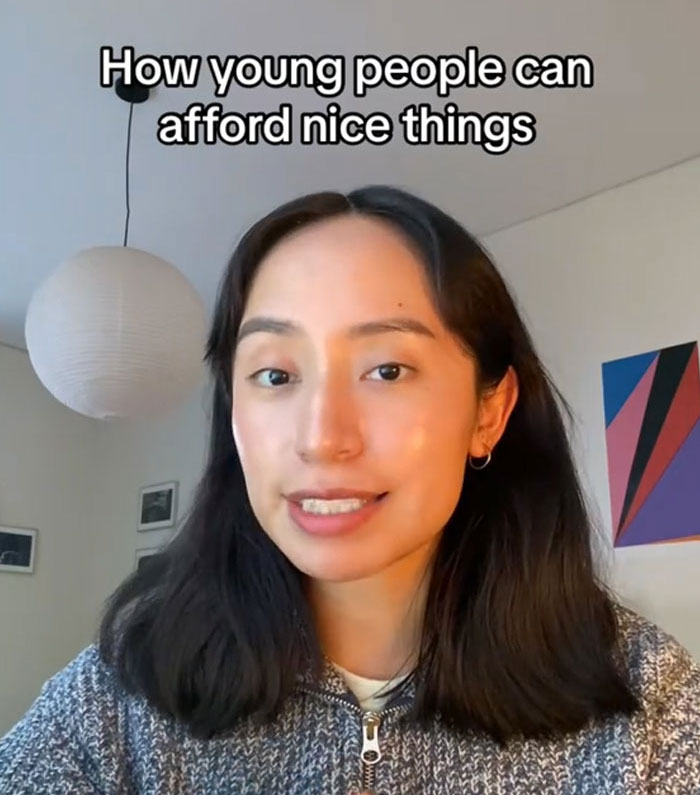

To give everyone interested a better understanding of the phenomenon, Maria Melchor, a NYC-based financial content creator, made a comprehensive video about it.

More info: FirstGenLiving.com | Instagram | TikTok

Personal finance expert and content creator Maria Melchor took it upon herself to explain the concept of “doom spending” to the internet

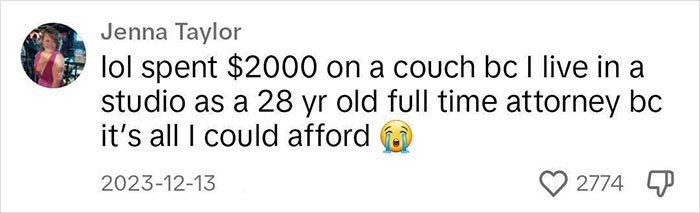

“When older people ask me how young people are affording nice things that they wouldn’t even buy for themselves, I tell them it’s because we can’t afford anything else. Homeownership or starting a family is so out of reach that we’re using that down payment or kid money on whatever it is we can afford.”

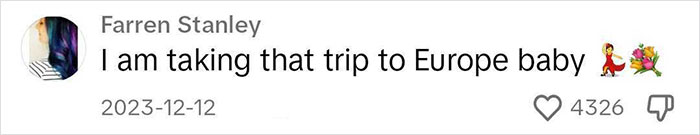

“That’ll bring us a semblance of the kind of adulthood we were promised when houses are a million dollars plus, and an older couple will likely outbid us anyway. We’re going to relinquish any lingering delusions about homeownership, and instead use that money to give our dogs the most enriched puppyhood they can have.”

Experts believe this practice is harming people’s well-being in the long run

The aforementioned Credit Karma study was conducted in November 2023, and it also discovered that in the six months leading up to it, half of Americans’ financial situation had worsened, with 42% reportedly struggling to afford enough food for themselves and/or their household, and another 56% living paycheck to paycheck.

During the same period, nearly one-third (32%) of Americans’ debt level had increased, mostly among millennials (38%) and Gen X (35%). Of those with debt, a quarter estimated they held more than $10,000 in debt – a significant amount, especially amid such high interest rates.

“Much like doom scrolling, we’re seeing people mindlessly shop to soothe concerns about the economy and foreign affairs, which could take a toll on their financial well-being,” said Courtney Alev, consumer financial advocate at Credit Karma.

Alev believes this is not a good practice. To keep yourself in check, she suggests doing an assessment of your finances to understand how much money you have coming in and out each month, as well as how much debt you owe. “This will help you make a plan for how you’re going to spend your money moving forward.”

“To get in the habit of better spending, consider using cash instead of cards until you get your spending in check. That way, you can limit your chances of overspending. Also, if your card information is stored online, you might consider deleting stored card information through your browser to make shopping online less frictionless,” Alev added.

While doom spending may capture the economic zeitgeist of today, the habit isn’t new. Stephen Wu, an economics professor at Hamilton College in Clinton, New York, published a paper in 2004, explaining some people who feel luck and other outside factors play a significant role in their financial success are less likely to save.

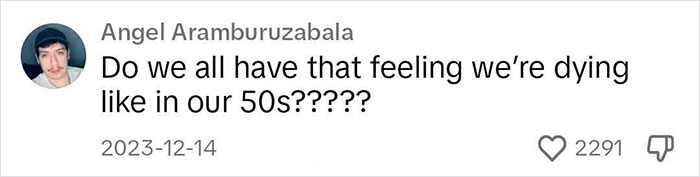

He thinks that feelings of fatalism and counterintuitive spending habits have become more common in recent years, particularly after the pandemic and Great Recession. That’s when people began to realize that “a large part of their successes and failures were out of their control,” Wu said.

Melchor’s mini video lesson has since gone viral

@firstgenliving #zillennial #dink ♬ original sound – Maria | FirstGenLiving

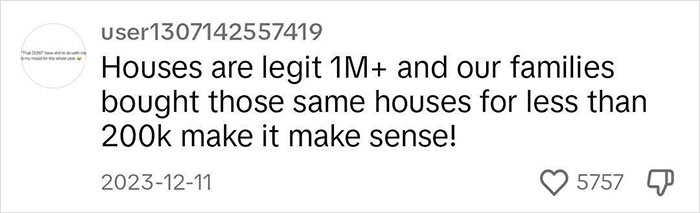

And it has ignited quite a heated discussion