Probably most of you will agree that everyone wants to be successful and not worry about their finances. And in many cases, the reason for this is not only to be able to afford fancy cars, housing, trips, stuff, etc. (but this is also cool), but to help our parents. Knowing that all their life, they were providing for us, it feels like the least we can do is to somehow help them to retire.

However, it may be annoying when you work hard to help your parents and find out that they transfer money to your siblings for partying. One Reddit user shared their story online asking if she was wrong for reducing her parents’ allowance by the amount they share with her siblings.

Cultures vary in their levels of filial piety, but most of us want to support our parents so they don’t have to worry about money

Image credits: Tima Miroshnichenko (not the actual photo)

This woman shares that her parents live in a less developed country than her, thus when she got a new job, she calculated that she could send $1300 to help her parents

Image credits: MART PRODUCTION (not the actual photo)

She set up a joint account, but after a year and a half, she noticed that there was a $200 transfer every month for her brother as her parents were helping him out

Image credits: Yan Krukau (not the actual photo)

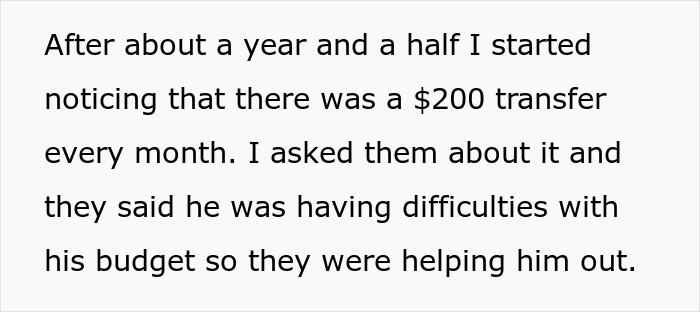

She noted that her brother is a scholarship student and he wants this money for partying, so she just reduced the amount she sends to her parents by $200

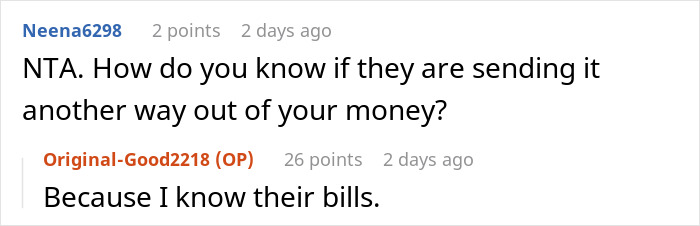

Image credits: u/Original-Good2218

When her parents noticed this, they called her scolding her for being a bad daughter and sister, which caused serious family drama

One Reddit user recently shared her story asking community members if she was in fact being a jerk for reducing her parents’ ‘allowance’ by the amount they send to her siblings for partying. The post caught a lot of folks’ attention and collected over 13K upvotes and 1K comments.

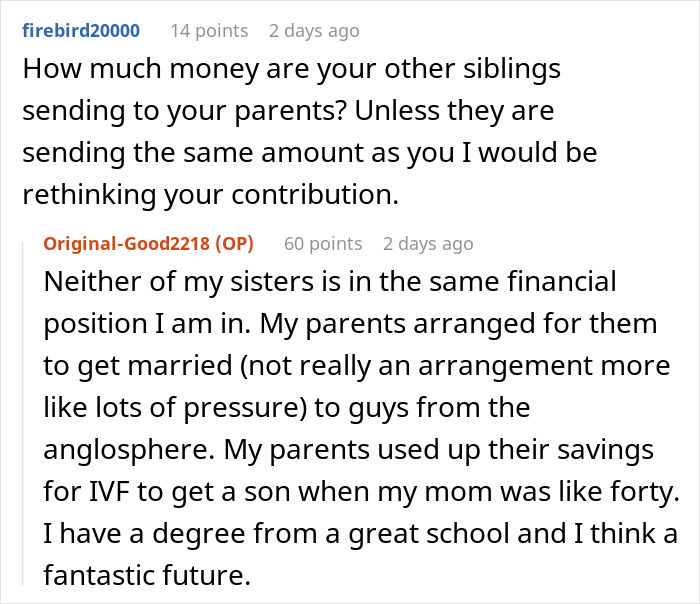

The original poster (OP) shared her story by explaining that her parents live in a less developed country than her siblings. So after she got a new job, she did some calculations and saw that she could send $1300 to her parents. She set up a joint account, and after around 1.5 years, she noticed a transfer of $200 being made every month to her brother. As it turned out, her brother was having difficulties budgeting.

However, OP immediately noted that he doesn’t need help and this money goes to his partying. So without further ado, the woman reduced the amount she transfers to her parents by this amount. After her mom and brother noticed this, they called her scolding her for being a bad daughter and sister. However, the woman stood her ground, explaining that she has a better use for her money than giving it away to her brother so he can party.

It’s not a surprise that when we are young, many things don’t look that expensive and we don’t think that much before we spend our parents’ money. However, when it’s time to earn by ourselves – well, our point of view changes a bit.

The community members gave the woman the ‘Not the A-hole’ badge and discussed that setting boundaries was a good step. “Your parents should be grateful that you are helping them out. Their son is their problem, not yours,” one user wrote. “I am so glad to finally read something where someone took a stand for themselves without dragging the issue on forever. I also love how you handled it,” another added.

Image credits: Eren Li (not the actual photo)

People online discussed that the woman is not responsible for her parents’ retirement plan (which would actually fall into the list of reasons why people shouldn’t have kids), and they are lucky that she is helping them at all.

Now, Bored Panda got in touch with David M. Allen, M.D.,a psychotherapist, relationship expert and author. He emphasized that it is very common for people from poor countries to immigrate to the US for financial benefits. “If the kids come by themselves, they send money home in most cases to make the parents’ lives better, so that wouldn’t be unusual.”

However, speaking about this case, David pointed out that it looks as if the parents are giving a mixed message to the woman, as well as possibly fomenting sibling rivalry. “They didn’t pay for her education but finance her brother’s partying.”

Also, the expert noted that one common pattern is that the family does this due to unresolved gender issues, as in cases where a mother lives vicariously through a daughter who does things she cannot, but then gets upset that the daughter is getting to do stuff she couldn’t and won’t talk about it.

David M. Allen emphasized that in these types of cases, his recommendations are not the conventional wisdom. “The woman would have to find a way to get past her parents’ defensiveness in order that they might discuss and resolve the underlying issues.” He added that many people and many therapists think this is impossible in cases like this, but it is not.

Also, to get more insights into how to do this in mild to moderately dysfunctional families, check out David’s book – Coping with Critical, Demanding, and Dysfunctional Parents: Powerful Strategies to Help Adult Children Maintain Boundaries and Stay Sane.

So while money and finances may be tough topics to speak about, it’s important to set ground rules. Also, the expert noted that the common pattern is still gender issues, and looking at this case where the only daughter was miserable in her own home – it looks like it may be the case. But what do you think about this story? Share your thoughts below!

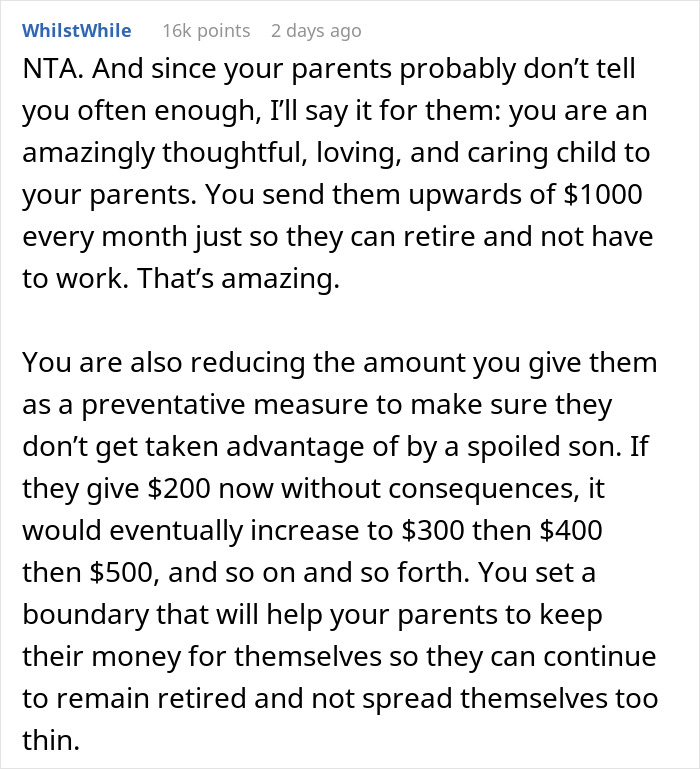

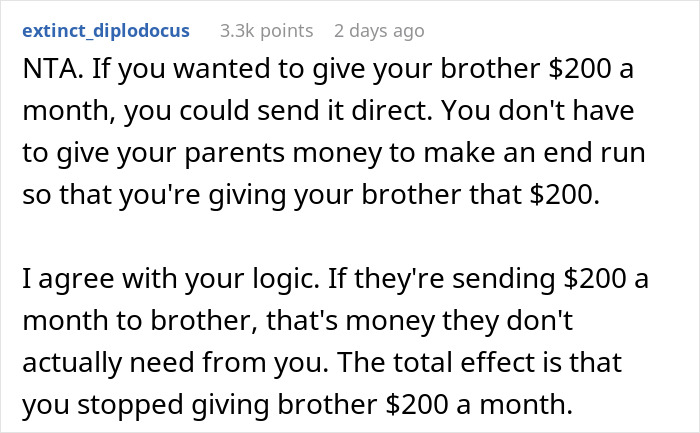

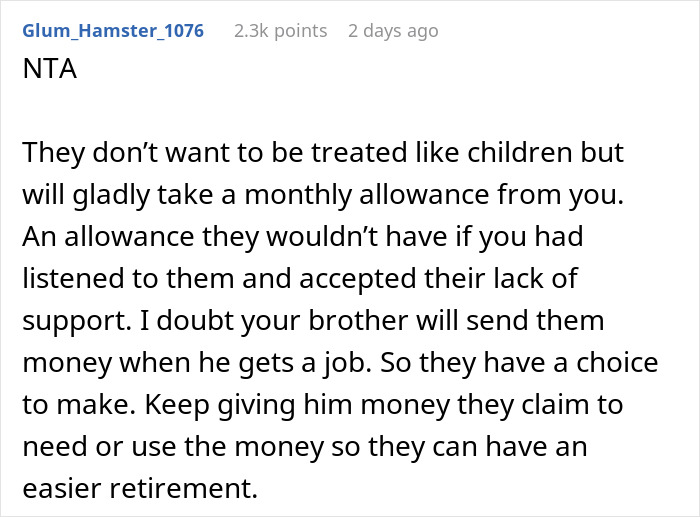

Redditors backed up the woman and assured her that she was not being a jerk in this situation

.jpg?w=600)