Falling victim to fraud of any kind can leave you feeling both vulnerable and violated. It’s especially distressing when the fraudsters have gained access to your financial information and gone on a merry spending spree with your hard-earned cash.

For one Redditor who discovered her credit card had been used to rack up a bunch of bogus expenses, enough was enough. She tracked the thieves down to a hotel and got the cops involved, who discovered the fraud was just the tip of an illegal iceberg.

More info: Reddit

Woman called her credit card company to investigate suspicious charge on card she hadn’t used for months

Image credits: Pixabay / pexels (not the actual photo)

Credit card company told her that her card had been used for 3 weeks already, but had since been canceled for flagged charges

Image credits: Andrea Piacquadio / pexels (not the actual photo)

She and her boyfriend decided to visit the hotel where one of the fraudulent charges had occurred to see if the thieves were still there

Image credits: RDNE Stock project / pexels (not the actual photo)

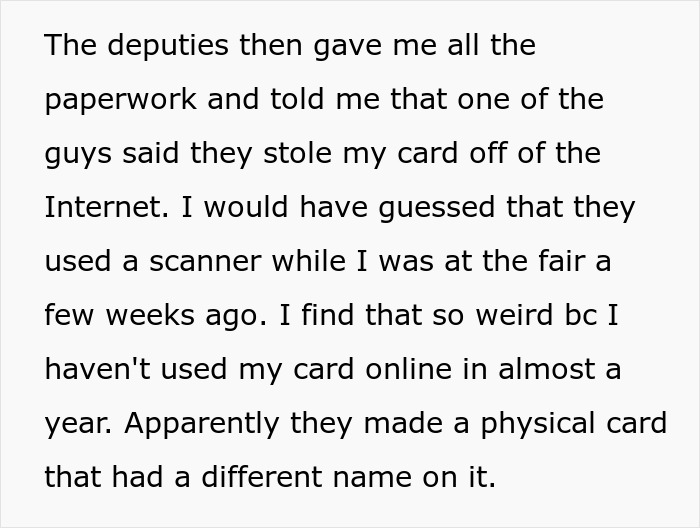

She called the police, who busted the fraudsters while they were trying to sneak out of the hotel

Image credits: methodrn00

Cops discovered a mountain of evidence during their search, including bags of an illegal substance, and arrested the perps immediately

OP begins her story by telling the community that she noticed an unusual charge on her credit card and called her credit card company to report it. That’s when she discovered her card had been used to rack up charges for the previous 3 weeks. Luckily her credit card company had flagged the charges and canceled her card.

The next day the woman’s boyfriend had a doctor’s appointment in the city where one of the fraudulent hotel charges had occurred, so they decided to visit the hotel to see if the credit card thieves were still checked in. OP reported the fraud to the front desk, who were able to find the reservation by card number.

OP called her credit card company, who advised her to get the police involved. Just after they arrived, the front desk lady yelled out that one of the fraudsters was trying to leave.

The police cuffed him, then brought out two other scammers loaded with luggage. As the cops were going through the bags, they discovered a mountain of contraband, including a bag of an illegal substance.

The deputies then searched the hotel room and seized two more bags of the illegal substance, among other damning evidence. The cops gave OP all of the paperwork and said that one of the perps had told him they’d stolen her card off the internet.

That’s when OP remembered that there’d also been a charge for a storage unit in another city. The cops told her the unit was out of their jurisdiction, so she drove there and made another police report. OP says that, in the meantime, she’s going to call up the credit bureau to freeze her social security and asked the community if she needed a lawyer.

Image credits: Kindel Media / pexels (not the actual photo)

She remembered seeing a charge for a storage unit in another city, so she drove there and made another police report, then asked the community if she needed a lawyer

From what the cops told OP, it seems likely that her type of credit card fraud was the result of a data breach. In her article for Forbes, Jenn Underwood writes that data breaches and data leaks—accidentally exposing personal information—are on the rise. Last year alone, U.S. data leaks and breaches impacted the personal information of 353 million people.

Fortunately, many major credit cards offer $0 fraud liability to their credit cardholders, but you’ll still need to remain vigilant to maintain the security of your accounts.

Underwood recommends keeping your credit card information secure by updating your passwords regularly, not shopping online on public WiFi, and registering for paperless statements to reduce the risk of mail theft.

Underwood goes on to add that you should monitor your credit regularly and subscribe to texts and email notification services from your bank or credit provider, so you can spot any suspicious transactions immediately. It’s also a smart move to regularly review your credit report – you can do it for free at AnnualCreditReport.

If you think you’ve been a victim of credit card fraud, there are a number of steps you can take to minimize the damage and protect yourself. These include contacting your credit card issuer (who will freeze your account and issue you with a new card), updating your passwords and security settings, placing a fraud alert at any of the three major credit bureaus, and filing a complaint with law enforcement.

Luckily OP’s credit card company caught the suspicious charges before any further damage could be done, but it seems there are still a few steps she should take.

Bored Panda caught up with OP to ask her what urged her to share her story with the Reddit community. She said that she started lurking on Reddit after listening to a lot of narrated Reddit stories on YouTube.

She added that, when all this happened, she figured Reddit users would get a kick out of it and she’s glad that it brightened so many people’s day in the identity theft subreddit. While she didn’t have any more updates, she said she was waiting for her credit card company to mail her all the transactions before calling the deputy again.

What would you have done if you’d found yourself in OP’s shoes? Would you have had the courage to track down the criminals? Let us know your opinion in the comments!

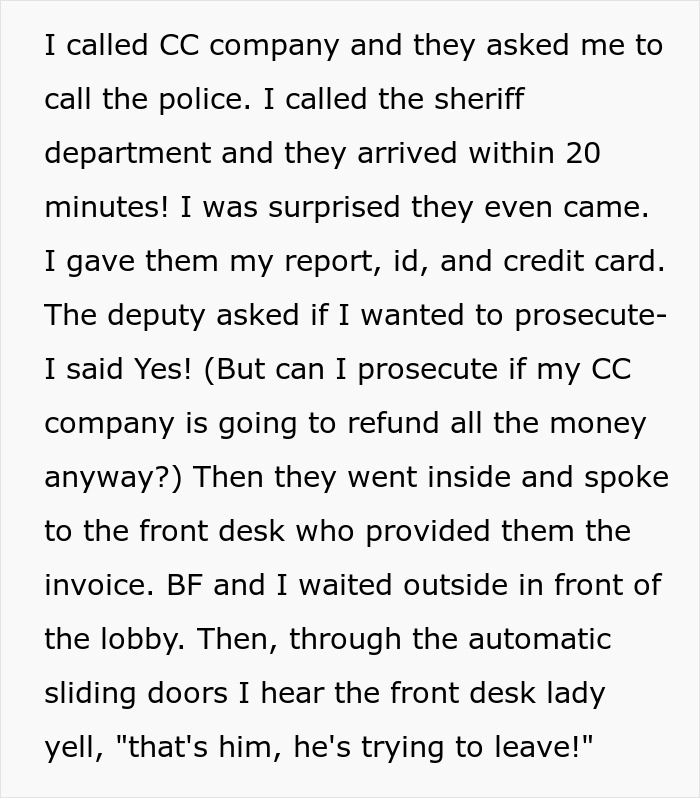

Redditors weighed in with their own stories of fraud and one even suggested the credit card company should hire the woman