In August, NIO Inc. (NIO) reported delivering 19,329 vehicles, marking an outstanding year-over-year growth rate of 81%. The electric vehicle (EV) manufacturer anticipates distributing approximately 55,000 to 57,000 vehicles in the third quarter, demonstrating a notable increase from the reported 31,607 EV units delivered during the same period in the previous year.

However, the financial health of the company has experienced turbulence. In the fiscal second quarter, NIO incurred losses of $835.10 million, more than double its losses in the same period the preceding year. Concurrently, its gross margin on vehicles for the quarter was 6.2%, down from 16.7% a year ago.

While sales have increased in recent months, a broader economic slowdown in China might potentially disrupt future delivery volumes. Coupled with contracting margins, it implies an increasingly challenging landscape for NIO to reduce its losses and move to profitability. Factor in the company’s substantial debt obligations, and it lends to a cautious approach regarding investment in NIO. Below are some of its key metrics that support my bearish stance.

Analyzing NIO’s Financial Performance from 2020 to 2023

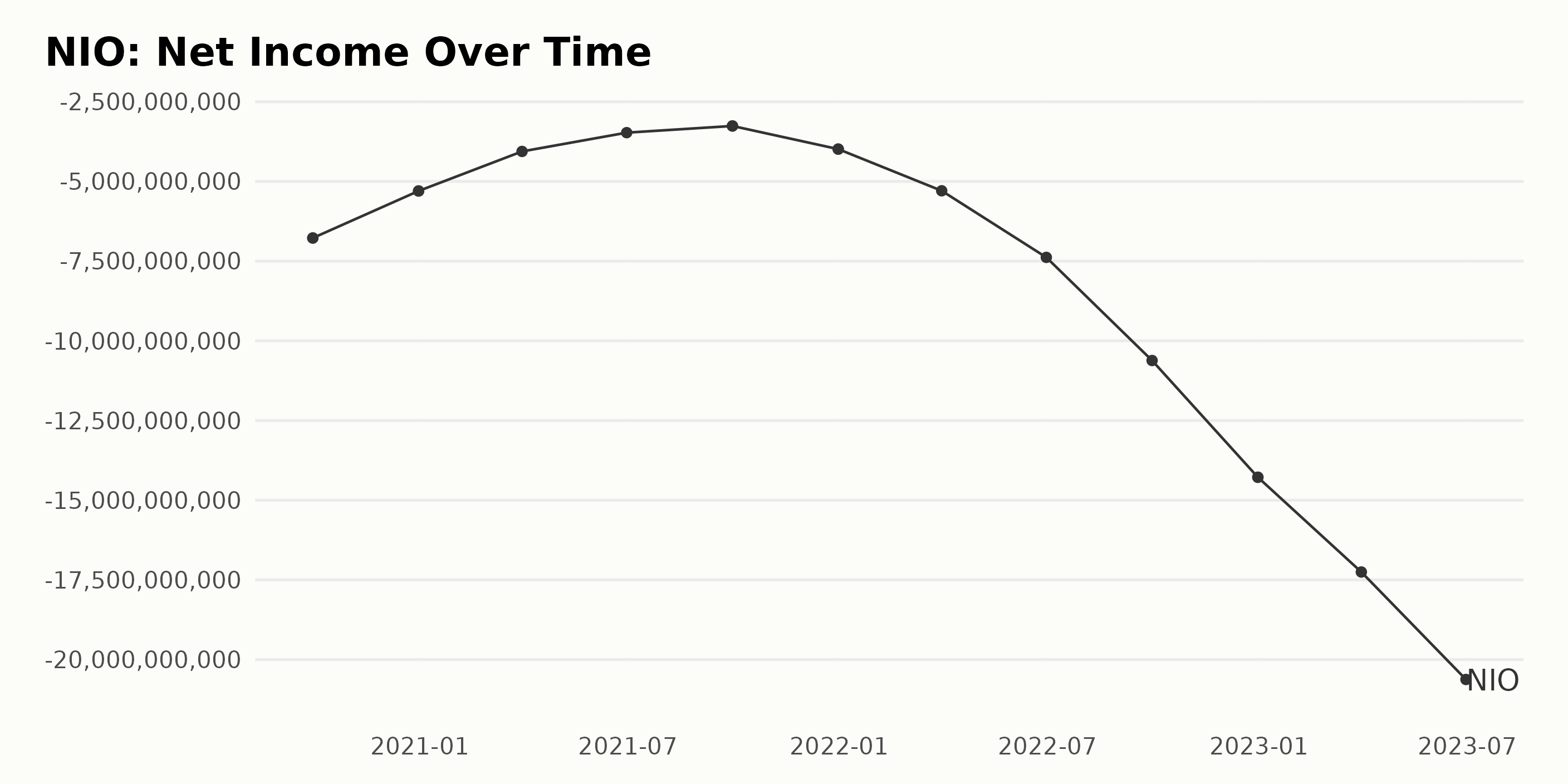

The trailing-12-month net income of NIO shows a consistent trend of decrease from September 30, 2020, to June 30, 2023. Below is a summary of the changes:

- On September 30, 2020, the net income was approximately -$6.77 billion, leading to another similar figure within the month.

- This value saw a slight improvement by the close of December 2020, where the net income was around -$5.3 billion.

- The first quarter of 2021 ended with the net income at -$4.06 billion and then fell to -$3.47 billion by June 30, 2021.

- By the end of 2021, the net income had dipped to -$4.99 billion in December.

- In the first half of 2022, there were notable decreases where it fell from -$5.29 billion in March to -$7.38 billion in June.

- The situation worsened in the next two quarters of 2022 as the net income further dropped from -$10.62 billion in September to -$14.28 billion in December.

By the end of June 2023, NIO’s net income was approximately -$20.62 billion, indicating an increasing rate of losses over this period. The growth rate measured from the first value to the last reveals an increase in the company’s losses by a factor of about 3. To conclude, the trend within this period underscores a deteriorating financial situation for NIO, with its net income consistently falling deeper into the negatives. The most recent data significantly highlights the scale of this downward trend, culminating in the most recently reported net income of -$20.62 billion.

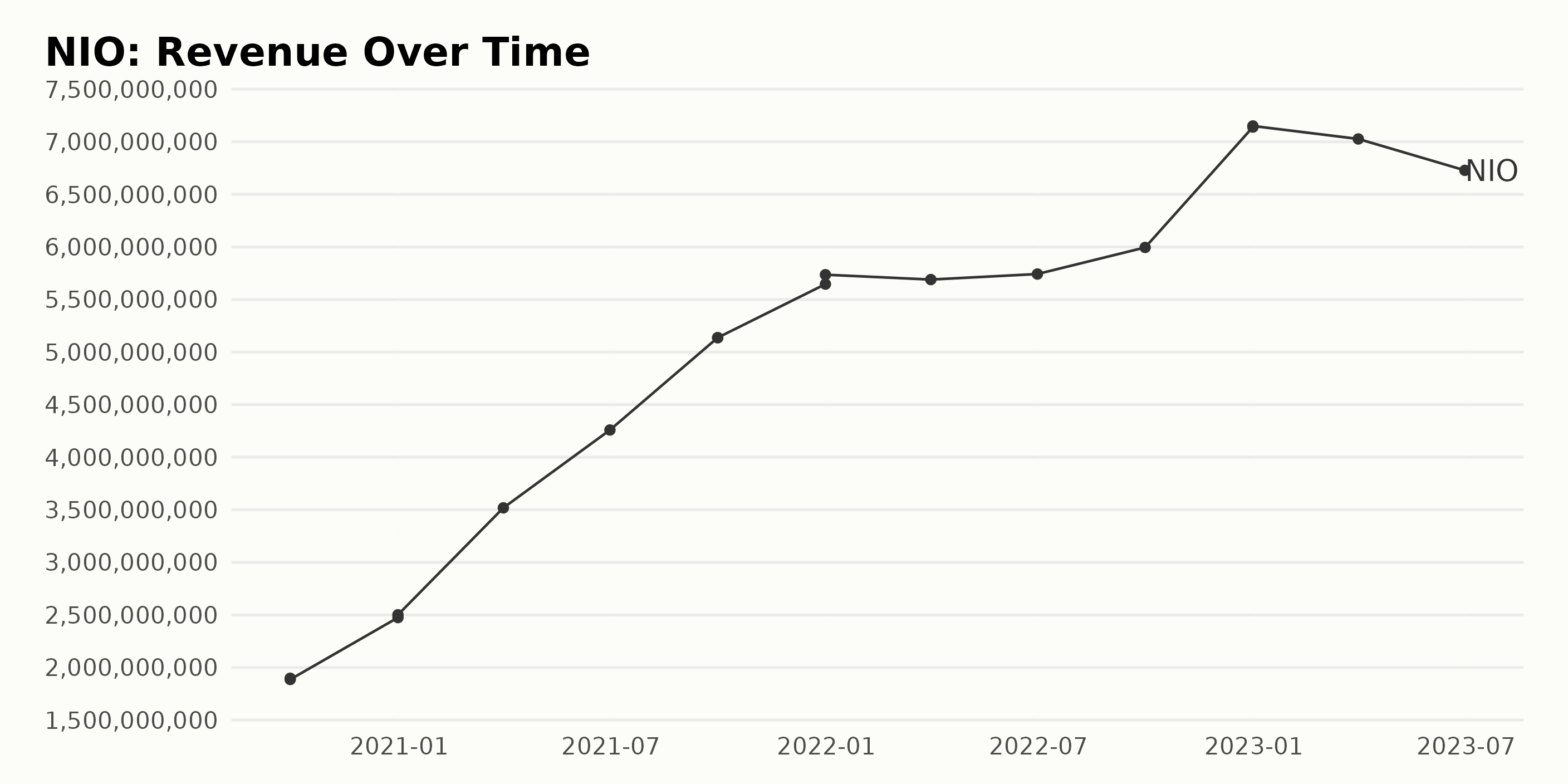

The trailing-12-month revenue of NIO over time indicates a significant trend of growth with some fluctuations. In numerical terms:

- At the end of September 2020, NIO reported a revenue of $1.89 billion and $1.88 billion.

- By December 2020, there was an appreciable rise in revenue, which reached $2.47 billion and $2.5 billion.

- The upward trend proceeded till the end of the third quarter of 2021, posting a revenue of $5.13 billion.

- However, revenue saw a slight dip in the first quarter of 2023, falling to $7.02 billion from $7.15 billion at the end of 2022.

- This was followed by a subsequent reduction to $6.72 billion at the end of the second quarter of 2023.

Focusing more on recent data and the last value in the series, NIO achieved its highest revenue in the fourth quarter of 2022, with a reported value of $7.15 million. However, it showed a slight fall in the subsequent quarters of 2023.

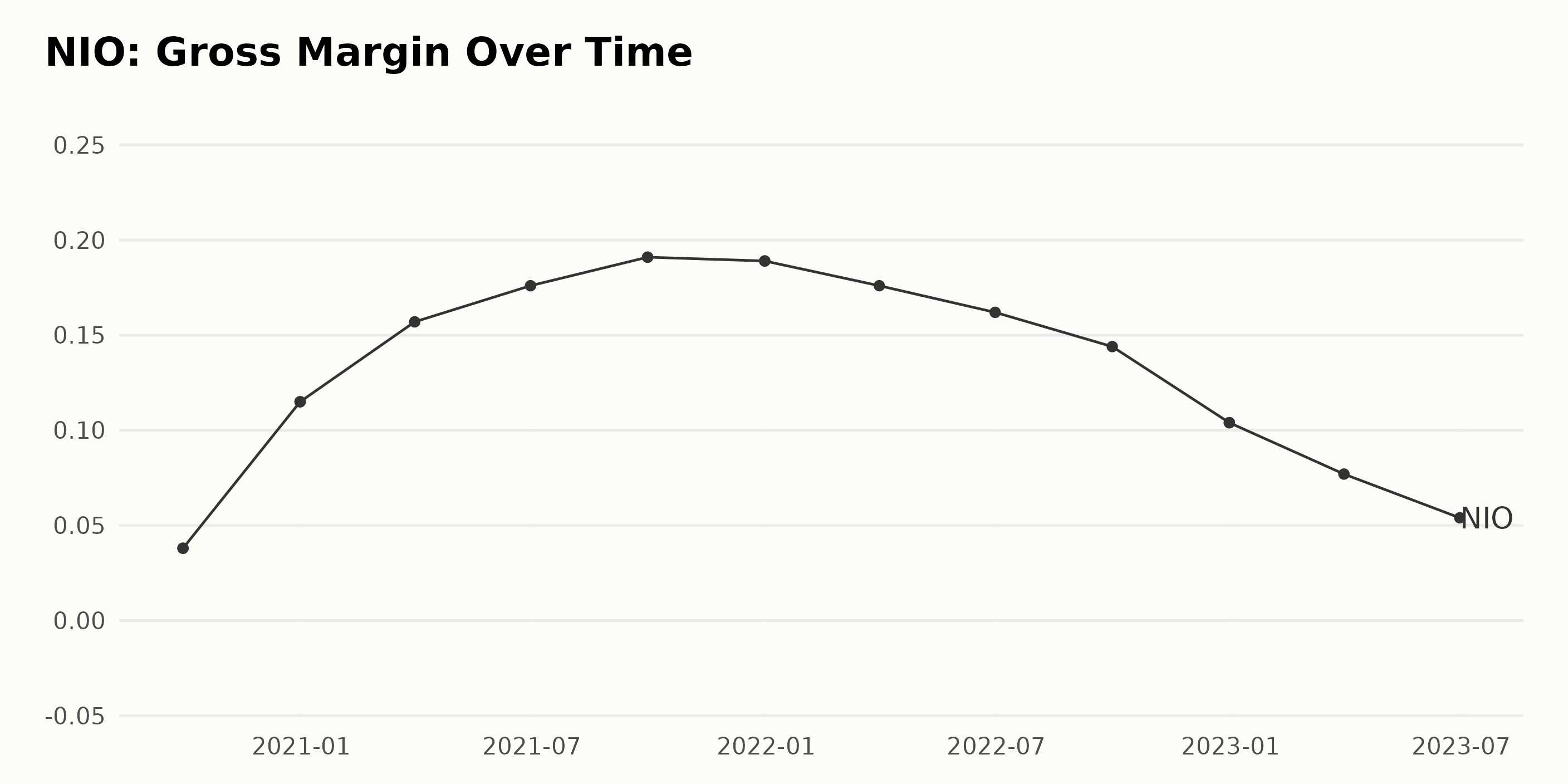

The gross margin of NIO exhibited significant fluctuations over the considered period. Here’s a summary of the reported gross margins:

- As of September 30, 2020, the gross margin was 3.8%.

- In the fourth quarter of 2020 (December 31), it recorded a drastic increase to 11.5%.

- By the end of the first quarter of 2021 (March 31), the gross margin had climbed to 15.7% and increased further to 17.6% at the end of the second quarter, June 30, 2021.

- The margin peaked at 19.1% on September 30, 2021, and held steady through the end of the year (December 31, 2021 at 18.9%).

- However, there was a noticeable downward trend in 2022; by the end of the first quarter (March 31, 2022), it dropped to 17.6%, further decreased to 16.2% in the second quarter (June 30, 2022) and 14.4% in the third quarter (September 30, 2022).

- This trend continued into the fourth quarter of 2022, where it fell to 10.4% as of December 31.

- As we move into 2023, the gross margin has continued to decrease. It stood at 7.7% at the end of the first quarter (March 31, 2023) and 5.4% at the end of the second quarter (June 30, 2023).

Emphasizing on the more recent data, we notice that NIO’s gross margin has been on a steady decline since peaking at 19.1% in the third quarter of 2021. By the end of the second quarter of 2023, it had fallen to 5.4%, indicating a significant downward trend. Comparing the last value with the first value, the gross margin has shrunk by 3.6%. This represents a negative growth rate of approximately -94.7% over the reported period. It is significant to note this decline, considering the peaks observed in 2021. This indicates that NIO, by June 2023, was underperforming compared to its profitability in 2020.

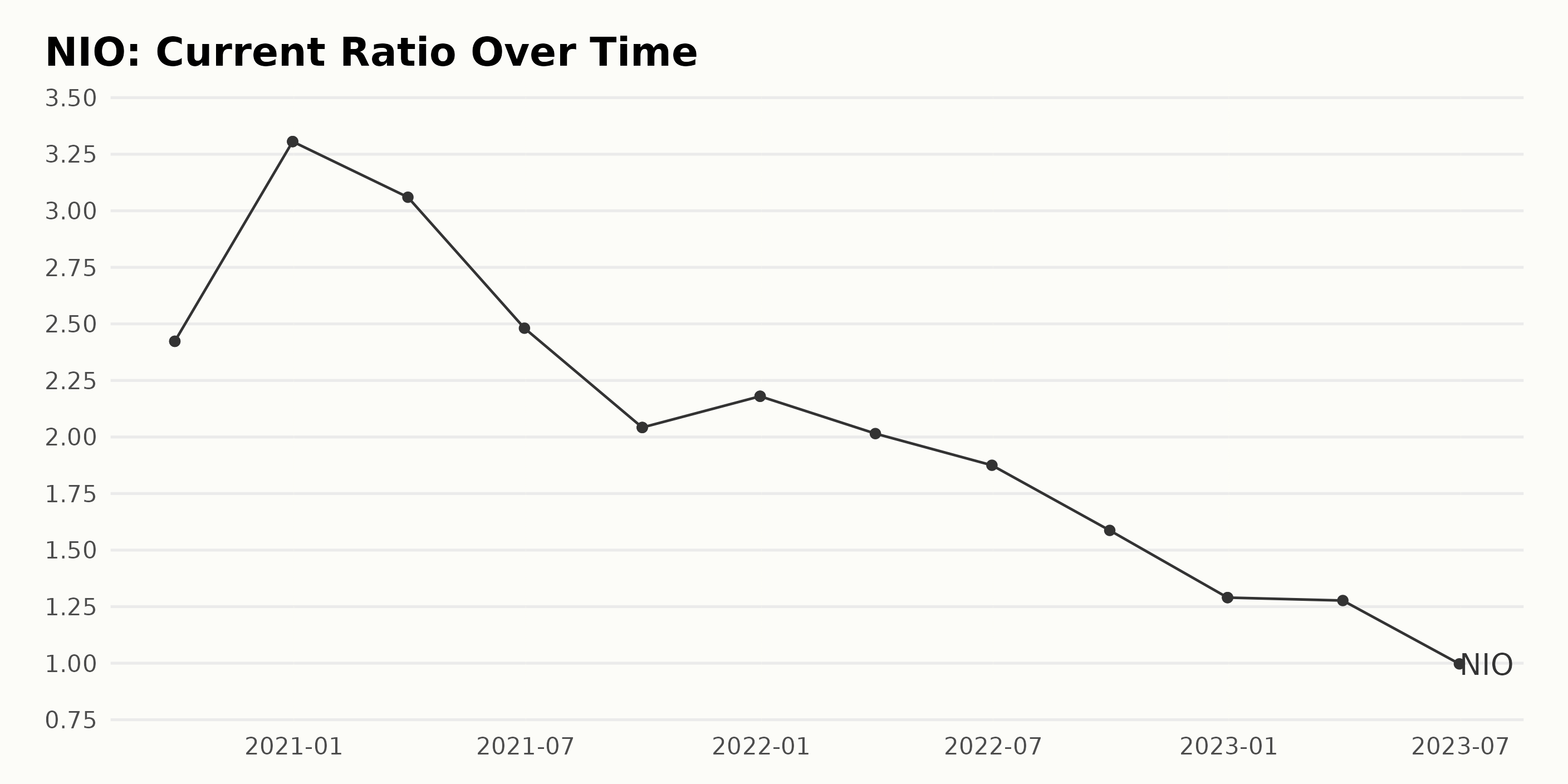

The current ratio of NIO has experienced a downward trend from September 2020 to June 2023. The data presents the following key elements:

- Beginning in September 2020, NIO held a current ratio of 2.42.

- By the end of December 2020, there was an upward fluctuation, with the current ratio reaching 3.31.

- This was followed by a continuous downward trend starting in March 2021 from 3.06, descending to approximately 0.997 by June 2023.

Particular emphasis on recent data:

- In 2022, the current ratio fell from 2.02 in March to 1.29 by the close of the year.

- In the first half of 2023, it kept dropping to reach 0.997 in June.

Growth rate: The current ratio decreased by 42% from September 2020 to June 2023, indicating a significant reduction in the company’s ability to cover short-term liabilities with short-term assets over this period. This negative growth reveals some financial strains that NIO may face, which could impact its overall performance and stability.

Analyzing NIO’s Share Price Fluctuations and Growth Trends Throughout 2023

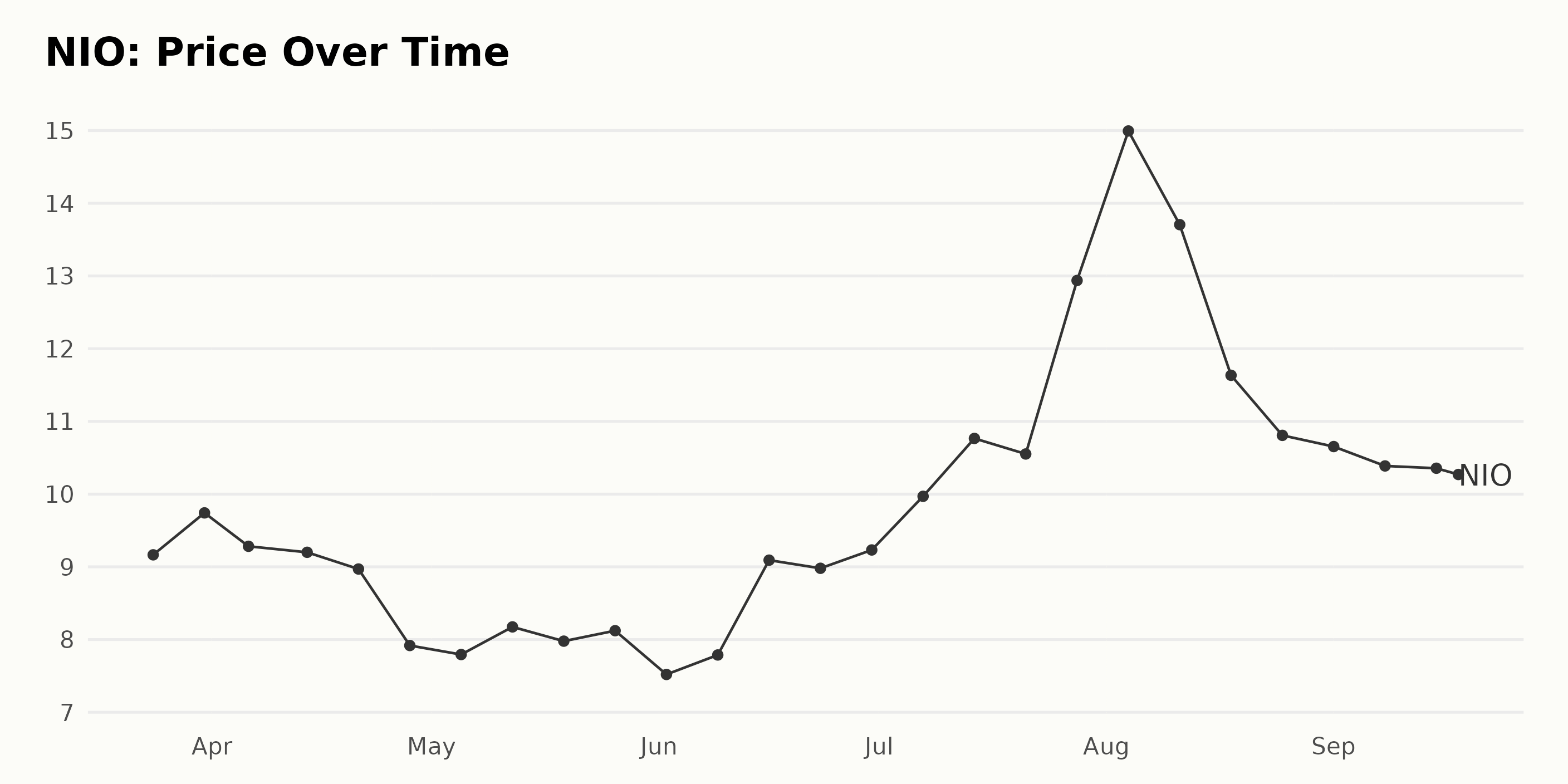

The data for the NIO share price across multiple dates during 2023 shows variable growth and decline rates.

- From March 24, 2023 ($9.17) to March 31, 2023 ($9.74), NIO share prices indicate a minor spike, suggesting a short-term growth seen in the final week of March.

- However, throughout April, the prices experienced a dip, decreasing from $9.28 on April 6, 2023, to $7.92 by April 28, 2023. This trend suggests a deceleration during this month.

- During May 2023, share prices fluctuated between $7.79 and $8.12, indicating a stable market with slight oscillations.

- In June 2023, there was a minor growth in price from $7.52 at the beginning of the month to $9.23 by its end.

- A significant increase can be observed from July 7, 2023, with the share price at $9.97, to July 28, 2023, where the value rose drastically to $12.94. This indicates a strong growth spurt within this period.

- However, beginning in August, the share prices display high volatility, with a peak at $14.99 on August 4, 2023, and then dropping to $10.81 by August 25, 2023, suggesting a decelerating trend after a quick rise.

- From September 1, 2023, onwards, the price seems to stabilize around the $10.65 - $10.35 range, indicating more steadiness in its pricing by this time.

In summary, while the share price for NIO has its ups and downs throughout 2023, there’s a general growth trend seen from its beginning price in March at $9.17 to its final recorded price in September at $10.27. Despite periodic fluctuations, the overall growth rate for the year appears positive, with periods of significant growth, particularly noted in July. Here is a chart of NIO’s price over the past 180 days.

Analyzing NIO’s Performance: Momentum, Value, and Growth Trends in 2023

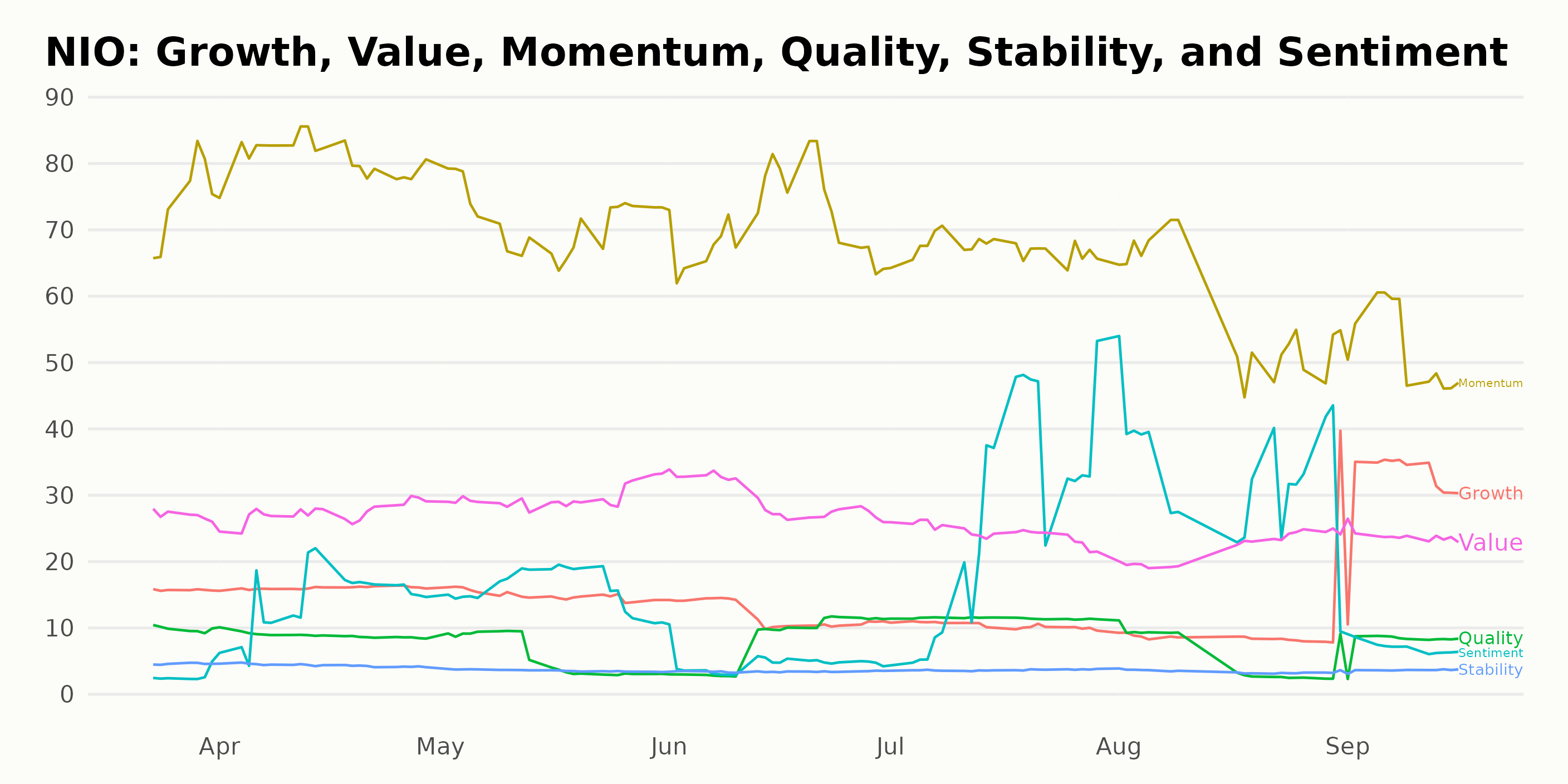

NIO has an overall F rating, translating to a Strong Sell in our POWR Ratings system. It is ranked #51 out of the 55 stocks in the Auto & Vehicle Manufacturers category.

Upon reviewing the POWR Ratings for NIO, three dimensions stand out as having the highest ratings: Momentum, Value, and Growth. Here’s a detailed look into how these aspects evolved over time:

Momentum: In March 2023, the Momentum score was noted as 75, which saw a slight increase in April 2023 to 81. By May 2023, the score had declined slightly to 71. This trend of slight decreases continued across June and July 2023, with scores of 72 and 67, respectively. There was then a notable decrease in the Momentum score in August 2023, down to 57, before a further reduction to 52 in September 2023.

Value: For the Value dimension, the ratings started at 27 in March 2023. This rating remained steady in April 2023 but showed a moderate increase to 30 in May 2023. By June 2023, the value rating slightly dipped to 29, then dropped to 24 in July 2023, which was maintained till September 2023.

Growth: The Growth rating began with a score of 16, which lasted from March through April 2023. There was a moderate decline to 15 in May, then more significant drops to 12 in June and 10 in both July and August. However, September 2023 experienced a major upturn, with growth spiking to a rating of 32.

These findings provide a snapshot of the shifting performance of the NIO across various key dimensions.

Stocks to Consider Instead of NIO Inc. (NIO)

Other stocks in the Auto & Vehicle Manufacturers sector that may be worth considering are Mercedes-Benz Group AG (MBGAF), Honda Motor Co. Ltd. (HMC), and Subaru Corp. (FUJHY) -- they have better POWR Ratings.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

NIO shares were trading at $9.21 per share on Tuesday morning, down $1.10 (-10.67%). Year-to-date, NIO has declined -5.54%, versus a 16.31% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

Will NIO (NIO) Be a Buy for Investors by the End of 2023? StockNews.com