Microsoft (MSFT) and Apple (AAPL) have been two of the major leaders as U.S. equities have surged back from the doldrums.

The S&P 500 is up in four straight weeks and in five of the past six weeks. For Apple’s part, the stock enters this week on a six-week win streak and is up a third (34%) from the lows.

But there’s reason for some caution with the stock when we look at the charts.

Is that also true for Microsoft?

Microsoft stock is up 21% from the 2022 lows, but a big chunk of those gains has come in the past four weeks: The stock is up 17% from that low. For what it’s worth, Apple is up about the same 17% in that stretch.

Despite Microsoft’s disappointing earnings results on July 26, the shares have been powering higher. Let’s look at the charts to see whether it’s time to pump the brakes.

Trading Microsoft Stock

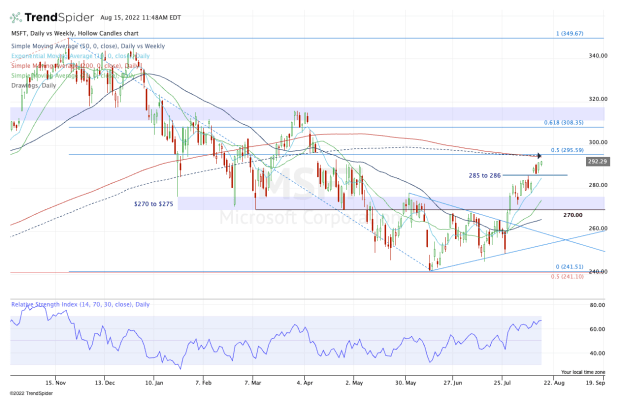

Chart courtesy of TrendSpider.com

As two of the leaders for the recent market rally, Apple and Microsoft should command part of investors' attention.

Even for investors not trading these specific stocks, their impact on the market can't be ignored. Apple and Microsoft make up almost 24% of the Invesco QQQ Trust and more than 13% of the S&P 500.

Not only did Microsoft stock hold uptrend support on its selloff before its earnings report, it broke out over downtrend resistance after the report.

The stock then kicked matters up a notch by clearing the key $270 to $275 zone, which had previously gone from prior support to current resistance.

From here, Microsoft faces a tough hurdle near the $295 zone.

Not only is that the 50% retracement of the current range, but it’s also the 200-day and 50-week moving averages.

I would expect this area to be resistance, given how big of a move we’ve already seen and the significance of these levels.

That said, if Microsoft can eventually power through them, then the $308 to $310 zone is next, while the stock will have cleared a bevy of key levels and measures.

As for the downside, I am closely watching the $285 zone.

Earlier this month, $283.50 to $285 was stout resistance. Once Microsoft broke above it though, the $285 to $286 area became support. The stock also has its 10-day moving average approaching this zone.

So if we see Microsoft shares pull back to the $285 level, the bulls will need to see support come into play.

If it fails, we could be looking at a potential trip down to the $275 area and the 21-day moving average.