When it comes to trading and investing, it’s common to hear that the market is a forward-looking discounting mechanism. In effect, “buy the rumor, sell the news.”

As it relates to cruise stocks, one would think that they would be soaring as these companies are back to sailing and as travel trends surge into the summer.

I mean seriously, have you been to the airport lately?

Now that cruises are slowly dropping their Covid restrictions, many investors assume this will lead to even more momentum in bookings and revenue.

Despite this, stocks like Carnival Cruise (CCL) and Royal Caribbean (RCL) are still down tremendously, with the stocks lower by 50% and 43% from the second-quarter high, respectively.

What are the charts signaling now with Friday’s rally?

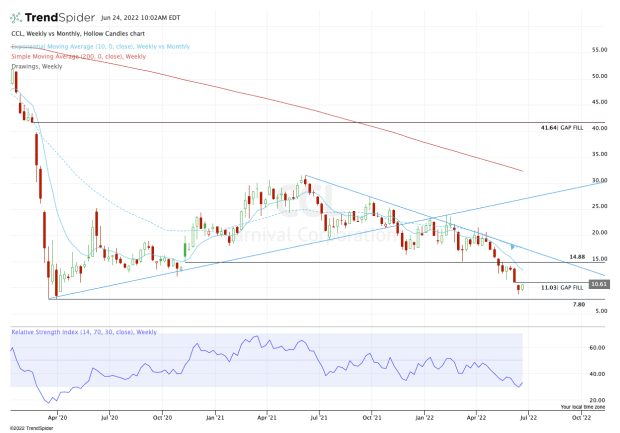

Trading Carnival Cruise Stock

Chart courtesy of TrendSpider.com

Carnival is up more than 14% on Friday and over 10% for the week. Despite that, shares recently hit their lowest level since mid-2020.

Now trying to go weekly-up over last week’s high of $10.54, Carnival stock can fill the gap up at $11.03 with a bit more of a push. If it continues to rally, the 10-week moving average and the $14.88 to $15 zone is next in line.

If the momentum is really strong, bulls might see Carnival Cruise rally up to the 10-month moving average and downtrend resistance (blue line) between $17 and $18.

On the downside, the levels are even more clear: Lose the June low at $8.70 and a retest of the 2020 low at $7.30 is on the table.

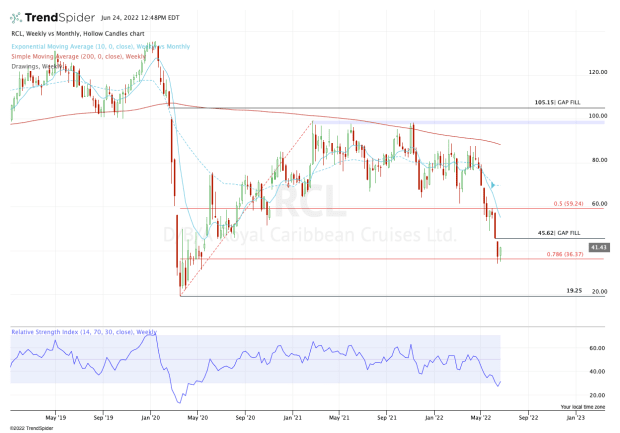

Trading Royal Caribbean Stock

Chart courtesy of TrendSpider.com

Royal Caribbean stock looks quite similar to Carnival. Shares have collapsed over the last several months, recently bottoming at $34.10 as support came into play at the 78.6% retracement.

That’s right — the stock has retraced more than three-quarters of its post-Covid rally.

From here, that $34.10 level becomes vital. A break and close below it opens the door down to the $20 area.

On the upside, there’s a gap-fill level at $45.62 if Royal Caribbean stock can gain more upside momentum. Above that and the declining 10-week moving average is in play. Although that’s active resistance, a move back above it would open the door up to the $60 area.

For now, the cruise stocks remain in active downtrends. However, they also have clearly defined risk levels to watch on the downside.