The markets have end lower as company reporting season winds down, with results from Qantas and Medibank making for interesting reading.

Look back on how the day unfolded.

Disclaimer: This blog is not intended as investment advice.

Key events

Live updates

Market snapshot at 4.20pm AEDT

By Rachel Pupazzoni

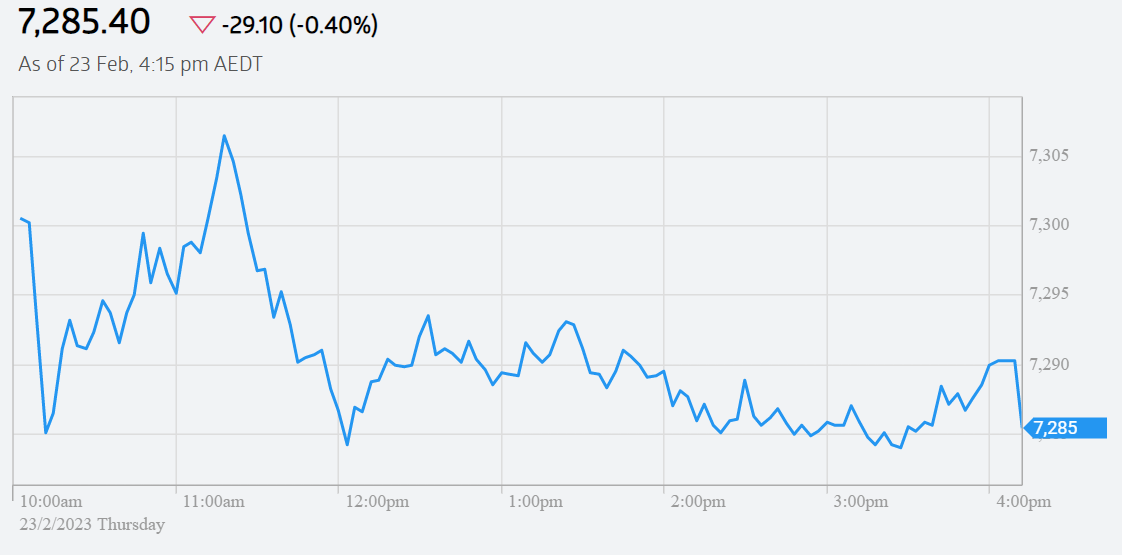

- ASX 200: Down 0.4 per cent to 7,285

-

All Ordinaries: Down 0.3 per cent to 7,492

-

Aussie dollar: Up 0.3 per cent to 68.24 US cents

-

Dow Jones: Down 0.39 per cent to 33,001.48

-

Nasdaq: Up 0.09 per cent to 11,502.18

-

S&P 500: Down 0.26 per cent to 3,986.97

-

FTSE 100: Down 0.59per cent to 7,930.63

-

Euro Stoxx 50: Down 0.18per cent to 4,242.88

-

Hang Seng: Up 0.55 per cent to 20,535.97

-

Nikkei 225: Down 1.34 per cent to 27,104.32

-

Spot Gold: Up 0.18 per cent to $US1,828 an ounce

- Brent Crude: Up 0.32 per cent tp $US80.86 a barrel

- Bitcoin: Up 2.9 per cent to $US24,500

Another day done

By Rachel Pupazzoni

That's it from the markets blog for today. I hope you've enjoyed following along.

Don't forget to use the comments button – we love hearing from you.

My brilliant colleague Michael Janda will take you through all the action tomorrow on the blog.

At this stage, the market is looking like it'll end the week down but tomorrow is a new day with endless possibilities.

I'll be busy in the studio tomorrow putting together Close of Business — you can watch it on your TV, or catch up on iView any time.

And of course, The Business is on your screens tonight.

Bye for now.

Markets end the session lower

By Rachel Pupazzoni

The ASX200 touched a new 20 day low today.

By the end of the session it lost 0.4 per cent.

The index is more than 4 per cent below its 52 week high.

Here's what the day looked like in chart form.

Qantas ended the day down 6.8 per cent to $6.03 a share.

Medibank was one of the better performers, adding 6.5 per cent to $3.28 a share.

The broader All Ordinaries lost value today too.

It's chart looks a lot like the Top 200.

The bottom performing stocks were gold miner Red 5 (-22.86%) and financial manager Platinum Asset Management (-17.00%).

Trading on the ASX to wrap up soon

By Rachel Pupazzoni

With less than an hour left of trade, I thought I should check to see where things are at.

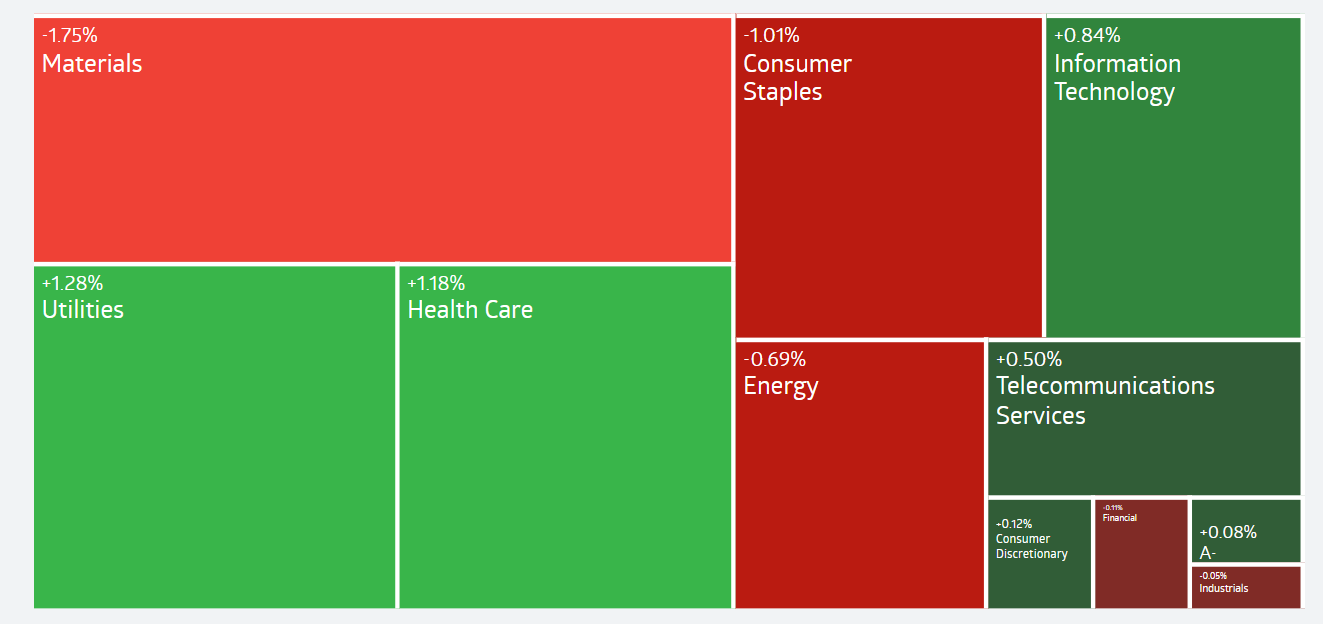

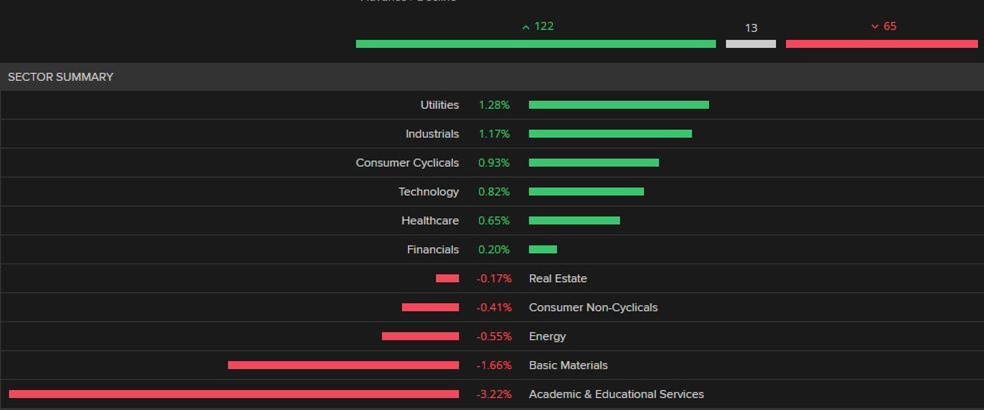

Here's the sector view as at 3.10pm AEDT.

Not much has changed since my last post on this. Utilies and health care are at the top, while materials (mining stocks) are the worst performing sector.

Here are the top 10 stock gains on the ASX 200 as at 3.15pm AEDT.

Note Medibank, which reported today, has seen its shares gain value.

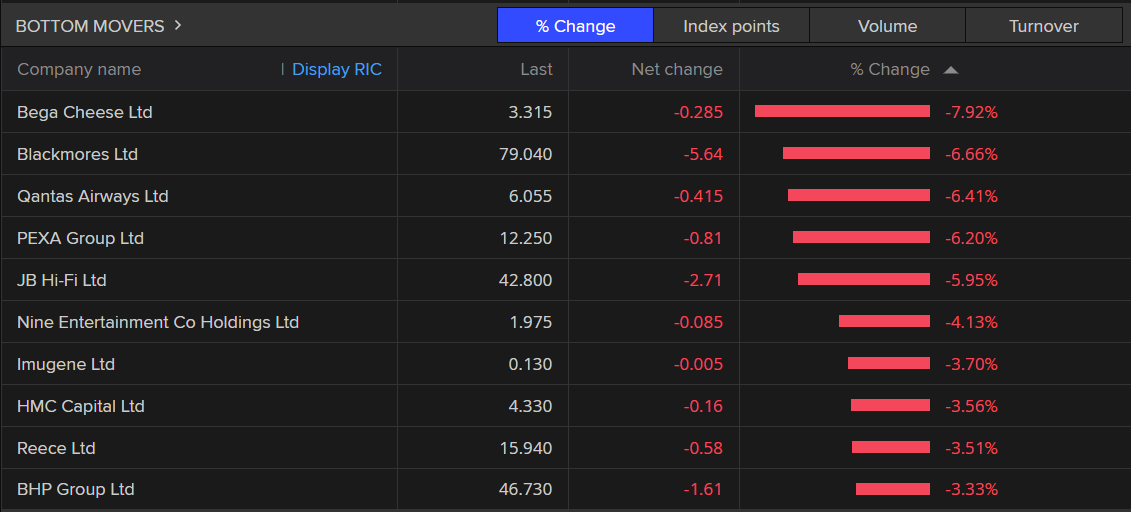

Here are the worst10 stock losses. Qantas, which also reported today, makes this list.

Standby for the closing numbers after 4pm AEDT.

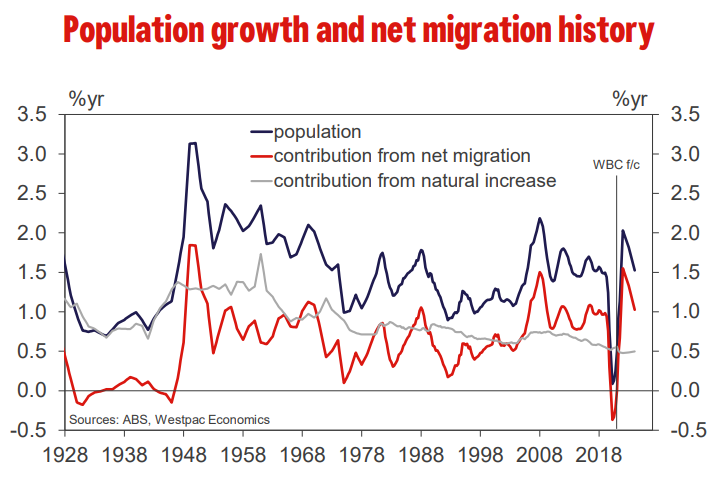

Are we about to see a migration surge like the post WW2 era?

By Rachel Pupazzoni

Can you believe it's been a year since Australia's border with the rest of the world, that had been in place for two years, came down on February 21, 2022?

Me either.

The team at Westpac have done some number crunching and sent me their research on what happened with migration, when that hard border was abolished.

In his note, Westpac economist Ryan Wells says "the reopening has unleashed a surge of migration, the likes of which have not seen since post WW2".

"Almost exactly one year ago on 21 February 2022, Australia's borders reopened to fully vaccinated individuals across the world.

"Since then, it has become increasingly evident that a net migration surge is well underway, stronger than what was initially expected coming out of the pandemic."

ABS quarterly population estimates show net migration was 156,000 k in the first half of 2022.

That was just 3,000 fewer than the first half record of 159,000 in 2008 - even with the border being closed for almost two months!

There isn't any official data about net migration beyond the first six months of 2022, Mr Wells noted "limited but timely indicators are pointing to a further strengthening over the second half of the year."

He wrote that monthly data on overseas arrivals and departures suggests net visitor arrivals lifted from 419,000 in the first half, to 676,000 in the second half.

A similar theme is also found within net visa arrivals.

"Net arrivals surged in the 'temporary work' group of visas (including skilled, working and other temporary visas), and the strength in net student arrivals was largely sustained too."

"In our view, the surge in net migration is beginning to have a material impact on the labour market too, with growth in the working age population rising to be well above pre-pandemic levels at an elevated 2.1 per cent a year."

There has also been a lift in student visa applications and grants.

Add to that the removal of COVID-zero restrictions in China and the mandate for students to return to in-person learning, arrivals from China are set to jump this year, complementing the strength already being seen in arrivals from India.

By the end of the calendar year, Westpac estimates net overseas migration to come in at 400,000 for 2022.

"This historic high – well above the 316,000 in 2008 – represents a temporary 'catch-up' from the substantial loss of net migration flows over the pandemic.

"This will be followed by a gradual easing over the course of 2023 and 2024 as migration targets are likely to be pared back in response to the boom over 2022."

Though the numbers will still be elevated, according to Westpac.

It expects net migration to be 350,000 in 2023 and 275,000 in 2024.

I think we're going to need some more housing...

Weekly earnings have risen, but people's take home pay is still way off the cost of living

By Rachel Pupazzoni

Regular readers and followers of economic data will know the Wage Price Index (WPI) was released yesterday and it revealed the index rose 3.3 per cent in 2022.

Today the Australian Bureau of Statistics (ABS) has given us some new numbers to pour over - the average weekly ordinary time earnings for full-time adults.

It was up 3.4 per cent to $1,808 in the 12 months to November 2022, seasonally adjusted.

ABS's head of labour statistics, Bjorn Jarvis, said that's an increase of $59 a week.

"It is the highest it has been since May 2020, when low paid jobs were particularly impacted during the lockdowns early in the pandemic.

"Prior to the pandemic, the last time it increased by more than that during a year, was in May 2013, when it increased by 5.3 per cent.

“The rise in average earnings reflects strong wage growth, particularly in skilled occupations.”

The best paid industry is... drumroll please... mining.

Here's a full breakdown of industries.

Mining sector workers remain the highest paid on average, at $2,812 per week for full-time employees.

The lowest paid full-time workers on average were in the Accommodation and food services ($1,294) and Other services ($1,333) industries.

And here's the average weekly earnings by state and territory. WA and the ACT lead the way in this measure.

Though check out the gender pay gap in my home state, WA. (ahem)

There's always context though isn't there.

The Wage Price Index is up 3.3 per cent, but the Consumer Price Index - aka inflation - is up 7.8 per cent.

That's a big gap and means, just as you no doubt suspected, your money isn't going as far as it used to.

Will Qantas boss Alan Joyce stay on?

By Rachel Pupazzoni

My colleague Peter Ryan spoke to Qantas chief executive Alan Joyce after the release of its first half results.

There have been a lot of calls for him to retire - but as Peter explains, after 15 years at the helm, Mr Joyce he's committed until the end of this year, but wouldn't speculate on what happens after that.

Here's the interview, via Peter's Twitter account.

Happy listening.

Sector snapshot

By Rachel Pupazzoni

The local share market is on track for its third straight day of losses.

Energy, mining and consumer staples are all lower.

Medibank was up as much as six per cent to $3.26 after the health insurer announced its half-year net profit after — see my earlier post for more on than.

Qantas was down as much as 7.3 per cent to a six-week low of $6 despite the airline returning to profitability for the first time since COVID — more on that in earlier posts too.

Here's a visual look at how the sectors are performing about 1.20pm AEDT.

Thousands of Medibank customers leave after that massive data breach

By Rachel Pupazzoni

Hello, it's Rachel Pupazzoni taking over from my colleague Dan Ziffer for the afternoon.

What better place to start than to delve a little deeper into some more company results - Medibank.

Results season can sound like it's going to be a bunch of numbers in a spreadsheet that don't say much, but that couldn't be further from the truth.

Publicly listed companies are forced to open the books twice a year - and if you're prepared to look, sometimes there's some interesting information in those numbers.

Other times, the story is very obvious - especially when a company has been rocked by a massive security data breach compromising the information of millions of its customers.

The data breach where 9.7 million Medibank and ahm customer's data was stolen and released to the dark web in October 2022 was huge news at the time.

Now, Medibank has revealed some of the damage that caused to its business.

It lost almost 13,000 customers from October until the end of December and has seen what it called 'subdued growth' in new customers of 1,700 during the past six months.

Medibank has since spent $26m strengthening its cyber defence.

Chief executive officer, David Koczkar, said there's more to do.

"We recognise the significant impact the cybercrime event has had on our customers. We will continue to support them through our Cyber Response Support Program, which includes mental health and wellbeing support, identity protection and financial hardship measures.

"There is more work to do, and the lessons we have learnt from the cybercrime will continue to shape our response and we will emerge stronger."

Here's what Medibank revealed about what happened:

- The criminal accessed the system using a stolen Medibank username and password, used by a third party IT service provider

- They then used the stolen credentials to access Medibank's network, through a misconfigured firewall, which did not require an additional digital security certificate

- They then gained more usernames and passwords to gain access to a number of Medibank's systems, their access was not contained

- After a security alert on October 11, Medibank closed down the criminal's attack path

- It says they have not detected any more activity by the criminal since 12 October 2022

So, what is the health insurance provider doing now?

It says it's defending about 18 million perimeter attacks a day.

So the company says its prioritising support for its customers, continuing to strengthen its security environment and is changing their approach to data management.

So, how did this all impact Medibank's profit?

Well, they still made one - and it increased.

The Group's net profit after tax for the first half of FY 2023 was up 5.9 per cent to $233.3m.

It's revenue rose 1.3 per cent to $3.65bn.

Shareholders will be paid an increased dividend of 6.3 cents.

Market at midday: ASX 200 down 0.3%, Qantas, JB Hifi slump more than 5%

By Daniel Ziffer

The value of shares in retailer JB Hi-Fi, cosmetics brand Blackmores, transaction company PEXA and food manufacturer Bega Cheese are all down more than 5% each in trading this morning.

Overall the ASX 200 index of the largest 200 listed companies is down 0.38% after morning trading.

Here's how some of the biggest movers are faring.

Of the 200, 106 are in positive territory, 10 are flat and 84 have lost value at this point of the day.

Investors in logistics company Qube will be happy, shares have leapt 8.2% today to 3.23 after underlying earnings soared 37% from a year ago.

But the most famous Q-based stock is having a tough day. Shares in Qantas are down 4.95% to 6.12 at midday. You can read more about the company's results - including the first profit since the pandemic began - in this article.

Earnings data dejavu

By Daniel Ziffer

If it feels like Wednesday today, that could be the release of average earnings data from the ABS.

After yesterday's wage price index gave our latest look at how fast (or slowly) people's pay was going up, today's research on average earnings largely matches the trend.

Seasonally adjusted, full-time adult average weekly ordinary time earnings lifted 3.4% annually to November, to hit $1,875.20.

Yesterday's data on the wage price index - a slightly different way of measuring wages - was up 3.3% annually to December.

The gap between that rise and the surge in inflation - creating cost of living pressures for workers and fall in 'real wages' - led Matt Grudnoff, senior economist at the Australia Institute, to accuse the Reserve Bank of trying to blame workers for their problems.

"To blame workers for current inflation while they experience unprecedented real wage drops, and companies post surging profits, is economic gaslighting of the highest order"

"This data shows fears of a 'wage-price spiral' similar to the 1970s are a speculative fantasy."

The 'real' value of wages declined by 4.5 per cent in 2022, the biggest deterioration on record., as inflation pushed up the cost of unavoidable things like fuel, food and housing.

"That story is now itself a risk to the Australian economy. Australians are not living in the 70s. We are falling behind on the cost-of-living in 2023," he told Gareth Hutchens.

The Star loses $1.2B

By Daniel Ziffer

Troubled gaming giant The Star has revealed some big hits in its half-year results.

In the first half of financial year 2023 it's statutory net profit after tax is a $1.264 billion loss. For the same period a year earlier it lost $74 million.

If you use the measure of normalised earnings, which wipe away big 'one off' costs, its net profit after tax was $44 million for the half year to December.

Earnings before interest, taxes, depreciation, and amortisation (known as EBITDA) were $200 million.

There's a whole page in the results of 'Significant Actions/Matters', which I'll summarise here....

- Proposed increases to NSW casino taxes

- Financial crimes agency AUSTRAC's civil penalty proceedings against it over breaches of anti-money laundering laws. (Breaches at Commonwealth Bank and Westpac resulted in respective fines of $700M and $1.3B)

- Four separate class actions on behalf of shareholders who've seen the value of the company tank

- ASIC taking civil penalty proceedings against former executives and a current director

It's A LOT.

On the upside, Star says domestic revenue is only down 1% compared to pre-COVID and it's up 30% on the same measure in the Gold Coast.

Trading remains halted in the shares: they're at 1.52

Crowd support is the home ground advantage, research suggests

By Daniel Ziffer

Not strictly business, but the behaviour of crowds (and markets) clearly interests you, so digest this as we wait for The Star to release its results and come out of a trading halt.

Does loud screaming impact the result of a match?

Monash University researcher Josh Leota has examined the effect of home crowds using a natural experiment created by the lockdowns and conditions of the pandemic.

Crowds were roughly cut in half during the 2020/2021 NBA regular season games and in an article for the Journal of Sports Sciences his study found that home teams won 58.65 per cent of matches with crowds, compared with just 50.6 per cent of crowd-free home games.

Expressed as a percentage, having crowds was associated with a 15.91 per cent increase in home team winning percentage.

That's notable, especially when you consider the difference between the winning percentages of teams that finished fifth (58.3 per cent) and 10th (49.0 per cent) out of 15 total Western Conference teams that season.

“For context, this differential represents a guaranteed playoff spot (fifth) and having to win two play-in games on the road to make the playoffs (by getting tenth),” Mr Leota said.

The study didn’t look at Australian data - when many 2020 seasons were played without crowds - so it's hard to know what the results would be.

“However, given the immense popularity of elite sports in Australia and the similarities in sports fandom with the US, we speculate that future research would likely find a similar crowd effect in Australian elite sports leagues like the AFLM, AFLW, NRL, and NRLW,” Mr Leota said.

Market at 1030 AEDT - Qantas shares slump on results

By Daniel Ziffer

Here's a quick look at the sharemarket just after opening

Qantas shares are down 3% to 6.26 after the airline announced a profit, after three long pandemic-affected years.

(This generally means analysts expected the result to be better. Read this article, below, by Michael Janda to learn more).

By contrast, Medibank share leapt 4.8% after it revealed half-year results. It's had a tumultuous time as well, when a hacker exposed the private medical details of millions of Australians.

The ASX 200 is down 0.3% to 7291.60 points. Here's what's happening in different sectors.

Market open, down

By Daniel Ziffer

The key ASX 200 index has headed down, 0.38% in early trade, to 7,286.50 points.

The market is open until 4PM AEDT and we've got lots more news, company data and releases before then.

Real wages falling - you are going backwards

By Daniel Ziffer

Hold on - wages lifted yesterday, right?

Yes, but no. That's because the wage price index (or WPI) rose to 3.3% for the year to December. That's higher than the last time we got data, which showed a 3.2% lift in wages to September.

But inflation is smashing wage rises. With the consumer price index running at 7.8% a year, comparing those means worker's 'real wages' are going backwards at 4.5% for the year.

My wonderful colleague Rachel Pupazzoni filed this report about what it means for you - watch the video or read the online.

Share market set to open lower

By Daniel Ziffer

Watch out for Qantas and Medibank when the sharemarket opens at 1000 AEDT today, after big profit announcements.

The ASX is expected to open lower on Thursday after a fall in commodity prices and uncertainty around rate hikes from our central bank, New Zealand's and the U.S. Federal Reserve.

The local share price index futures fell 0.4%, which puts it 95.5-points lower than the where the ASX 200 index closed.

(The futures index is where traders bet what's going to happen, essentially).

The benchmark ASX 200 index - which tracks the value of the 200 largest listed companies in Australia - closed 0.3% lower on Wednesday.

The Star in trading halt ahead of results

By Daniel Ziffer

Want to trade shares in The Star?

You can't. The troubled gaming giant went into a 'trading halt' yesterday ahead of the release of its half-year results

Just how big a hit have they taken? We'll find out soon. In the announcement yesterday, the ASX said:

"Unless ASX decides otherwise, the securities will remain in a trading halt until the earlier of the commencement of normal trading on Friday, 24 February 2023 or when the announcement is released to the market"

Qantas boss lauds profit

By Daniel Ziffer

Qantas CEO Alan Joyce has lauded the company's first profit since the pandemic.

"This is the recovery our people, our shareholders – and in many respects, our customers – have been waiting for. Because this result isn’t just about a single number. Ultimately, it’s about getting back to our best by reinvesting in the national carrier".

The company was found to have illegally sacked thousands of workers, and then lost an appeal against that decision in the Federal Court. It is now taking an appeal to the High Court, the nation's top legal body.

In his speech, Mr Joyce did not refer to the court losses, apart from noting it had been a "long – and frankly, difficult – journey to get to today".

But he did reveal benefits for staff and thanked them for their "incredible grit and dedication".

He said around 20,000 non-executive staff would be eligible for shares and cash bonuses of up to $11,500 each and that $500 in staff travel credits had been put aside to say thank you.

Qantas, Medibank results

By Daniel Ziffer

Two of the most high-profile companies in Australia have revealed big profits.

For the half-year, the profit at airline Qantas jumped more than 100%. You'll remember that this time last year the airline was struggling with huge numbers of lost bags and a high level of cancelled flights.

Compared to that period, the December 2022 half year result shows:

- Revenue $9.9B (up from $3B in the same period a year ago)

- Profit $1.001B (up from a $456M loss in the same period a year ago)

What about Medibank? It's year has been dominated by a massive hack that exposed the private medical details of millions of Australians.

The group's net profit after tax is $233.3M, up 5.9%. It's said it spent another $26M on its cyber-crime response.

More to come...