Apple (AAPL) did what the bulls needed it to do as it rallies about 5% on Friday after reporting earnings.

It’s not just the Apple bulls that wanted a rally. It was the overall stock market bulls, too. Apple accounts for more than 7% of the weighting in the S&P 500 and 12.5% in the Invesco QQQ Trust Series ETF (QQQ).

The company now boasts a market cap of $2.75 trillion, so while its impact on the market is important in terms of weighting, it’s also important in terms of sentiment.

Don't Miss: How Far Can Shopify Stock Rally? The Charts Hold a Clue.

One can see how megacap tech is steering the ship. When you add in Microsoft (MSFT) — which also had a bullish post-earnings response — the two stocks account for more than 13% of the S&P 500 and 25% of the QQQ ETF.

In the case of Apple, the firm delivered a top- and bottom-line beat. While guidance was actually a disappointment, investors seem willing to overlook that forecast (perhaps in lieu of its new $90 billion buyback plan).

Either way, Apple stock is rallying after it entered the week at a critical area on the chart. Let’s look.

Trading Apple Stock on Earnings

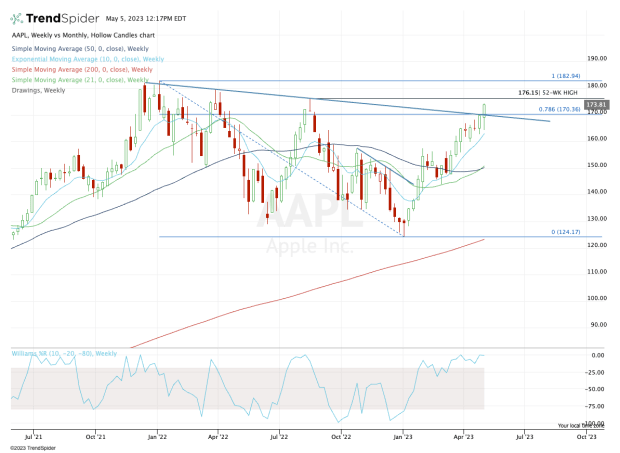

Chart courtesy of TrendSpider.com

Coming into the week, Apple stock was at a fork in the road. That’s not a technical term, but at least in regards to the technicals, that was the scenario.

Either way, the stock was going to run out of steam at resistance as the Fed raised rates and the company reported earnings, or Apple stock was going to break out to the upside after these events.

In this scenario, potential resistance was twofold.

First was the key downtrend-resistance mark that had been in play since January 2022 when Apple touched its all-time high. Second, there was the 78.6% retracement from the 52-week low up to the all-time high.

Don't Miss: Set Sail With Cruise Stocks? Trading Royal Caribbean and Carnival Now

With the stock breaking over these measures today, bulls can turn their attention to the 52-week high up at $176.15. Above that and they can look at major resistance between $180 and $183.

On the downside, all the bulls really need to see is for Apple stock to hold its short-term moving averages. Ideally, that’s the 10-day and 21-day moving averages, but really, as long as it holds the 10-week moving average, the trend remains bullish.

All year, Apple has been a stock market leader, helping to push the indexes higher. For now, that remains the case as the stock hits multimonth highs.

Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.