During a tough year, investors were hoping that Amazon (AMZN) stock would have performed better in the fourth quarter.

Given how well the company tends to do during the holidays, it was a reasonable hope that after the shares fell 39% from their all-time high to the end of the third quarter — with a peak-to-trough decline of 45.5% — they'd turn higher this quarter.

Instead, Amazon stock broke to new lows this quarter.

While some tech names like Nvidia (NVDA) bottomed in October, Amazon didn’t bottom until November.

That came after the shares collapsed, falling nearly 30% and declining in 10 out of 11 sessions until the stock hit its low.

Amid that stretch, Amazon also reported disappointing quarter results.

At one point, Amazon stock looked as if it was ready to snap its downtrend, but now the stock is rolling over once again.

Will Amazon Stock Break to New 2022 Lows?

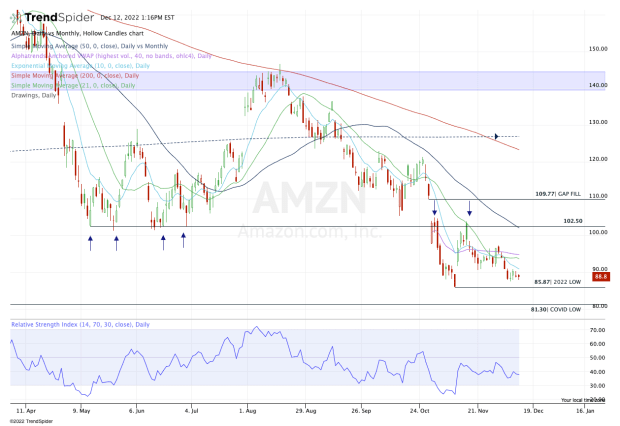

Chart courtesy of TrendSpider.com

As I look at the daily chart, I struggle to find positives for the bulls.

That’s not to say that Amazon stock will necessarily make new lows, but that also doesn’t change the fact that there is no uptrend to be found.

The stock is below all its key daily, weekly and monthly moving averages and VWAP measures (with the exception of the 200-month moving average).

Executive Chairman and former Chief Executive Jeff Bezos has warned for months now that a recession is looming. (Tesla TSLA CEO Elon Musk has as well.)

What that means for Amazon stock I’m not sure. What I do know is the bulls will not be able to enjoy a sustained uptrend with the stock below all the key measures outlined above.

On the upside, it starts by clearing the $90 to $91 area and the 10-day moving average. If Amazon can do that, it’s the first step toward retesting that key $100 to $102.50 pivot. That was a prior support area that's currently acting as resistance.

If the stock can clear that — and thus, a majority of its daily moving averages — the gap-fill level near $109.77 is in play.

On the downside, a break and/or close below $87.50 could open the door down the 2022 lows. A close below $85.50 could put the covid lows in play at $81.30.