Marriage is built on the promise of sticking together through thick and thin. But even the most loving relationships hit bumps when life gets complicated.

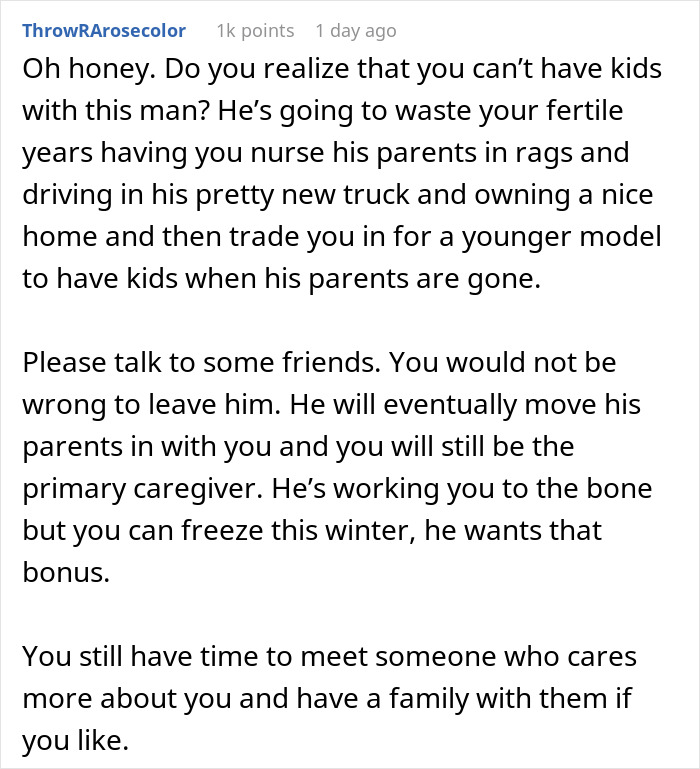

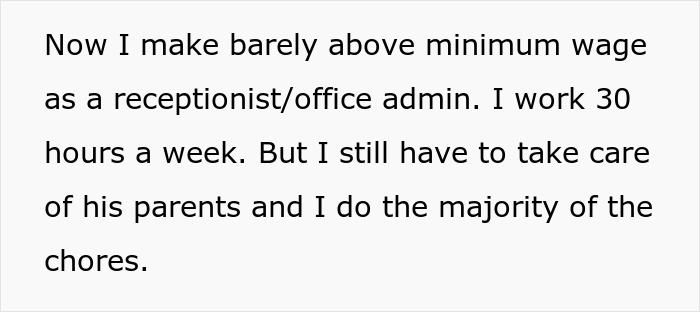

One woman, frustrated by a recent argument with her husband, took to Reddit for advice. After being a stay-at-home wife and caregiver for his parents, she took on a job to support the family’s finances. She just earned a bonus for her hard work and was hoping to finally treat herself, but her husband insists the money should go toward bills. Meanwhile, all she wants is a little something to make her happy.

Read on for the full story and let us know what you think she should do.

After earning a bonus for her hard work at a new job, the woman looked forward to treating herself

Image credits: Kaboompics.com/Pexels (not the actual photo)

But her frugal husband insists she use the money for bills, sparking an argument they’re yet to solve

Image credits: Mikhail Nilov/Pexels (not the actual photo)

Image credits: Throwra_Progress_449

For many couples, money is a significant source of conflict

Image credits: Ketut Subiyanto/Pexels (not the actual photo)

The couple from Reddit certainly isn’t the first, nor will they be the last, to argue over finances. According to the American Psychological Association (APA) Stress in America survey, nearly a third of adults in relationships report that money is a major source of tension. Research also shows that among sensitive issues, arguments about money tend to be more intense, more problematic, and often remain unresolved.

However, with the right approach and a willingness from both partners to work through these issues, financial disagreements don’t have to become dealbreakers. Bobby Hoyt, CEO and founder of Stellar Brands, offers valuable insights to make this topic feel less intimidating.

Hoyt encourages couples to make it a habit to talk about money frequently and early in their relationship. “To have a successful marriage, you need to have good communication—that’s a no-brainer, but it’s still harder than it sounds,” he says. “If one person in the relationship is worried about money and the other isn’t, it’s pretty easy for things to fall off the rails, especially if no one is willing to admit that they have concerns.”

Next, keep a close eye on your spendings by tracking them. “It’s important to know what’s coming in and going out every month,” Hoyt explains. “Once you know, you can do something about it rather than wondering why your money never seems to quite make it to the end of the month.” There are plenty of apps and tools available that can help you see exactly where your money is going. You can review them during your financial check-ins to make more responsible choices.

Once you know your budget, it’s easier to make a plan and see where you can improve. You’ll be able to identify where to cut costs and eventually allocate money toward long-term goals like paying off debts, building an emergency fund, or saving for retirement.

Don’t be afraid to reward yourself for reaching your financial milestones. It doesn’t have to be extravagant; even a nice night out or a bottle of wine can keep you excited about handling your expenses. “Celebrating your wins brings you together, helps you stay on track, and reminds you that the struggle is worth it,” says Hoyt.

Lastly, keep in mind that everything you do also has an impact on your partner. “It can be easy to forget sometimes, but marriage is a partnership,” adds Hoyt. “Not to diminish it, but in some ways, it’s like going into a lifelong business partnership with your best friend, and this means all money decisions affect both of you.” The silver lining is that whatever challenges arise, you won’t have to face them alone.

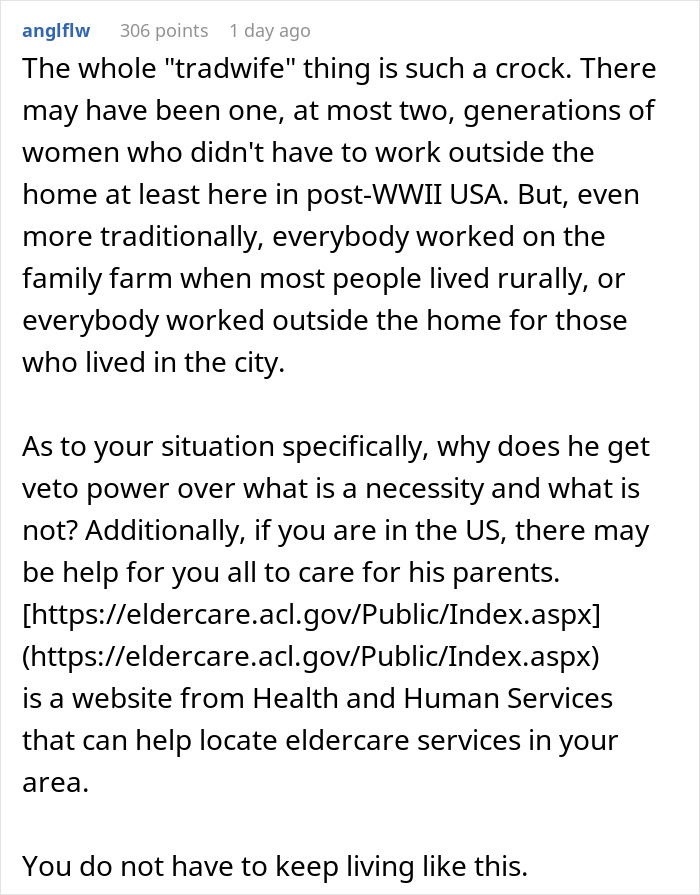

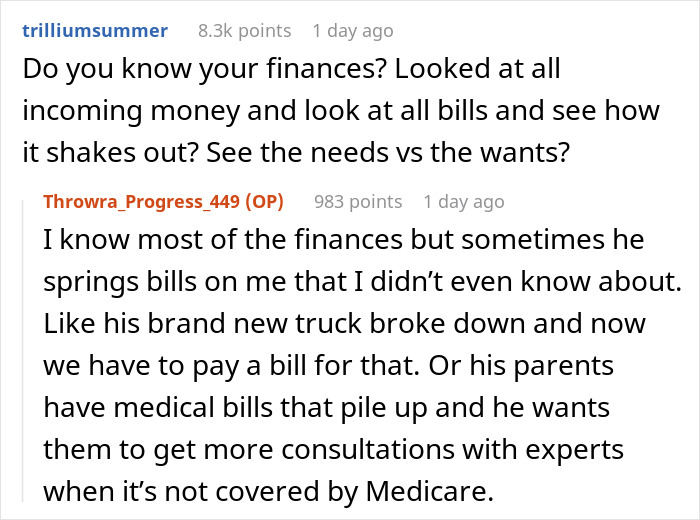

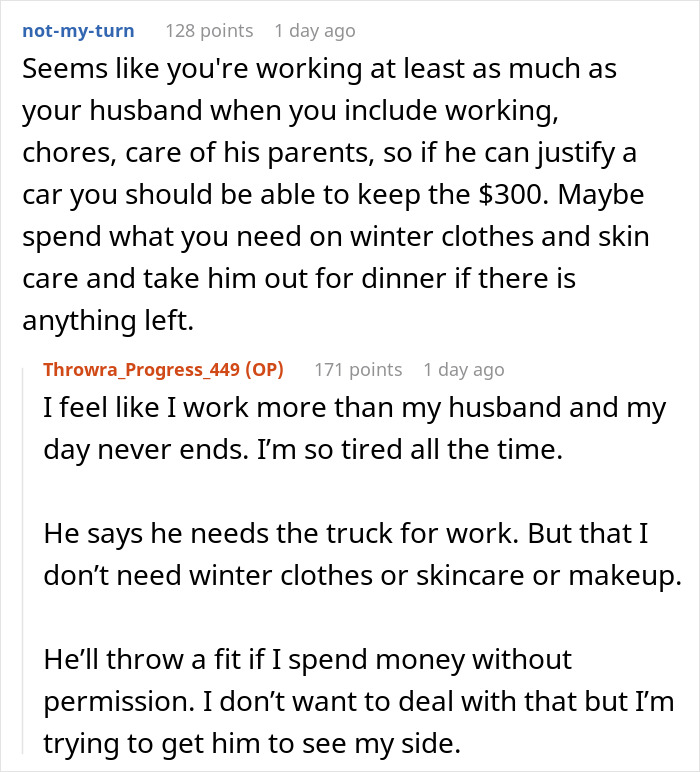

In the replies, the woman said she puts in more effort than her husband and deserves to spend her own money

The commenters suspected the husband was manipulating her and encouraged her to realize her true worth in the relationship