Small-company stocks are notoriously volatile. And these days, large-company stocks seem expensive. So for Goldilocks-style investors, medium-size companies can seem just right.

After all, the firms in the middle range of the stock market have survived the risky small-company stage "and still have a long runway for future growth. They are in a sweet spot," says Stephen Grant, manager of the Value Line Mid Cap Focused Fund, which has notched a 10-year average annual return of 12.8%, edging the 12.0% return of the large-company S&P 500 index over the same period.

Before you invest in midsize companies, consider their parameters. There's surprising variation in what counts as a medium-size company. Generally, investors gauge a company's size by the value of its outstanding shares, or market capitalization. The stocks in the middle range are called mid caps.

Stocks in the S&P 400, one of the most-cited indexes of mid-cap companies, have an average market cap of $6.8 billion, but the index lists stocks with values running from $1.7 billion to nearly $18 billion. FTSE Russell, which produces broader indexes, defines mid caps as the 800 companies below the 200 largest in the Russell 1000 index. Companies in the Russell Midcap index range in size from $3 billion to about $65 billion, with an average market cap of $23 billion.

Investors have to be choosy with stocks in this range. The history of mid caps' performance serves as a caution against blanket bullishness, says Zach Johnson, chief investment officer for Stack Financial Management. Large-cap stocks have, on average, outpaced mid-cap stocks in nine of the past 10 years. The S&P 400's 16.4% return in 2023, although strong by historical standards, lagged the index of larger companies; the S&P 500 index returned 26.3%.

That's one reason the S&P 400 was trading at an average price multiple of just 14.4 times its companies' expected earnings over the next 12 months, compared with a price-to-earnings (P/E) ratio of 19.5 for the S&P 500.

Bargain hunters need to be selective and patient, Johnson says. He expects midsize valuations will start to close the gap relative to their larger brethren, and that promises relative outperformance, "but you just never know when" it will happen, he says. He advises mid-cap investors to focus on firms with good businesses and strong balance sheets. "The fundamentals of finance matter in the end," he says.

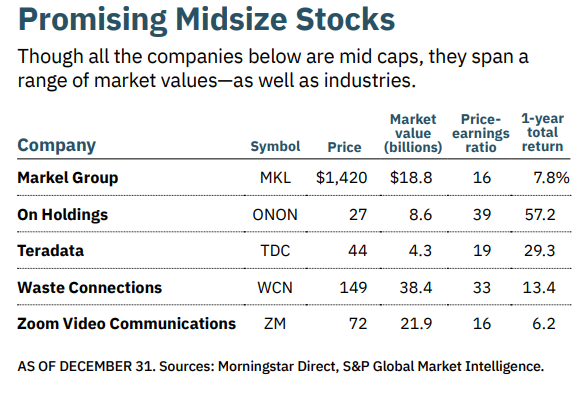

Below, we've listed five promising companies within the broader mid-cap range. Prices and other data are as of December 31, unless otherwise noted.

Markel Group

Markel Group (MKL), a Richmond, Virginia-based insurer, is a "mini Berkshire Hathaway," says Bruce Kennedy, a portfolio manager for the DF Dent Midcap Growth fund, a member of the Kiplinger 25, the list of our favorite no-load mutual funds.

Like Berkshire, the company uses cash from its operations to buy stable (if not flashy) companies. Among Markel's holdings are Costa Farms, one of the nation's largest houseplant growers, and Ellicott Dredges, the oldest manufacturer of ships that can suck up sand and dirt from the bottoms of waterways.

Another Berkshire parallel: Markel has more cash in reserve than it owes in debt. The financial stock has grown steadily for decades. It traded at $12 in 1987, and it closed out 2023 at $1,420, giving it an annualized growth rate of about 14% and a market value of $18.8 billion.

Markel's overall revenues have grown steadily. And though profits have been affected by dropping valuations of the bonds it holds to fund insurance payoffs, the company is on a pace to report $113 per share in profits for 2023. Analysts expect earnings to grow by an average of about 7% a year over the next three years. The stock was recently trading at 16 times expected 2024 earnings. At that valuation, Kennedy described the investment as "a grinder" that he's happy to own. It won't be a top or bottom performer, he says, but will grind out gains for the long term.

On Holding

Zurich-based On Holding (ONON) makes distinctive athletic shoes, such as running shoes with soles made of light, flexible honeycombed tubes. Runners apparently love them, and as a result, so do many investors and analysts. "It is a great brand with a huge market opportunity that continues to take share from competitors," says David Baron, portfolio manager of the mid-cap heavy Baron Focused Growth Fund.

On, which trades on the New York Stock Exchange, increased its global sales by more than sevenfold between 2019 and 2023 to reach $2.1 billion. The stock returned nearly 60% in 2023, closing the year at $27, giving it a market capitalization of $8.6 billion.

Baron said he was a buyer in late 2023 at prices in the mid $20s because of the company's rapid growth and lucrative profit margins. On's global sales reach and low-debt balance sheet insulate it from the vagaries of the U.S. economy, he adds.

"I'm even more bullish on the stock now than I was six or seven months ago," says Baron. He expects the company's sales to be turbocharged in late 2024, when the Swiss Olympic team wears its On-created uniforms.

Sixteen of the 20 analysts who follow the stock, trading at a P/E ratio of 39, rate it a Buy. Morgan Stanley's Alex Straton calls On one of the most attractive companies in the sports-apparel niche, in part because it has been able to increase sales without much discounting. The company's tennis shoes – named "the Roger," after investor and brand representative Roger Federer – retail for $199.

Teradata

Teradata (TDC) is a cloud-computing firm that helps companies analyze and make the best use of their data. The tech stock has had a bumpy ride over the past five years, closing out December at $44 a share – close to its price at year-end 2018.

With a market capitalization of just $4.3 billion, it's one of the smaller mid-cap companies. But it is the single biggest holding in the Heartland Mid Cap Value fund. The fund's lead manager, Colin McWey, is betting the stock is more of a bargain than indicated by its P/E of nearly 19.

Recurring revenues from Teradata's cloud-computing services snowballed by more than 60% in 2023. McWey expects the rapid growth to continue, pushing the company's total revenues ahead by more than 10% a year. Teradata's stock price in relation to revenues doesn't reflect that potential, he says: "Teradata trades at a recurring-revenue multiple that implies no growth."

Eight of the 11 Wall Street analysts who follow the company are similarly bullish. Analysts have, on average, set a target price of $62 for the shares over the next 18 months, implying they see room for gains of more than 40%.

Waste Connections

Investors who focus on Wall Street's darlings can miss out on profitable opportunities, says Value Line's Grant. "The glamour stocks are the ones that people tend to overpay for," he says. That's one reason he sees opportunity in the definitively unglamorous Waste Connections (WCN), the third-largest hauler and recycler of non-hazardous trash in the U.S.

The company is headquartered in Canada but trades on the New York Stock Exchange – at a relatively lofty P/E of 33, reflecting a "growthy" outlook. Grant says his single most important criterion for choosing a stock is whether the company has a 10-year history of increasing earnings per share, and Waste Connections checks that box. It reported earnings of $1.58 per share in 2013, and it is expected to report $3.42 in 2023. Its 10-year compound annual earnings growth rate is in excess of 8%.

Of the 22 Wall Street analysts who follow Waste Connections, 17 rate the stock a Buy. The analysts at Truist Securities like the way that trash hauling is insulated against the ups and downs of the economic cycle. The stock is "an attractive place to park capital amid current macro uncertainty," they say. Trading at $149 per share, the company has a market capitalization just north of $38 billion. Truist's analysts have set a target price for the company of $160 in 2024.

Zoom Video Communications

The application we all used to talk with one another during the COVID shutdowns took a beating when we could connect in real life again. At the end of 2023, Zoom Video Communications' (ZM) stock was trading at $72, a long way off from its October 2020 peak of $568. The recent price translates into a market capitalization of $21.9 billion.

ARK Invest CEO Cathie Wood was buying shares in late 2023. "I'm pretty excited about the artificial intelligence products and services that Zoom is evolving," she says. One such service is automated meeting summaries. Zoom, which is a top-five holding in the ARK Innovation exchange-traded fund, has seen its profitability rebound recently. For the fiscal year ending January 31, Zoom is on pace to report $1.33 per share in earnings, up from just 34 cents in the previous year.

The company is attractively priced, trading at less than 16 times expected earnings for the next 12 months. Perhaps more important for growth-focused investors is the stock's PEG ratio, which is the P/E divided by the expected growth rate over the next three to five years. Zoom's PEG ratio was recently under 0.4; anything below 1 is generally viewed as a sign of strong growth.

Morningstar senior equity analyst Dan Romanoff believes there is plenty of room for the stock to rise. Noting that the company is debt-free and that demand for online meeting spaces continues to be robust, he has pegged Zoom's fair value at $89 per share, implying a 24% upside.

Note: This item first appeared in Kiplinger's Personal Finance Magazine, a monthly, trustworthy source of advice and guidance. Subscribe to help you make more money and keep more of the money you make here.