Consumer price inflation stuck at 8.7% in May, defying expectations of a slowdown and making a further rise in UK interest rates inevitable.

The May figures came out the day before the Bank of England’s Monetary Policy Committee (MPC) was due to meet to discuss changing the UK base rate. This sets the interest rates for borrowing by the government, businesses and banks – who then feed any increases through to borrowers such as people with mortgages.

A 13th consecutive rise in June had been expected for some time, because the headline rate of inflation has been well above its medium-term 2% target since mid-2021. At the risk of being accused of derailing the UK’s post-COVID economic recovery, MPC members’ main decision at the most recent meeting was not whether or not to hike rates, but by how much.

The latest 0.5% increase (to 5%) represents a jump from previous 0.25% increments, showing their concern that inflation is becoming embedded in the economy.

By increasing rates, the central bank is engaging in “monetary tightening”, which is designed to reduce the level of demand for goods and services in the economy. Households are encouraged to pay down debts and channel more of their incomes into saving. Those who cannot reduce their borrowing must pay more for it, leaving less to spend on other things.

The knock-on effect of rate hikes on people’s mortgage costs could result in a 20% hit to the disposable incomes of 1.4 million mortgage holders before the next election, according to the Institute of Fiscal Studies. The government also finds its own debt costs going up, curbing ministerial inclinations to spend more money.

Read more: UK bonds are in meltdown again – what does that mean for pensions? Expert Q&A

And so, this policy has obvious social costs. As well as ruling out any government help with this latest cost of living shock, it punishes those who have been forced to borrow due to poverty, as well as the better-off who chose to borrow to accumulate more assets. It also has longer-term economic costs, deterring firms from borrowing for investment.

But the MPC believes it has no alternative. Although volatile items, especially food, can be blamed for some of the current overshoot, core inflation (which removes these fluctuating items) has risen to a 31-year high of 7.1%.

For monetary policymakers, the fear is that, if they don’t act decisively now, inflation will become built into firms’ expectations when setting prices, as well as those of employees bargaining over wages. Such self-fulfilling expectations are blamed by many for a “wage-price spiral” that created a decade-long period of inflation and stagnation in the UK following the oil price shocks of 1973.

The number of rate increases since 2021 reflects an unexpected slowness for these hikes to take effect on inflation. Although a painfully blunt instrument in this respect, interest rates are the only one the MPC has.

A convenient scapegoat

The government has pledged to halve inflation by year-end and is now in danger of breaking this promise. It’s convenient, then, to allow the blame for overshooting inflation to be placed on the independent central bank.

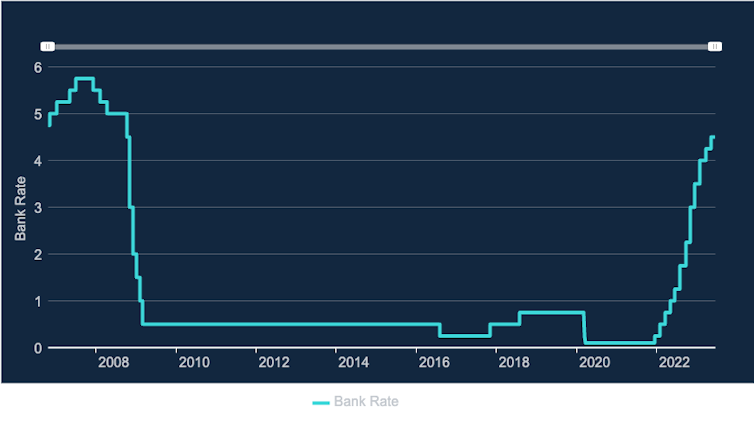

With hindsight, the Bank of England’s policy since the 2008 global financial crisis is easy to criticise. It kept interest rates close to zero from February 2009 to March 2020, reducing them further during the COVID pandemic, then lifting them rapidly since December 2021.

Base rate changes: 2006-2023

The long phase of ultra-low interest rates deterred households and firms from paying down the debts that underlay the 2008 crisis. So the unprecedented jump in interest rates since 2021 has caused a sudden shock to corporate and household cashflows. Even now, many mortgage borrowers are still waiting to feel the full force.

When this does happen, the rise in borrowing costs – on top of the surge in other living costs – could tip an already slow-growing economy back into full-blown recession. That would be compounded if, as in the early 1990s, falling house prices knock a further hole in the finances of UK homeowners.

But it could also be argued that the post-2008 decade of low interest rates was unavoidable. Governments and business needed to borrow at low cost to haul the economy out of the deep 2009-2010 recession. During this time, inflation was close to zero and any lasting fall in consumer prices could have created a further slump.

The sharp interest-rate rise since 2021 has been equally unavoidable. As well as restraining inflation, it is needed to attract foreign investment to finance the UK’s persistent current-account deficits.

These used to be comfortably financed by foreign direct investment (FDI), which offset the UK’s excess of imports over exports. But FDI has tailed downwards since the 2016 Brexit vote.

So external financing now relies more heavily on foreign financial investors, who are looking for a higher return – as is evident from the rising yield the government must pay on its own borrowing.

Treatment-resistant inflation

Although inevitable, the recent succession of interest rate rises has done little to tame the inflation we’re all experiencing at the moment.

Since early 2022, most prices have been pushed up by rising costs, which is known as cost-push inflation. Raw material costs have been fuelled by the global rise in food and energy prices, and last autumn’s steep depreciation of the pound against the US dollar. Rising wage costs are an inevitable result of widespread labour shortages, exacerbated in the UK by a post-COVID fall in workforce numbers and the loss of EU workers since Brexit.

With the government’s own borrowing costs climbing back towards the level that triggered fiscal meltdown after last September’s Truss budget, it now risks a further stagflationary spiral – a combination of high inflation and an economy in recession. Rising interest rates are likely to divert more budget spending from growth-promoting projects into servicing public debt.

But if mortgage borrowers get any short-term relief from rising rates, it will only be in the unlikely event that the shock from the latest rate rise to 5% prompts emergency action to avert a pre-election recession.

Alan Shipman does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

This article was originally published on The Conversation. Read the original article.