U.S. and global stocks continue to plummet after President Donald Trump announced hefty tariffs on imports from U.S. trading partners. The tariffs were much worse than what markets expected, with the levies against China now reaching 54%, pressuring stocks.

Meanwhile, while the broader market crash has eroded trillions of dollars of investors’ wealth, it has also opened up some buying opportunities. While many stocks appear on sale amid the crash, I capitalized on the slump and bought streaming giant Netflix (NFLX). Here’s why I find the stock a good buy amid the crash and an analysis of the risks associated with buying the company now.

U.S. Stocks Continue to Fall Amid Global Trade War Concerns

Concerns over a global trade war are not unfounded. China has retaliated with tariffs of 34% on U.S. goods, and Canada has also announced some limited measures. The EU is contemplating a joint strategy against U.S. tariffs while other impacted trading partners are looking to negotiate with Trump.

While reports indicate that many countries are aiming to negotiate, it is unclear how the Trump administration will proceed or how long negotiations will take. This means considerable uncertainty about companies that either rely heavily on imports or get a major portion of their revenues from global markets and are therefore at risk of retaliation and counter-tariffs.

Is Netflix Immune from the Trade War?

No company is immune from the trade war, and especially amid fears of more countermeasures against U.S. tech giants. Netflix pays a digital services tax (DST) in Europe and there is always a risk – even if that’s not the base case – that the EU targets Netflix. However, I will argue that Netflix is relatively insulated from the tariffs and sees it as a good buy. Here’s why.

Netflix Is Among the Best Stocks to Buy After the Crash

While Netflix shares have also fallen amid the crash, the stock is down just about 2.4% YTD and is outperforming the S&P 500 Index ($SPX) by a good margin. Netflix has proved critics wrong, adding a record 19 million subscribers in the final quarter of 2024, catapulting its total paid member count beyond 300 million.

The company has built a strong moat with its impressive and ever-expanding library of global content, and while other streaming peers are trying to play catchup, none have been able to match its compelling product proposition. Netflix has also added sports streaming and video games to its offering which makes it an even better value proposition for subscribers.

The ad-supported plan has also worked wonders for Netflix, and according to the company, in Q4 2025, 55% of new members opted for this tier in countries where it is offered. The password-sharing crackdown has also helped Netflix grow its subscriber base, as many people who previously watched its content through borrowed accounts are now paid subscribers.

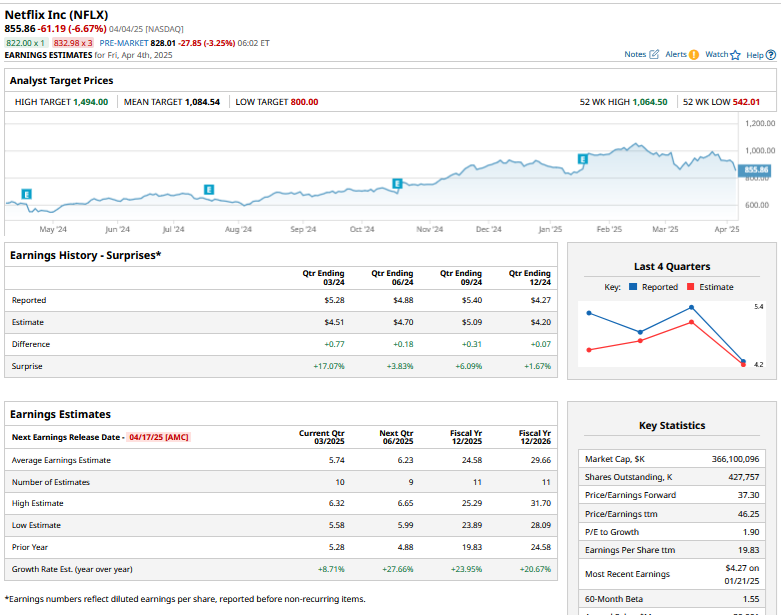

The company should eventually roll out password-sharing crackdowns in other regions which should help it buoy its paid subscriber base. Moreover, Netflix has just scratched the surface when it comes to ad revenues. As the subscriber base of its ad-supported tier grows, ad revenues are expected to become a significant driver of Netflix’s revenues over the next couple of years. Analysts are modeling Netflix’s earnings to rise by 24% this year and 20.7% in 2026 and a significant chunk of incremental growth is expected to come from ad revenues.

While there are fears that a recession might prompt some Netflix subscribers to cancel their subscriptions, I believe many of them might instead opt for a cheaper plan. Therefore, there might not be large-scale cancelations considering how hooked most users are to Netflix’s content.

NFLX Stock Forecast

Netflix has proved bears wrong and analysts have gradually warmed up to the company. The stock is currently rated as a “Strong Buy” or “Moderate Buy” by almost 70% of the analysts, while the corresponding number three months back was around 58%. Netflix’s mean target price is $1,084.54 which is 26.7% higher than the April 4 closing price.

Overall, I find the crash in Netflix stock a good buying opportunity and would add positions gradually as the trade war pulls down U.S. and global stocks.