Discounting the notion that only poor folks use free FASTs and OTA television, a new report by entertainment data analytics firm Hub Entertainment Research indicates that viewers who use free, ad-supported streaming also tend to pay for multiple subscription streaming services

According Hub, around 70% of all FAST users subscribe to three or more SVOD services, including Netflix, Hulu or Amazon Prime Video.

The data suggests FAST viewers (who now have nearly 2,000 channels available for viewing, according to a recent report by Gavin Bridge) are drawn not by the free price tag, but by the potential diversity of channel offerings.

Also Read: Fox Says Tubi Now Has 80 Million Average Monthly Users; FAST Platform’s Engagement Also Up 36%

Hub refers to a class of viewers it calls “video omnivores,” who use FAST catalogs as a cost-effective method to pad their already robust TV diets.

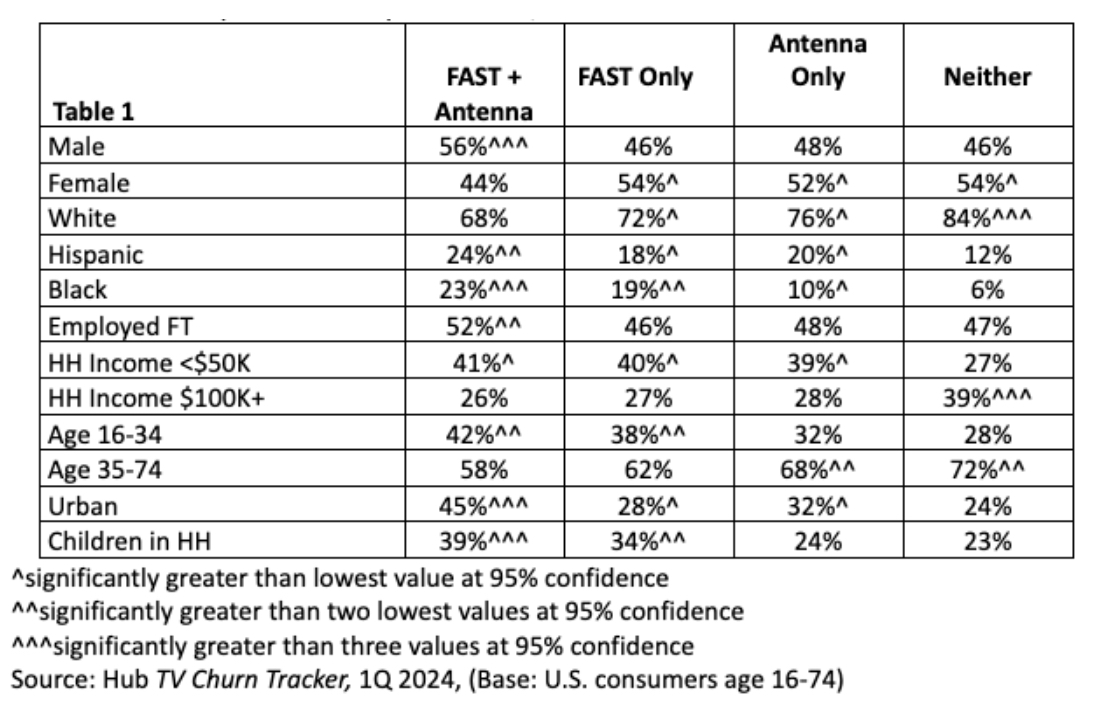

The most common consumers of this hybrid TV structure are white men between the ages of 35-74, the majority of whom utilize both FAST services and TV antennas.

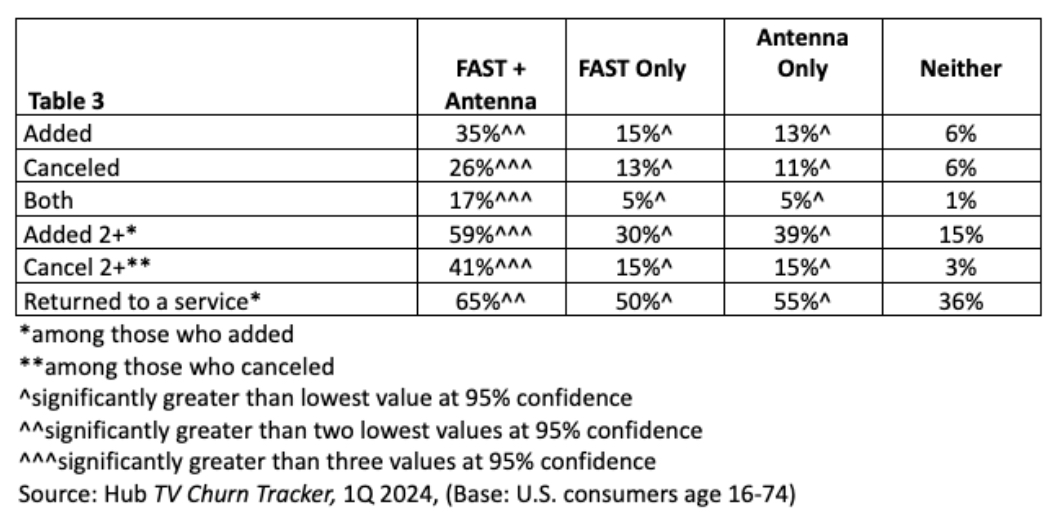

And nearly 40% of these hybrid viewers reported trying a new channel in the previous months.

However, Hub also indicated that an additional 40% of these video omnivores used another person’s account to access an SVOD service, and may not stick with it.

“The way the free viewers churn through TV services suggests they will pay for a service if they can no longer piggyback on another subscription,” explains the report. “But they may not be loyal to it long term.”

Hub’s report shows that video omnivores are the most likely group to both add and cancel TV services, with 59% of these consumers adding two or more subscriptions in the last month and 41% of those same consumers canceling two or more.

While FAST and antenna viewers are significantly more likely to be attracted by price promotions and bundling bargains, they are also much more likely to cancel those subscriptions when they feel they are no longer getting value out of them.

According to the report, the greatest challenge for SVOD service providers hoping to establish loyalty among transitory viewers is putting forward exciting content that viewers want to engage with.

Hub suggests that the best way to do this may be by advertising content recommendations and deals to FAST providers to communicate with consumers likely to return to a subscription.