U.S.-listed Chinese stocks were crushed on Monday morning after the Chinese Communist Party concluded its national congress meeting over the weekend.

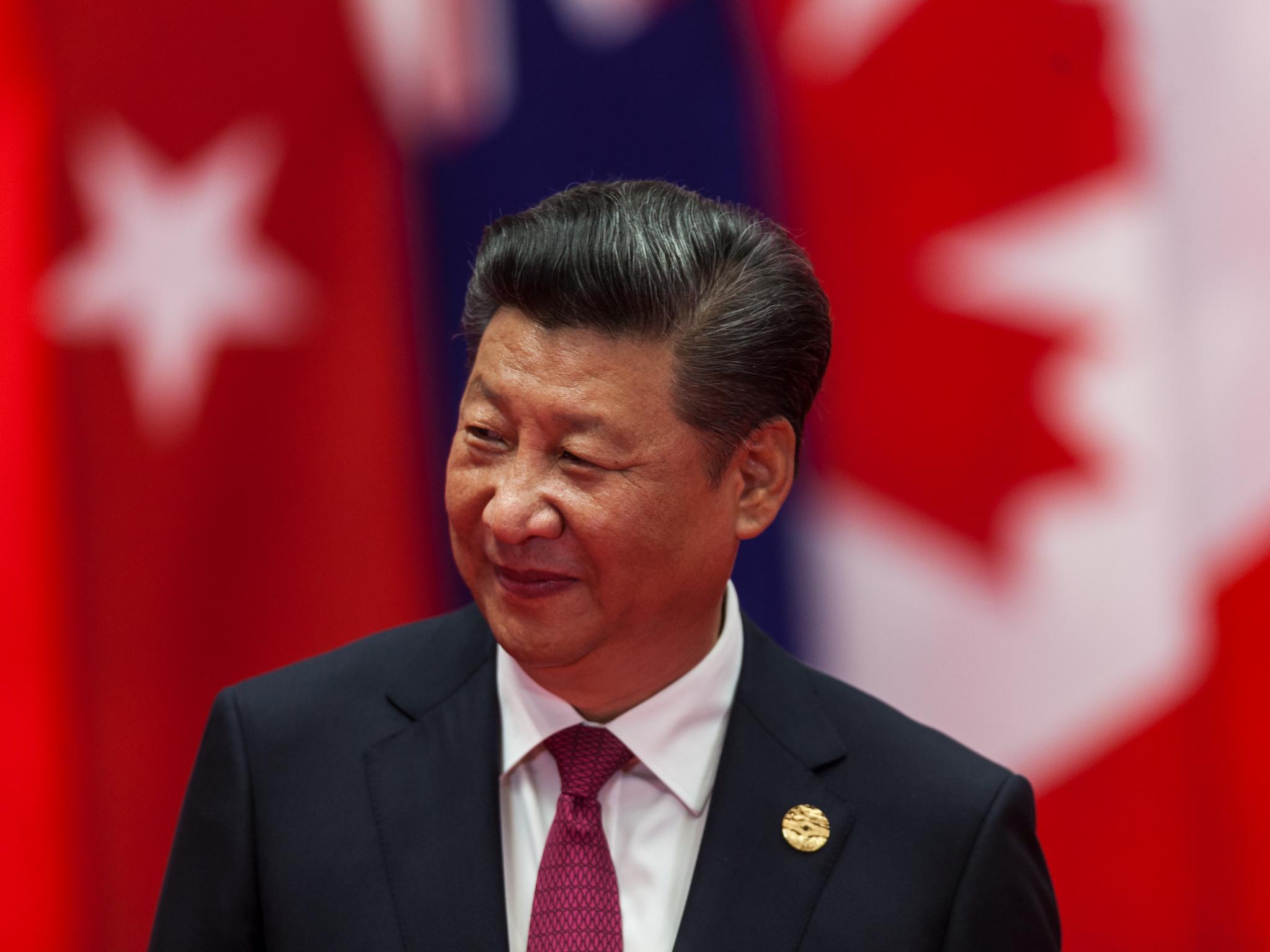

What Happened? Chinese leader Xi Jinping consolidated his control over China's Communist Party by appointing loyalists to the party's most powerful positions and shunning convention by maintaining his presidency for a third term.

Given Xi's aggressive crackdown on large Chinese tech companies in recent years, investors see his latest power grab as bad news for Chinese innovation and economic growth.

Why It's Important: Foreign investors reportedly pulled $2.5 billion from China's domestic stock market on Stock Connect on Monday, the largest single-day outflow since the platform was launched in 2014.

U.S.-listed Chinese stocks also took a big hit. Here's how some of them were trading on Monday morning:

- Alibaba Group Holding Ltd - ADR (NASDAQ:BABA) was down 14.3%.

- Pinduoduo Inc - ADR (NASDAQ:PDD) was down 28.5%.

- JD.Com Inc (NASDAQ:JD) was down 15.3%.

- Baidu Inc (NASDAQ:BIDU) was down 15%.

- Nio Inc - ADR (NASDAQ:NIO) was down 17.8%.

Bank of America economist Helen Qiao said the new leadership group in China and the absence of a successor for Xi means China's economic fate rests solely in the hands of Xi and a handful of his most loyal supporters.

"Some investors may worry about the lack of checks and balances, and the risk of potential policy mistakes evolves into major shocks to the economy. On the other hand, this setup also implies solidarity at the highest level, and may lead to more effective policy execution and little political resistance against bolder reforms or changes to existing policy stances," Qiao said.

In the near-term, one of the biggest question marks for Chinese investors will be the future of Xi's Covid Zero policy.

While most of the rest of the world fully reopened their economies in early 2021, China is still enacting periodic lockdowns of major metropolitan areas, including full or partial quarantines of more than 300 million people as recently as last month.

Benzinga's Take: More power for Xi in China is clearly bad news for anyone investing in Chinese stocks. In the last three years, the iShares China Large-Cap ETF (NYSE:FXI) is now down 48.6% overall while the SPDR S&P 500 ETF Trust (NYSE:SPY) is up 25.3% in that time.

Photo via Shutterstock.