● The People’s Bank of China boosted gold reserves to 2,076 tons from December to May, adding to a trend of central banks increasing gold purchases.

● Emerging market banks have been buying gold to diversify away from the dollar since it can be swapped into any currency.

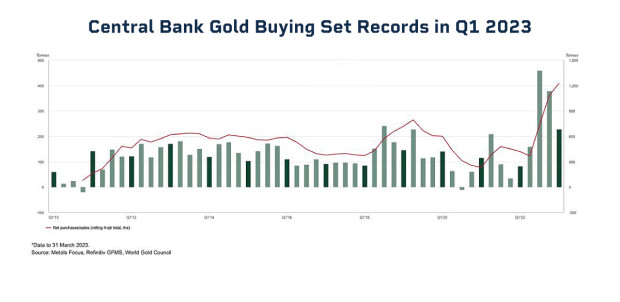

Central banks bought a staggering $70 billion of gold in 2022 – the most since 1950 – as heightened macroeconomic and geopolitical uncertainty drove governments to accumulate the precious metal.

And while some institutions, notably from China and Turkey, sold some of their holdings in the second quarter, the usual factors behind central bank purchases – fighting inflation or managing currency volatility – could remain in place for the foreseeable future.

Central banks buy the world’s “favorite safe haven” because it retains its value against volatile currencies or falling bond prices. Simultaneously, investors don’t need to rely on any particular issuer or government to trade it.

Russia’s invasion of Ukraine, volatile financial markets and rising economic uncertainty prompted central banks to purchase 1,136 tons in 2022, the most in 73 years, according to the World Gold Council. China led the trend, driven by its growing need to wean itself from the U.S. dollar amid rising political tensions with Washington.

The People’s Bank of China boosted reserves to 2,076 tons from December to May, adding itself to a chorus of other banks that bolstered reserves such as Turkey, India and Singapore.

However, when fears of a post-COVID economic slowdown emerged, China began to slash purchases in the spring, partly to finance an upcoming stimulus program to shore up its sagging economy. Turkey followed suit, selling 160 tons from March to May, according to the World Gold Council (WGC). This after soaring inflation prompted consumers to purchase the precious metal, forcing Turkey’s Central Bank to pare its holdings while curbing gold imports to rein in a growing current account deficit.

Buying, Selling – and Buying Again

Underscoring the fluctuating nature of central bank gold trading policies, Turkey made a surprise return to the market in June, this time boosting reserves by 11 tons to an aggregate 440 tons, WGC also reported.

The on-and-off purchases stemmed from its need to tackle runaway inflation coupled with a deep financial crisis that has sent the lira into a tailspin. Amid such uncertainty, investors have rushed to accumulate gold, forcing officials to ban gold imports to support the lira.

Then there’s Russia.

It has been accumulating bullion for the past year with its holdings jumping 1 million ounces as of March, the Bank of Russia revealed recently. The move helped it avoid Western sanctions linked to its Ukraine invasion, and boosted the bank's holdings to 74.9 million ounces.

“Gold is much harder to freeze in terms of movement than liquid assets such as currencies,” says Jeff Grills, head of emerging market debt at Aegon Asset Management, adding that China, India and Pakistan have also boosted reserves to be able to trade with Russia. Russia, in turn, has been using it to sell oil to China and other countries amid a European sales ban.

Diversification

Meanwhile, emerging market banks have been buying gold to diversify away from a weakening dollar as it can be swapped into any currency like the euro, yuan or yen.

Protection from geopolitical and economic shocks is also, of course, another reason emerging and developed central banks are purchasing gold. According to the WGC, eight central banks increased their gold purchases in May, led by Poland, China (though it slowed its rate of purchases), Singapore, Russia, Iraq, India, the Czech Republic and the Kyrgyz Republic.

Emerging nations, facing strong recessionary headwinds, will continue to accumulate gold in the near to medium-term future, says Joseph Cavatoni, WGC’s America’s market strategist. A recent survey showed these institutions as having a strong interest to amass the metal to stave off lingering currency and political risks such as those stemming from the Russia-Ukraine conflict.

“These banks have seen the benefits of diversification, of having more freedom and security to sell unimpeded assets to boost their currency reserves at any point in history,” Cavatoni notes.

He also expects Chinese purchases to gradually pick up in the next year as the nation has ample room to boost its reserves which stand sharply behind those of the U.S. – the largest holder with 8,133 tons – followed by Germany, with 3,354 tons.

Gold Outlook

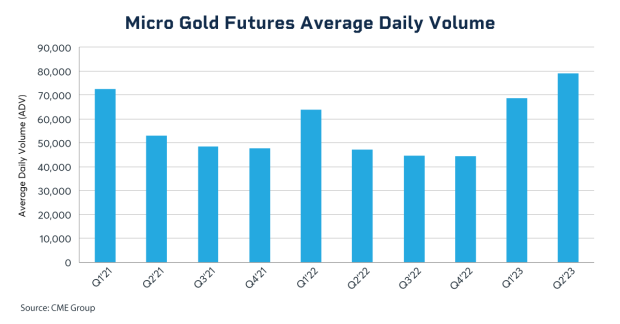

Gold remains a popular trade for those looking to manage price risk. Trading volume in Micro Gold futures at CME Group – contracts 1/10 the size of standard gold futures – rose 68% in Q2 over the same quarter a year earlier.

Weekly gold options, a shorter-dated contract that offers traders more precision around market events, also continue to see increased trading. Weeklies average daily trading volume through June is up 32% over 2022.

Meanwhile gold prices – up a whopping 5,400% since 1970 – could rise in the coming months, according to Bloomberg Intelligence and Saxo Bank. Their reasoning is due to a worsening U.S. and global economic outlook and expectations that equities will decline amid the specter of higher interest rates in the near term.

“Central bank accumulation and the potential for a global economic slowdown, on the back of the most aggressive rate-hike period ever, may set the stage for gold to move towards £2,357 or roughly $3,000 an ounce,” BI’s Senior Macro Strategist Mike McGlone wrote in a recent report.

Read More About Micro Gold Futures

But Cavatoni disagrees, adding that bullion faces significant near-term challenges to reach that lofty level.

“There is a long way to $3,000 considering that we are still having significant price pressures as a consequence of U.S. monetary policy and expectations for two additional rate hikes this year, which will continue to be there by year-end. This means we still have some time to gauge where rates will settle and how the economy will land, if in a soft or hard scenario. But we see more of an environment where we land in a recessionary world,” Cavatoni says.

Some of the risk factors that sent investors into a gold-buying frenzy, such as this year’s bank turmoil, are also ebbing, adding pressure on prices, the strategist adds.

How Hard Will the Landing Be?

Ultimately, how much and when investors resume their gold buying will depend on how the U.S. and global economies fare as central bank monetary policy will hinge on that performance.

Ed Moya, senior market analyst at FX researcher Oanda, expects the UK and European economy to fare poorly this year amid a worsening energy crisis that has sent electricity prices soaring. In fact, the IMF predicts UK gross domestic product will contract by 0.3% this year compared to a 4% expansion in 2022.

Moya also expects the U.S. to move into negative growth in the fourth quarter and fall into recession in the first half of 2024. He adds that a recession, not a soft landing, is needed to tame U.S. inflation that is still running above the Fed’s 2% target.