Sometime later this month, Amazon is going to blow up the TV ad market. It already told everyone it’s going to do it, and yet few people in the industry seem all that concerned.

The deal is that Amazon plans to flip a switch and turn Prime Video’s default mode to ad-supported, forcing anyone who wants to remain ad-free to spend an extra $3 a month to do so.

Our TVREV estimate is that at best, 30% of Amazon Prime subscribers will bother to upgrade, leaving around 70% of Prime’s approximately 165 million U.S. subscribers in the ad-supported bucket. That’s around 80 million U.S. subs, give or take 10 million in either direction.

Why so vague?

Two reasons.

First, Amazon does not release its subscriber numbers. The most we’ve gotten from them is a 2021 statement that Prime has “over 200 million” subscribers.

Second, and far more importantly, it’s impossible to know how many people have Prime because of the free two-day delivery, how many have it because of the video, and how many have it because it has both.

This means that whether they have 50 million ad-supported Prime subscribers or 100 million, not all of them are actually watching Prime Video.

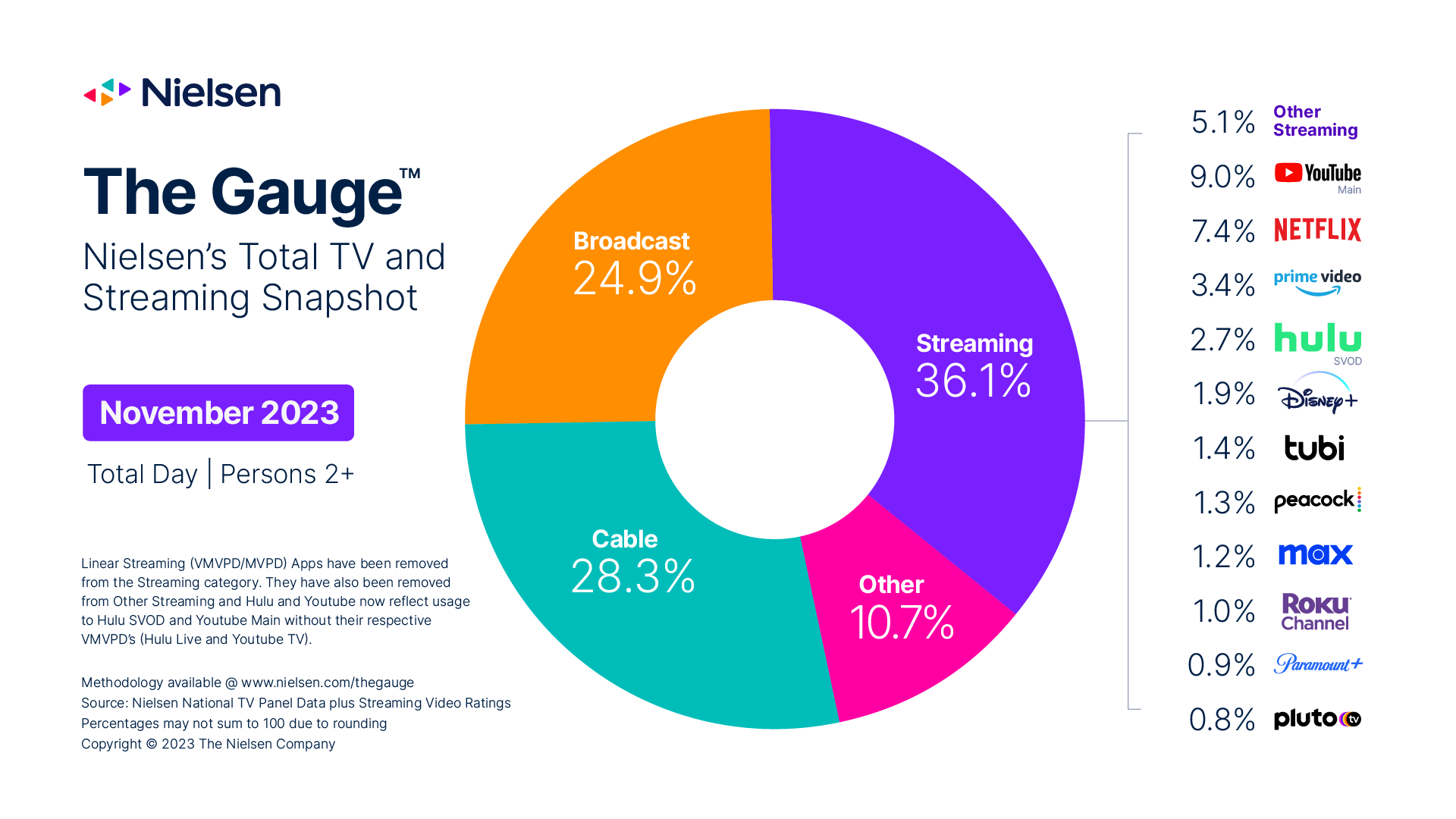

Nielsen’s The Gauge seems to bear this out — Prime’s November market share, according to the monthly Nielsen tracker, was 3.4% of U.S. streaming viewing, which puts it far behind Netflix at 7.4% and slightly ahead of Hulu at 2.7%. (It is also worth noting that Prime Video’s numbers are likely higher than usual right now thanks to Thursday Night Football.)

But that’s not why Amazon is about to blow things up.

The reason is that, even if we go for the very low-end estimates and assume that Prime will have 60 million ad-supported U.S. subs and that half of them will actually watch something on Prime Video, that is 30 million ad-supported subscribers, which will put them at about 3 times the number of ad-supported subscribers Netflix has.

And the thing about Amazon, of course, is the massive amount of data it has for advertisers. Amazon knows exactly what you’ve bought. It knows what you’ve searched for. And it knows what you’ve put in your cart and then deleted.

In practical terms, this means that there is going to be a massive pool of new connected TV inventory, all of it running against high-quality programming.

That is going to shake things up and then some.

First off, many big national advertisers have been hesitant to spend big bucks on FASTs because they see those services as analogous to cable — great places to get extra reach, but not exactly a showcase for their latest $20 million commercial.

Amazon, however, can give them slots on its original series. They’re slots that, due to the size of Prime Video’s audience, will reach many more viewers than slots on other ad-supported streaming services (Hulu being the possible exception here).

That’s for the big national advertisers.

Amazon has also launched a self-service business, aimed at the sort of small and medium businesses that sell their products on Amazon. This additional inventory, which can be geotargeted for local advertisers, will likely help the self-serve business to take off as well, given Amazon’s superior targeting capabilities and ability to steer companies that already spend money on search advertising on Amazon to this new TV product.

Which will, of course, have shoppable ads, something Amazon showed off during its Black Friday NFL game between the Jets and the Dolphins. Reaction seemed relatively positive, and the functionality gives Amazon yet another reason to nudge small and medium businesses to try TV.

Then there’s sports.

While the numbers still lag behind broadcast, Amazon is already seeing bigger Thursday Night Football audiences this year. That’s a trend that is likely to continue.

There are rumors this week that Amazon is looking to bail out Diamond Sports in exchange for streaming rights. That will open up massive new inventory — almost all of it local — along with a slew of new viewers, many/most of whom were already Prime subscribers, just not Prime Video viewers.

Finally, there’s Freevee, Amazon’s FAST service. The line between Freevee and Prime has always been murky, given that Freevee options come up when you search on Prime and I suspect few people realize they are two different services.

The assumption is that inventory on Prime Video and Freevee will be interchangeable and that Amazon will sell against both. That means advertisers will also be able to reach non-Prime subscribers, too. Not that there are all that many of them, but still, it’s a way for Amazon to expand its reach.

There are still some unanswered questions — when will Amazon make the switch, how difficult will it be to upgrade to ad-free (I’m thinking “very”) and how will the ads run against originals, e.g. will they all be preroll?

But those are all minor factors in what promises to be a very major disruption. Stay tuned.