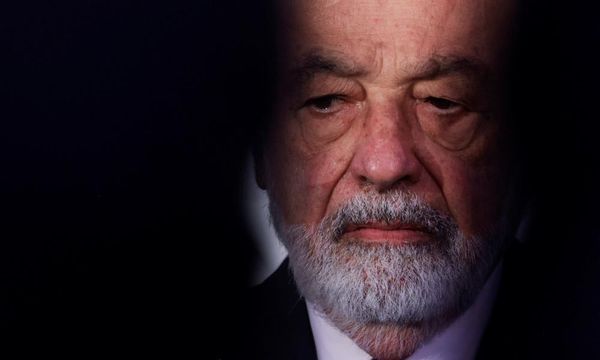

BT Group, the prominent European telecommunications company, has recently garnered significant attention following a substantial investment from Mexican billionaire Carlos Slim. Known for his control over the telecommunications giant America Movil, Slim's acquisition of a 3.2 per cent stake in BT Group marks a noteworthy development in the telecom sector.

Investment Details and Market Impact

Carlos Slim's investment, valued at approximately £408 million (equivalent to $522 million), was executed through his financial company, Inbursa, alongside two other group companies. According to The Guardian, this purchase positions Slim as the third-largest shareholder in BT, trailing behind fellow billionaire Patrick Drahi, who holds a 24 per cent stake via his subsidiary Altice UK, and Deutsche Telekom, which owns a 12.06 per cent share.

The market responded positively to Slim's investment, with BT's shares experiencing a 4 per cent rise on Thursday. This boost underscores the confidence that Slim's involvement has instilled in investors, likely influenced by his extensive track record in the telecommunications industry.

Several factors may have attracted Carlos Slim to invest in BT, Britain's largest broadband and mobile operator. One possible reason is BT's strong cash flow, a critical factor for any investor looking for stable returns. Additionally, the company is under new management led by Allison Kirkby, which might have presented an opportune moment for Slim to invest.

Carlos Slim's Background and Business Ventures

Carlos Slim Helú was born to Lebanese immigrant parents on January 28, 1940, in Mexico City. His father, Julián Slim Haddad, was a successful businessman who taught Carlos finance and management principles from a young age. By 11, Slim had already bought shares in a Mexican bank. He pursued a degree in civil engineering at the National Autonomous University of Mexico, where he taught algebra and linear programming.

Slim's investment portfolio spans various sectors, including telecommunications, manufacturing, retail, energy, and aviation. Slim's most valuable asset is his majority shareholding in America Movil, followed by stakes in holding company Grupo Carso and in banking and insurance firm Grupo Financiero Inbursa. Despite a decline in his ranking among the world's wealthiest individuals, his net worth has grown to an estimated $93 billion.

Carlos Slim, once named the "richest man in the world" by Fortune in 2010, continues to be a formidable figure in the business world. Although his wealth, estimated at $93 billion, now places him behind billionaires like Bernard Arnault, Elon Musk, and Jeff Bezos, Slim's strategic investments and business acumen remain highly influential.

Unlike many billionaires who indulge in a lavish lifestyle, Slim is known for his frugality. He has resided in the same house for 40 years, does not own yachts or private planes, and avoids the ostentatious displays of wealth commonly associated with individuals of his financial stature. This lifestyle is reminiscent of Warren Buffet, the chairman of Berkshire Hathaway, who is also known for his modest living despite immense wealth.

Implications for BT Group

Slim's investment in BT Group is seen as a vote of confidence in the company's prospects. His track record of successful investments suggests that he sees substantial potential in BT's operations and market position. The influx of capital and increased investor confidence could provide BT with the resources needed to expand and enhance its services.

For BT, this investment comes at a crucial time. With the telecommunications industry rapidly evolving and competition intensifying, having a strategic investor like Carlos Slim could be advantageous. It may facilitate new initiatives and innovations, bolstering BT's position in the market.

Daniel is a business consultant and analyst, with experience working for government organisations in the UK and US. On his free time, he regularly contributes to International Business Times UK.