(Please enjoy this updated version of my weekly commentary published October 10th, 2022 from the POWR Growth newsletter).

As usual, we will start by reviewing the past week…

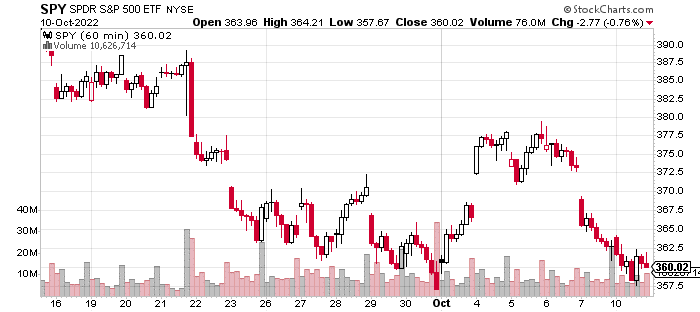

Here is an hourly, 3-week chart of the S&P 500 (SPY):

Over the last week, the S&P 500 is down by about 2%. Yet, this doesn’t really do justice to the volatility.

If we look at the chart below and focus on the last week, we see a burst higher at the start of the month as the market re-tested the June low and rallied more than 6% in a couple of days.

But, these gains were all given back in the aftermath of the jobs report.

What Was So Bearish About the Jobs Report?

On the surface, there wasn’t anything too concerning. The US economy added 263,000 jobs in September which was just short of expectations of 275,000. Wage growth also came in quite strong but in line with expectations. The unemployment rate dropped to 3.5%.

The good news for the economy is that despite a series of challenges and headwinds like inflation, higher rates, slowing growth, etc. The US economy continues to add jobs. The resilience is notable and from an objective perspective, quite impressive.

But, this is an environment where the ‘financial economy’ and ‘real economy’ are on divergent paths. In some ways an exact inverse of the post-March 2020 period when financial assets were racing higher, even while the economy was dealing with 10%+ unemployment.

In essence, the Fed’s hawkish stance is going to end in one of two ways - either inflation moves lower in a meaningful way or the economy starts to weaken, and the Fed has to back off.

The former scenario seems less likely following last month’s inflation data which actually saw a re-acceleration of monthly core CPI. And, the latter scenario may happen but it’s clearly not imminent.

Therefore, we are dealing with a reality of higher rates and higher rates for longer. Higher short-term rates are a headwind for financial assets because they are a magnet for capital. And, this becomes increasingly attractive during a period of volatility.

If these trends persist, it’s likely that the 2-year will be yielding more than 5% at the end of the year. It wouldn’t be hard to blame investors for putting their money in these securities especially in a year with the S&P 500 (SPY) down more than 25%.

The Fed Call

This brings up a bigger-picture issue. The last decade was one of the best for equity owners due to a combination of low inflation, low rates, and an accommodative Fed. In essence, we had a low and slow growth economy which was sufficient for earnings growth but not ‘hot’ enough to ignite inflation.

Thus, the Fed was more focused on supporting the labor market and economy through QE and extremely low rates. And, equity investors could be confident that in the event of a growth stumble or negative, exogenous shock - the Fed would have their back.

This was labeled as the ‘Fed put’.

Now, we have a ‘Fed call’. The Fed’s primary objective is to curb inflation, and it’s willing to sacrifice the stock market and the bond market if necessary. In fact, you could argue that a lack of weakness in these markets would indicate that the Fed is not doing enough.

In the same way, the absence of a buoyant stock and bond market would indicate that the Fed has more room to be accommodative.

We saw this in action in early August as the stock market was testing the 200-day moving average on the heels of an 18% rally due to hopes that inflation was actually turning lower which would result in a ‘Fed pivot’.

Yet, this rally was erased by FOMC Chair Powell’s Jackson Hole speech where he clearly reiterated the need to combat inflation and that the threshold for a pivot or a pause was nowhere near.

Thoughts on Inflation

As discussed earlier, weakness in the employment market would presage a pivot or a pause.

Another factor could be a meaningful and sustained decline in inflation.

There are 2 camps about inflation, and each makes compelling points.

One believes that inflation has already peaked, and it’s just a matter of lagging data catching up to this reality. They point to the drop in gasoline prices, freight and shipping rates, reports of excess inventories, and a slowing economy. They believe it’s inevitable that inflation will decline.

The other camp believes that ‘core inflation’ is a different beast. One that is self-perpetuating and reinforcing. Inflation in areas like wages and rents and services can persist for months if not years. The only solution is a brutal recession to crush demand to terminate these increases.

At this juncture, I don’t believe it’s necessary to commit to either argument, because the Fed is clearly in the latter camp.

It’s kind of like poker, where sometimes you don’t play your cards, but you play the person. Having a clear understanding of the Fed’s thinking and objectives is an advantage in this market environment.

The path of inflation (and which camp is correct) will matter. If the first camp is right, then I think we are in for a choppier, range-bound environment with opportunities for bulls and bears. If the second camp is right, then I believe that it will be much bleaker, and we should prepare for lower prices and much higher volatility.

What To Do Next?

The POWR Growth portfolio was launched in April last year and since then has greatly outperformed just about every comparable index…including the S&P 500, Russell 2000 and Cathie Wood’s Ark Innovation ETF.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +49.10% annual returns. I then take the very best stocks from this strategy and tell you exactly what to buy & when to sell, so you can maximize your gains.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

SPY shares rose $0.61 (+0.17%) in after-hours trading Tuesday. Year-to-date, SPY has declined -23.81%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles.

Which Breaks First…Inflation or the Economy? StockNews.com