If you are a beginner or new to the world of cryptocurrencies you have often wondered where to start.

Well even when you basically understand the principles of operation of this young industry there are times when you wonder how you manage in this world where new projects, new tokens emerge every day.

Don't worry, we have prepared a small menu that will help you take your first step. This little guide will also refresh the basics of the most knowledgeable.

So you've saved say $500. Your first question is probably whether you can buy cryptocurrencies directly with this small sum. Yes without hesitation, but you need either a bank account or Apple Pay, Google Pay, credit card or debit card. This will be requested by the platforms to convert the fiat currency into the digital currency you want to buy.

Know that you have the choice between more than 12,000 digital currencies, according to CoinGecko, a data firm.

Your broker, on the other hand, will not be able to offer you any. PayPal (PYPL) offers you the opportunity to buy and sell bitcoin and ethereum, the first two digital currencies by market value, while CashApp (Block (SQ)) offers you the possibility of trading bitcoin. Other Fintech firms, like Betterment, SoFi, also have options.

But what will probably make sense is a cryptocurrency exchange. There are over 500 listed by CoinGecko at the time of writing.

Shutterstock

Before diving into these exchanges, be aware that cryptocurrencies are a very volatile and risky asset. Their fluctuation is not very often based on fundamentals. It may depend on regulation, adoption by large corporations, institutional investors, businesses and generally we the people.

If bitcoin and ethereum between them concentrate 58% of the $2 trillion of the market value of digital currencies, other cryptocurrencies stand out. It is advisable to carefully read the documents accompanying their birth. Some experts advise to ask what is the use of the project that spawned the token.

Now back to exchange platforms. You should know that there are two types: centralized crypto exchanges (CEX), in other words they are governed by an entity. It's almost the same as a traditional stock exchange.

There are also decentralized platforms (DEX) and as the name suggests there is no middleman. We will focus on centralized exchanges because they concentrate the bulk of trading volumes.

We will focus on a small core of the most important and well-known. One last thing, you will not have access to all platforms from the United States for regulatory and legal reasons. And sometimes even, it all depends in which state you live. Binance US, an American partner of Binance, the world's largest crypto exchange, is not available in several states - New York, Hawaii, Idaho, Louisiana,Texas or Vermont.

We contacted several platforms and did not receive many responses.

Coinbase (COIN) , the only listed crypto exchange, for example, did not respond to our request. We collected information on the websites of these firms and also discussed with experts.

Shutterstock

Binance, The World's Largest Crypto Exchange

In the United States, people living in certain states have access to Binance.US.

Pros: low transaction fees: Binance US has some of the lowest transaction fees on the market. They range from 0% up to 0.50%.

Lots of educational resources: Binance Academy offers educational videos and crypto articles for traders of all skill levels, from beginner to more experienced.

The platform offers discounts on transaction fees, and holding Binance Coin (BNB), the native currency of the Binance blockchain, can give you big discounts up to 25% of transaction fees.

Cons: The account opening process is lengthy, including the process of verifying your identity. The verification process can take several days. You also have a limited choice in terms of the digital currencies you can trade. Finally, Binance, the partner company of Binance.US, is banned in many countries.

Popular crypto available to trade: bitcoin, ethereum, solana, cardano.

Coinbase, The Public Crypto Exchange

It is the most mainstream platform for buying and selling cryptocurrencies in the United States. Users can trade on the original Coinbase platform, which allows users to use U.S. dollars to purchase cryptocurrency.

And there's Coinbase Pro, former GDAX. It has advanced charting functions and allows users to make crypto-to-crypto transactions, as well as place market, limit and stop orders.

Pros: It is publicly traded, which means the market watchdog, the SEC, oversees the company. It is also one of the strengths compared to the competition.

Other highlights: your crypto are guaranteed in case of a hack; you have a wide range of digital currencies to trade and the minimum threshold is among the lowest. Coinbase also runs promotions from time to time, such as the equivalent of 5 dollars in bitcoin when you open an account.

One of the strengths is also a lot of cryptocurrency education via many articles and especially many guides for beginners.

Cons: One of the biggest drawbacks of Coinbase is the transaction fees. They are very high compared to the competition. Between 0.5% and 4.5% depending on the nature of the transaction. Additional charges may also apply.

The fee structure is confusing. We get lost sometimes.

Popular Crypto available: bitcoin, ethereum, dogecoin, Shiba Inu, cardano, aave, solana, polkadot, avalanche, polygon.

OKX, the Second Largest Exchange by Volume Transactions

OKX or OKEX is not available in the USA.

For people living abroad wishing to buy and sell cryptocurrencies OKX has several advantages.

Pros: The platform offers some of the lowest transaction fees on the market. Around 0.10% or even less depending on the type of transaction. Basically, the more you trade, the less fees you pay. And if you use the native OKX token, which is OKX, the fees are almost zero.

It's easy to buy crypto using a credit card, bank account, Apple Pay or Google Pay. It's just a few clicks away.

OKX also gives bonuses in bitcoin when you open an account and the platform like the others offers tutorials, in particular on how to ensure the security of your account.

Cons: On the cons side, OKX, which claims 20 million users in hundreds of countries around the world, is not available in the United States. For international users, the account opening process takes up to three days, identity verification time.

Apart from crypto, you can also trade other financial assets related to digital currencies.

Popular cryptocurrencies: bitcoin, ethereum, solana, cardano, dogecoin, polkadot.

Crypto.com, the Platform That Invests in Sports

Crypto.com is known for its ads with Matt Damon and also for having won the rights to the famous legendary Staples Center in Los Angeles, the home of the Los Angeles Lakers NBA franchise.

The platform is one, along with Coinbase and FTX, of those who are most active in promoting the widest possible adoption of cryptocurrencies and the technologies on which they are based.

Pros: low transaction fees; it has a partnership with Visa and thus offers a debit card that can only be obtained after having owned the platform's native currency, CRO, for 180 days; This card entitles you to many advantages; Crypto.com has a wide range of cryptocurrencies to buy, sell. Many advantages for those who own its native currency, CRO and keep it in their wallet for a long time.

The fees range from 0.04% to 0.4% depending on the operation. Crypto.com has the advantage of guaranteeing crypto for a value of up to $250,000.

Cons: The fees which are rather an advantage of Crypto.com can also be considered as a disadvantage because the platform charges 2.99% on transactions made with a credit card. While promoting security, Crypto.com was the victim of a hack in January. Cryptocurrencies worth $35 million were stolen on this occasion.

Finally, the firm lags behind in terms of educational materials compared to its rivals.

Popular cryptocurrencies: bitcoin, ethereum, solana, avalanche, cardano, dogecoin, polkadot.

FTX

FTX, Tom Brady's Favorite Platform

The legendary quarterback, who has just retired, and his wife Gisele Bundchen own a stake in FTX and are its main charm ambassadors.

In the United States, users have access to FTX US, American Sister of FTX. This platform has a particularity that the transaction fees depend on the volume of transactions carried out over a period of 30 days. These fees range from 0.10% to 0.40%. The lower the trading volume, the higher the fees and vice versa.

FTX US customers must verify their identities to qualify for full access under know your customer (KYC) rules. 'These rules limit the amounts that can be deposited daily or than can be rolled over a certain period.

It has advanced features for pro traders. Nor surprising since FTX presents itself as a platform "built by traders for traders."

One of the cons of FTX US is that it has a limited number of digital currencies that can be traded. Which is not the case with FTX, its parent company.

It also has limited support options: some information, such as how to close your account, is difficult to find. There is no phone number and FTX US recommends customers to open a support ticket with their team using an online portal.

Popular Cryptocurrencies: bitcoin, ethereum, solana, avalanche, dogecoin.

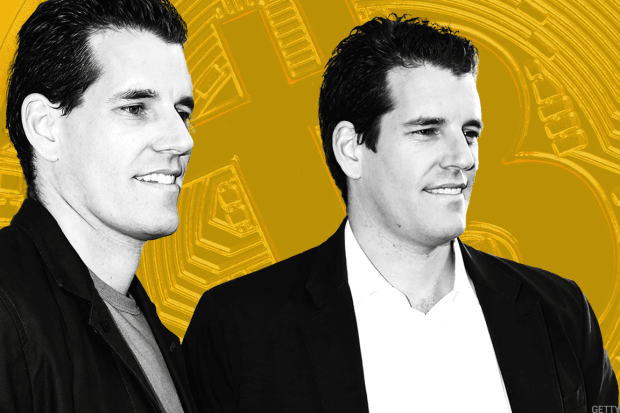

Gemini, the platform of the Winklevoss brothers

The Winklevoss brothers, Tyler and Cameron, used part of the money received in the settlement with Mark Zuckerberg whom they accused of having stolen their idea of social network to create Facebook, to found Gemini.

Pros: the process to sign up for an account is free. All customers will need is their name, email address, password and mobile phone number to further secure their account. If customers want to buy/trade cryptocurrency, customers will need to add a funding source so this could be linking their bank automatically.

To complete the account, Gemini requires email and identity verification.

Opening an account is free and instant, but there is a verification process when customers want to trade cryptocurrency, which can take minutes or 24 hours.

Gemini offers Gemini Earn, an interest earning program that allows customers to earn up to 8.4% interest on 60+ cryptocurrencies available on our exchange. Gemini claims that it currently offer one of the highest yields of competitive crypto interest offerings and the most flexible redemption policies.

One of its best-selling point is that Gemini offers the opportunity for users to earn interest on cryptocurrency in every state, including New York.

Cons: Gemini's biggest drawback is its transaction fees, which are among the highest of exchanges. They range from 0.5% to 3.99% depending on the payment method and the transaction.

Gemini offers a lot of things - security - but it comes at a cost. The platform is both for beginners and professionals.

Popular cryptocurrencies: bitcoin, ethereum, dogecoin, shiba Inu, uniswap.

Other Interesting Platforms

Bybit, Kraken, Bitfinex, KuCoin, Huobi Global, Gate.io.

What Do Experts, Competitors Say?

Antoni Trenchev, co-founder and managing partner at Nexo, recommends giving a chance to small exchange platforms, like Nexo.

"Natural pros to large exchanges are things like high liquidity, more available assets, and complex trading tools. Add to this a larger user base, off of which one can gauge an established exchange's credibility and reputability, and you have quite a secure and versatile offering to benefit from," said Trenchev.

"As for cons to larger exchanges, the main risk is they hold billions in funds and may become more palatable targets for hackers. Another counterintuitive con of big exchanges is that they tend to offer market pairs for smaller coins and tokens only with bitcoin, ethereum, and tether, and not much else," he continued.

Adding: "The result tends to be that we users have to make multiple swaps via the larger cryptos to get smaller assets. Meanwhile, smaller providers – usually crypto lenders like Nexo or wallets that have "swap" capabilities – sometimes offer so-called exotic pairs between two less-popular assets. I'd urge people to check out smaller trading venues in search of such pairs; they can be convenient and cost-efficient."

As for Gautham J, CEO of decentralized exchange Polkadex, he urges potential cryptocurrency investors to also look at decentralized crypto exchanges, such as his platform Polkadex because, he said, they "provide the next generation of the decentralized exchange where blockchain secures user funds and offers the rich user experience and access to high-frequency trading that users expect, which is possible without handing our custody user funds to the orderbook operator."