FedEx (FDX) stock is seeing one of its largest one-day drops in decades, with the shares down more than 22% at last check.

The stock is getting decimated after an update from the Memphis package-delivery giant. Its preliminary first-quarter results and profit warning are quite the disappointment for investors.

The company said it saw its fiscal-first-quarter earnings coming in near $3.44 a share, missing consensus estimates of $5.14 a share. Management also pulled its full-year profit guidance.

The company elaborated: “Global volumes declined as macroeconomic trends significantly worsened later in the quarter, both internationally and in the U.S.”

As a result, rival United Parcel Service (UPS) stock is down about 5% on the news today.

Beyond that, investors and analysts are concerned about what FedEx’s messaging could mean for the broader economy.

The move is reminiscent of the price action in May, when negative news from Walmart (WMT) and Target (TGT) caused massive declines in the stocks, but also in the overall stock market as investors extrapolated management’s comments and applied it to other parts of the economy.

Let’s look at the setup for FedEx stock.

Trading FedEx Stock

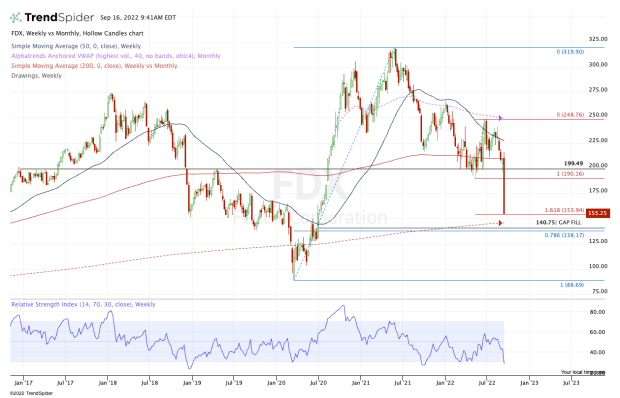

Chart courtesy of TrendSpider.com

Some contend that FedEx is not a stock to buy on the dip. And with today’s price action, it’s hard to argue with that logic.

When I look at the chart, the $153 area is one zone of interest for a potential bounce, but not a “this is the bottom” type of bounce. It's just a downside extension area from the recent range that could provide a technically driven bounce.

The real potential support zone sits down between $138 and $145.

While that’s a fairly wide range to work with, investors there are not looking at just a downside extension. Instead, they’re looking at the 78.6% retracement from the all-time high to the covid low, the 200-month moving average and a gap-fill level at $140.75.

This zone is where the bulls need to see FedEx stock fetch a bid. If it can’t, the next area of support is not entirely clear. Perhaps the $125 level will draw in some buyers.

Management's comments were not all that inspiring. The executives didn’t say it was a one-off quarter or that the first quarter was bad but the rest of the year looks okay.

They said the first quarter was bad and they weren’t very certain about the rest of the year.

On the upside, I’m watching $175, $185, then $200, with the last of that lineup being a strong area of interest. That said, I don’t see it getting there anytime soon.