In the latest quarter, 25 analysts provided ratings for Darden Restaurants (NYSE:DRI), showcasing a mix of bullish and bearish perspectives.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 6 | 7 | 12 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 5 | 7 | 10 | 0 | 0 |

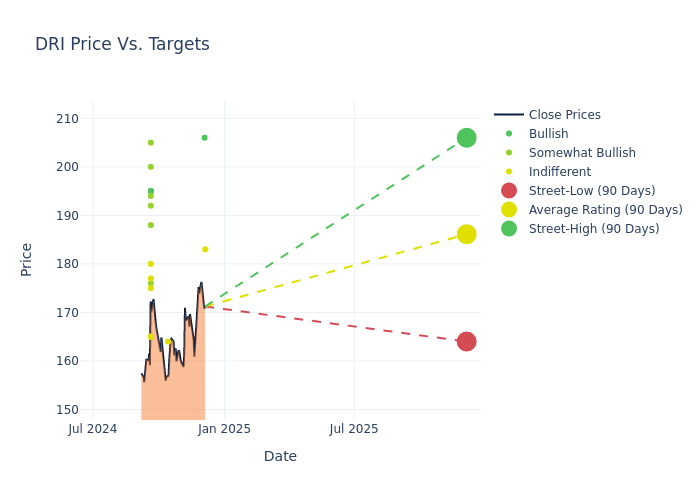

Insights from analysts' 12-month price targets are revealed, presenting an average target of $179.72, a high estimate of $206.00, and a low estimate of $150.00. Surpassing the previous average price target of $170.79, the current average has increased by 5.23%.

Understanding Analyst Ratings: A Comprehensive Breakdown

An in-depth analysis of recent analyst actions unveils how financial experts perceive Darden Restaurants. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Christine Cho | Goldman Sachs | Announces | Neutral | $183.00 | - |

| Jon Tower | Citigroup | Lowers | Buy | $206.00 | $209.00 |

| Jim Salera | Stephens & Co. | Maintains | Equal-Weight | $164.00 | $164.00 |

| Zachary Fadem | Wells Fargo | Raises | Equal-Weight | $165.00 | $160.00 |

| Sara Senatore | B of A Securities | Raises | Buy | $195.00 | $184.00 |

| Peter Saleh | BTIG | Raises | Buy | $195.00 | $175.00 |

| Andrew Strelzik | BMO Capital | Raises | Market Perform | $175.00 | $165.00 |

| Eric Gonzalez | Keybanc | Raises | Overweight | $194.00 | $170.00 |

| Jake Bartlett | Truist Securities | Raises | Buy | $195.00 | $185.00 |

| John Ivankoe | JP Morgan | Raises | Overweight | $176.00 | $165.00 |

| Brian Mullan | Piper Sandler | Raises | Neutral | $177.00 | $159.00 |

| Jeffrey Bernstein | Barclays | Raises | Overweight | $192.00 | $180.00 |

| Dennis Geiger | UBS | Raises | Buy | $195.00 | $188.00 |

| Brian Harbour | Morgan Stanley | Raises | Overweight | $188.00 | $175.00 |

| David Palmer | Evercore ISI Group | Raises | Outperform | $205.00 | $165.00 |

| Nick Setyan | Wedbush | Raises | Outperform | $200.00 | $170.00 |

| Jim Salera | Stephens & Co. | Raises | Equal-Weight | $164.00 | $159.00 |

| Danilo Gargiulo | Bernstein | Lowers | Market Perform | $180.00 | $190.00 |

| Andrew Charles | TD Cowen | Raises | Hold | $165.00 | $150.00 |

| Andrew Charles | TD Cowen | Maintains | Hold | $150.00 | $150.00 |

| Jim Salera | Stephens & Co. | Maintains | Equal-Weight | $159.00 | $159.00 |

| Jim Salera | Stephens & Co. | Lowers | Equal-Weight | $159.00 | $165.00 |

| Andrew Charles | TD Cowen | Maintains | Hold | $150.00 | $150.00 |

| Jon Tower | Citigroup | Lowers | Buy | $191.00 | $192.00 |

| Nick Setyan | Wedbush | Maintains | Outperform | $170.00 | $170.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Darden Restaurants. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Darden Restaurants compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Darden Restaurants's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Capture valuable insights into Darden Restaurants's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Darden Restaurants analyst ratings.

Get to Know Darden Restaurants Better

Darden Restaurants is the largest restaurant operator in the us full-service space, with consolidated revenue of $11.4 billion in fiscal 2024 resulting in 3%-4% full-service market share (per NRA data and our calculations). The company maintains a portfolio of 10 restaurant brands: Olive Garden, LongHorn Steakhouse, Cheddar's Scratch Kitchen, Ruth's Chris, Yard House, The Capital Grille, Seasons 52, Eddie V's, Bahama Breeze, and The Capital Burger. Darden generates revenue almost exclusively from company-owned restaurants, though a small network of franchised restaurants and consumer-packaged goods sales through the traditional grocery channel contribute modestly. As of the end of its fiscal 2024, the company operated 2,031 restaurants in the us.

A Deep Dive into Darden Restaurants's Financials

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Positive Revenue Trend: Examining Darden Restaurants's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 0.97% as of 31 August, 2024, showcasing a substantial increase in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Discretionary sector.

Net Margin: Darden Restaurants's net margin is impressive, surpassing industry averages. With a net margin of 7.52%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Darden Restaurants's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 9.45%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Darden Restaurants's ROA excels beyond industry benchmarks, reaching 1.83%. This signifies efficient management of assets and strong financial health.

Debt Management: Darden Restaurants's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 2.48.

Analyst Ratings: Simplified

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

.png?w=600)