Walgreens (WBA) stock is getting dragged through the mud after the drugstore giant reported disappointing fiscal-third-quarter results.

While revenue of $35.42 billion grew 8.7% year over year (and topped expectations by more than $1 billion), adjusted earnings grew just 3.3% from a year earlier to $1 a share, missing consensus estimates of $1.07 a share.

From the news release: "Operating loss in the first nine months of fiscal 2023 was $6.4 billion compared to operating income of $2.2 billion in the year-ago period."

Don't Miss: Microsoft Keeping Monthly Streak Alive? Check the Chart

Unadjusted earnings of 14 cents a share fell by more than half year over year, while management pared its outlook for full-year adjusted earnings.

Even as WBA missed estimates by just 7 cents, management axed its outlook from a range of $4.45 to $4.65 a share down to $4 to $4.05 a share.

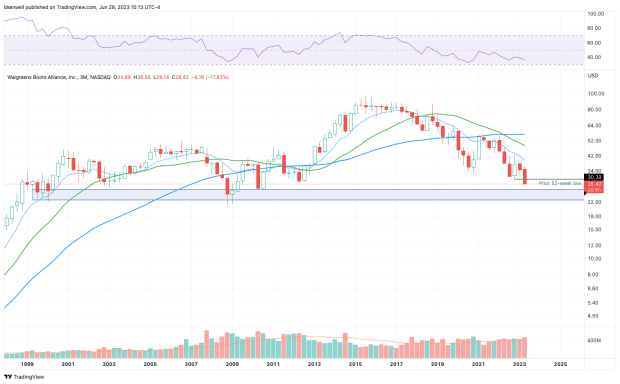

The stock’s decline sent the shares down to 52-week lows, and they touched their lowest level in more than a decade. Even if we adjust for the dividend, Walgreens shares are trading at their lowest levels since 2013.

Dividend, Valuation and Reality

The pullback has allowed the stock’s dividend yield to climb to 6.8%, which may be setting off a few alarm bells for investors.

But let’s consider some realities here.

Based on the new adjusted earnings outlook, Walgreens stock trades at roughly 7 times this year’s forecast and at an even lower valuation based on estimates for 2024. The company is currently operating its fiscal fourth quarter.

For investors who don't like adjusted earnings, the GAAP outlook for next year is much better, too.

Additionally, the company has not only paid but has raised its annual dividend for 47 consecutive years.

Don't Miss: C3.ai Stock Is Struggling for Support; Here's the Setup

Walgreens stock has been around for a long time, trades at a low valuation and puts an emphasis on its dividend. But it’s also true that the shares have declined in six of the past seven years and are down more than 70% from the highs.

While the dividend has been a priority for Walgreens over the years, it was that way for General Electric (GE) and more recently AT&T (T). I’m not saying Walgreens is going to cut the dividend, only that dividend streaks and longevity do not always equal a riskless scenario.

When to Buy the Dip in Walgreens Stock

Chart courtesy of TrendSpider.com

For almost 25 years, pullbacks into the low- to mid-$20s have been excellent long-term buying opportunities.

Notice that the chart above is a quarterly look at Walgreens shares and it's not odd for the stock to spend several quarters — or anywhere from six to nine months — in this range.

Aggressive buyers could consider accumulating the stock on the current dip and locking in that inflated dividend yield.

But conservative traders who are trying to combine the fundamentals and the technicals will likely wait for the stock to enter the $22 to $26 area before accumulating any shares.

Don't Miss: Alphabet Has Helped Drive the Nasdaq; Here's Where to Buy the Dip

Both groups face risks. Today’s buyers risk the stock continuing to underperform, while those who wait risk the stock never dipping into the support area highlighted on the chart.

Bottom Line: Walgreens has a history of being committed to the dividend and that may very well remain the case going forward.

While its valuation is low based on adjusted earnings, its valuation is much higher when using the GAAP figures for this year.

Investors must consider all this — along with the stock’s recent performance over the years — when deciding whether this is a name they want to own.

July 4th Sale! Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now for 75% off.