/O)

O'Reilly Automotive, Inc. (ORLY), headquartered in Springfield, Missouri, is a leading retailer and supplier of automotive aftermarket parts, tools, supplies, equipment, and accessories. Valued at $79.6 billion by market cap, the company sells its products to do-it-yourself customers, professional mechanics, and service technicians. The auto parts giant is expected to announce its fiscal first-quarter earnings for 2025 after the market closes on Wednesday, Apr. 23.

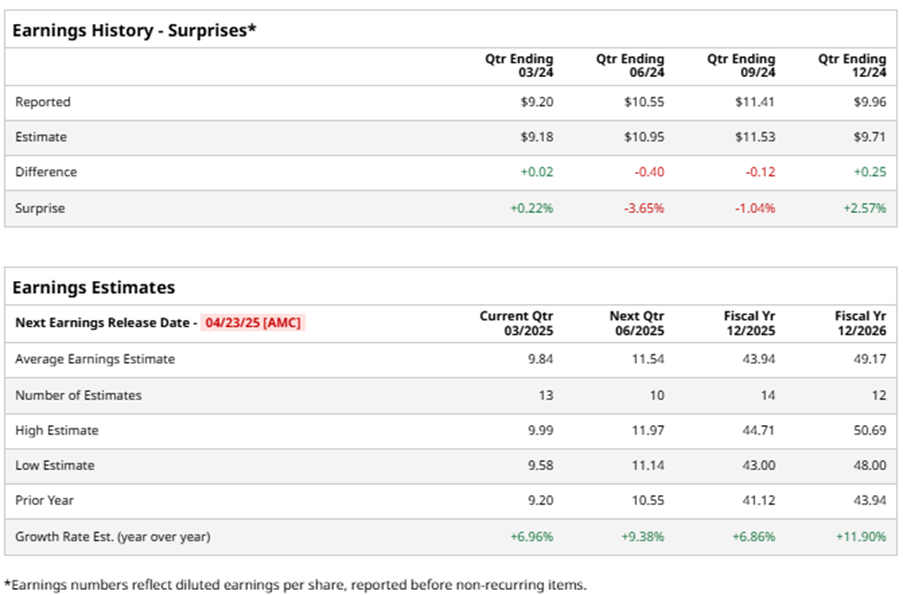

Ahead of the event, analysts expect ORLY to report a profit of $9.84 per share on a diluted basis, up 7% from $9.20 per share in the year-ago quarter. The company beat the consensus estimates in two of the last four quarters while missing the forecast on two other occasions.

For the full year, analysts expect ORLY to report EPS of $43.94, up 6.9% from $41.12 in fiscal 2024. Its EPS is expected to rise 11.9% year over year to $49.17 in fiscal 2026.

ORLY stock has outperformed the S&P 500’s ($SPX) 2.7% losses over the past 52 weeks, with shares up 19.4% during this period. Similarly, it outperformed the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 1% uptick over the same time frame.

ORLY's strong performance is driven by an increase in comparable store sales over the past two years, showcasing its ability to boost spending at existing locations. With a unique product assortment and pricing power, ORLY boasts a best-in-class gross margin of 51.2%. Additionally, its strong free cash flow margin of 12.2% allows for consistent reinvestment or capital returns.

On Feb. 5, ORLY shares closed up more than 1% after reporting its Q4 results. Its EPS came in at $9.50, up 2.6% year over year. The company’s revenue was $4.1 billion, beating Wall Street forecasts of $4 billion. ORLY expects full-year EPS to be between $42.60 and $43.10, and expects revenue in the range of $17.4 billion to $17.7 billion.

Analysts’ consensus opinion on ORLY stock is bullish, with a “Strong Buy” rating overall. Out of 27 analysts covering the stock, 18 advise a “Strong Buy” rating, two suggest a “Moderate Buy,” and seven give a “Hold.” ORLY’s average analyst price target is $1441.10, indicating a potential upside of 8% from the current levels.