With a market cap of $35.4 billion, Baker Hughes Company (BKR) is one of the world’s largest oilfield service providers, delivering integrated oilfield products, digital solutions, and industrial technologies to the global energy and industrial sectors. Through its Oilfield Services & Equipment (OFSE) and Industrial & Energy Technology (IET) segments, it supports traditional oil and gas operations while expanding into clean energy solutions like LNG to enhance efficiency, reduce costs, and lower environmental impacts.

The Houston, Texas-based company is expected to announce its fiscal Q1 2025 earnings results after the market closes on Tuesday, Apr. 22. Ahead of this event, analysts expect BKR to report a profit of $0.48 per share, up 11.6% from $0.43 per share in the previous year's quarter. It has surpassed Wall Street's bottom-line estimates in the past four quarters. In Q4 2024, BKR beat the consensus EPS estimate by 11.1%.

For fiscal 2025, analysts expect the oilfield services company to report EPS of $2.58, up 9.8% from $2.35 in fiscal 2024. In addition, EPS is anticipated to grow 16.3% year-over-year to $3 in fiscal 2026.

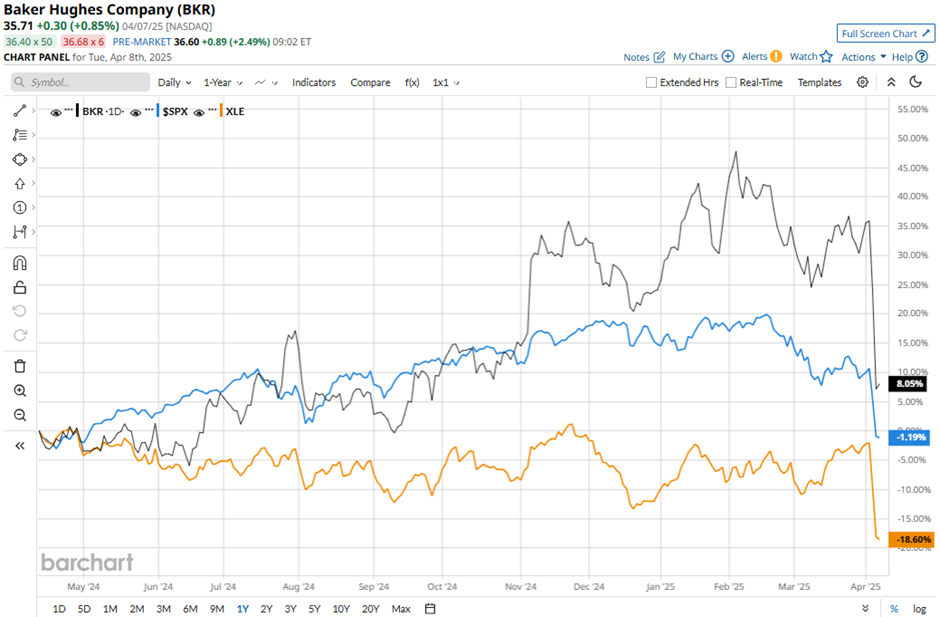

BKR stock has risen 6.1% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 2.7% decline and the Energy Select Sector SPDR Fund's (XLE) 17.7% drop over the same period.

Shares of Baker Hughes rose 3.5% following its Q4 2024 earnings release on Jan. 30, which beat analyst expectations, with adjusted EPS up 37.3% year-over-year to $0.70 and revenue rising 7.7% to $7.4 billion. The Industrial & Energy Technology segment drove growth with a 21% revenue increase and a 24% rise in orders, fueled by a 44% surge in gas technology solutions demand. Strong free cash flow growth of 41.2% year over year to $894 million also boosted investor confidence.

Management’s positive 2025 outlook, including a target of 20% EBITDA margin for the Oilfield Services & Equipment segment, further boosted investor confidence.

Analysts' consensus rating on Baker Hughes stock is bullish, with a "Strong Buy" rating overall. Out of 23 analysts covering the stock, opinions include 19 "Strong Buys," one "Moderate Buy," and three "Holds." As of writing, BKR is trading below the average analyst price target of $52.88.