/Advanced%20Micro%20Devices%20Inc_%20logo%20and%20chart%20data-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

Valued at a market cap of $154 billion, Advanced Micro Devices, Inc. (AMD) is a semiconductor company that offers a broad portfolio of high-performance and adaptive processor technologies, combining CPUs, GPUs, FPGAs, Adaptive SoCs and deep software expertise to enable leadership computing platforms for cloud, edge and end devices. The Santa Clara, California-based company is expected to announce its fiscal Q1 earnings for 2025 after the market closes on Tuesday, May 6.

Prior to this event, analysts project this semiconductor company to report a profit of $0.75 per share, up 74.4% from $0.43 per share in the year-ago quarter. The company has met or surpassed Wall Street's bottom-line estimates in each of the last four quarters. Its adjusted earnings of $1.09 per share in the previous quarter outpaced the consensus estimates by 1.9%.

For the full year, analysts expect AMD to report EPS of $3.87, up 47.7% from $2.62 in fiscal 2024. Its EPS is expected to further grow 36.2% year over year to $5.27 in fiscal 2026.

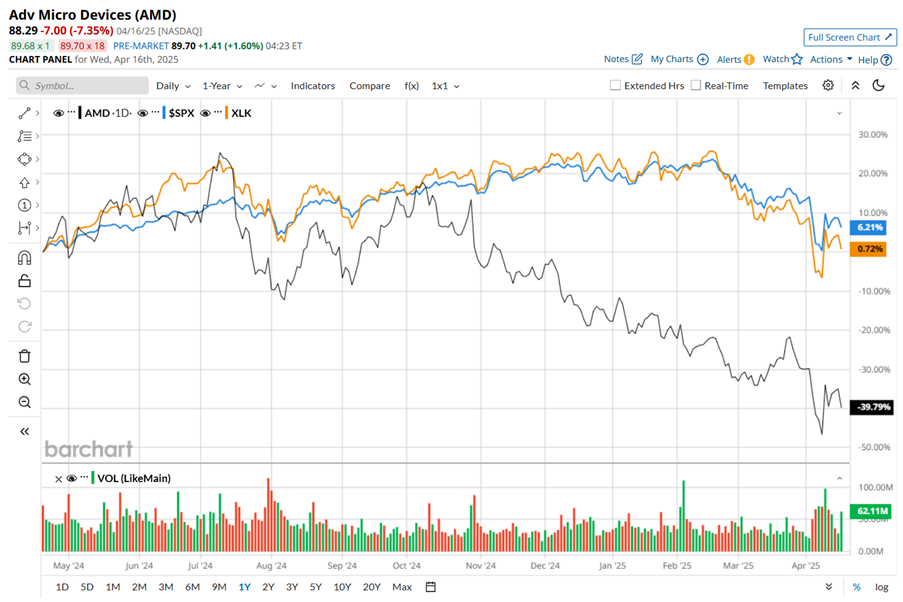

AMD has declined 46% over the past 52 weeks, considerably falling behind both the S&P 500 Index's ($SPX) 4.4% gain, and the Technology Select Sector SPDR Fund’s (XLK) 3.9% downtick over the same time frame.

On Apr. 16, shares of AMD plummeted nearly 7.4% following the announcement of new U.S. export restrictions. AMD will now be required to obtain an export license to sell its MI308X artificial intelligence (AI) processors in the Chinese market. Given the low likelihood of receiving such a license, the company is effectively prohibited from selling these processors to Chinese customers. As a result, AMD expects to incur an inventory loss of $800 million.

Nonetheless, on Feb. 4, AMD’s shares gained 4.6% after its strong Q4 earnings release. The company's revenue grew 24.2% year-over-year to a record $7.7 billion and topped the consensus estimates by 1.9%. Moreover, its adjusted earnings of $1.09 improved 41.6% from the year-ago quarter and also surpassed the estimates. A strong growth in data center and client segment revenue benefited the company.

Wall Street analysts are moderately optimistic about AMD’s stock, with a "Moderate Buy" rating overall. Among 41 analysts covering the stock, 26 recommend "Strong Buy," one advises a “Moderate Buy,” and 14 suggest “Hold.” The mean price target for AMD is $146.53, which indicates a notable 66% potential upside from the current levels.