Buying a home is becoming increasingly challenging for Canadians. But there is a new solution available to help buyers take their first step onto the housing ladder.

As of April, first-time buyers can open a first home savings account (FHSA). This account is specifically designed to help first-time buyers purchase their first home.

It combines the benefits found in two existing registered accounts: the registered retirement savings plan (RRSP) and the tax-free savings account.

An FHSA provides a tax shelter for investments, turbo-charging the growth of savings for a home down payment. When a taxpayer contributes to their FHSA, their tax bill is lowered for that year. Additionally, when the funds are withdrawn to buy a first-time home, no tax is owed.

Initially, the federal government said the FHSA could not be combined with the Home-Buyers Plan, which lets people borrow from their RRSP to finance a home purchase. This has since changed and taxpayers have been assured they can use both programs in combination.

The finer details

Is there a catch? Not really, but there are specific rules to follow. To use the FHSA, you must be 18 years of age and can’t have owned a home within the past four years.

Contributions are limited to $8,000 annually, up to $40,000 over a lifetime. The funds to purchase a home must be used within 15 years (or by the time you turn 71).

Many first-time buyers may find it difficult to save $8,000 in a single year. But the good news is you can carry over the contribution room to the following year.

It’s important to note that the maximum amount you can pay into the FHSA in any year is $16,000. This includes $8,000 from the current year and $8,000 of the unused from the year prior.

But what if circumstances change and you decide not to purchase a home? Or maybe you do buy a home, and there are funds left over? No worries — you can transfer the funds to your RRSP without impacting your RRSP contribution room.

Should millennials rejoice?

Statistics Canada data shows that home ownership has declined from 2011 to 2021, with the greatest decline occurring for millennials ages 25 to 34.

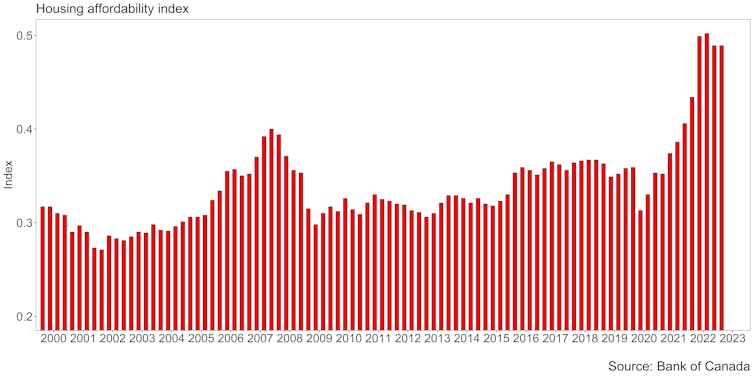

The main challenges to owning a home are high real estate prices, high borrowing costs and the cost of living rising faster than wages (though wages are now slowly starting to catch-up). One way to measure this challenge is with the Bank of Canada’s housing affordability index.

The housing affordability index illustrates how difficult it is to afford a home by measuring housing-related costs (mortgage payments and utility fees) relative to average household disposable income. It has been around 45 to 50 per cent recently — far higher than previous years.

The current index shows that the average household needs to give up approximately half of their disposable income to own a home. So while the FHSA may provide hope for those saving for a down payment for their first home, the ongoing costs remain very high.

FHSA improves first-time buyers’ chances

If a first-time buyer is willing to sacrifice a potentially significant part of their monthly income to buy their first home, they first need a down payment. So is the FHSA sufficient to make a difference for first-time buyers trying to save for their down payment?

Some might see the maximum contribution of $40,000 to a FHSA as a drop in the ocean compared to the down payment required for homes in more expensive Canadian markets. In Vancouver, Toronto and Victoria, a 20 per cent down payment for a median home price is $238,471, $227,514, and $204,149, respectively.

A recent survey found that 25 per cent of first-time buyers relied on help from parents or relatives with their monthly mortgage payments. Thirty-five per cent needed help with their down payment.

The same survey of first-time buyers found that 67 per cent of respondents feared missing out on owning a home due to an inadequate down payment.

However, many first-time buyers start by buying more modest properties initially, and the FHSA could help them get into the housing market earlier. Of course, this will still take time given the $8,000 per year contribution limit.

While the impact of the FHSA won’t be instant, and while it’s not a complete solution, it’s a step in the right direction. For many Canadians, owning a home provides security and a sense of belonging. The FHSA could play a significant role in making this dream more attainable for first-time buyers, helping them reach the moment when they finally get the keys to their own front door.

The authors do not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and have disclosed no relevant affiliations beyond their academic appointment.

This article was originally published on The Conversation. Read the original article.