Microsoft Corporation (NASDAQ:MSFT) spiked up about 1% higher on Thursday morning after a bearish day on Wednesday saw the tech giant slide almost 5%.

Stocks in the broader technology sector have been hammered over recent weeks, leading the S&P 500 down over 15% since March 29.

The Federal Reserve’s decision to hike interest rates combined with its plan to begin quantitative tightening on June 1 has pressured the markets lower and caused institutional investors to take a step back until the dust settles and the effects of the central bank’s monetary policy become clearer.

Stocks, and the market in general, never head straight south, and bounces to the upside are part of every bear cycle. On Thursday, the bulls and the bears were battling for control of Microsoft’s stock, and the outcome will provide clues as to whether the downtrend is set to continue or if the stock is about to reverse course.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

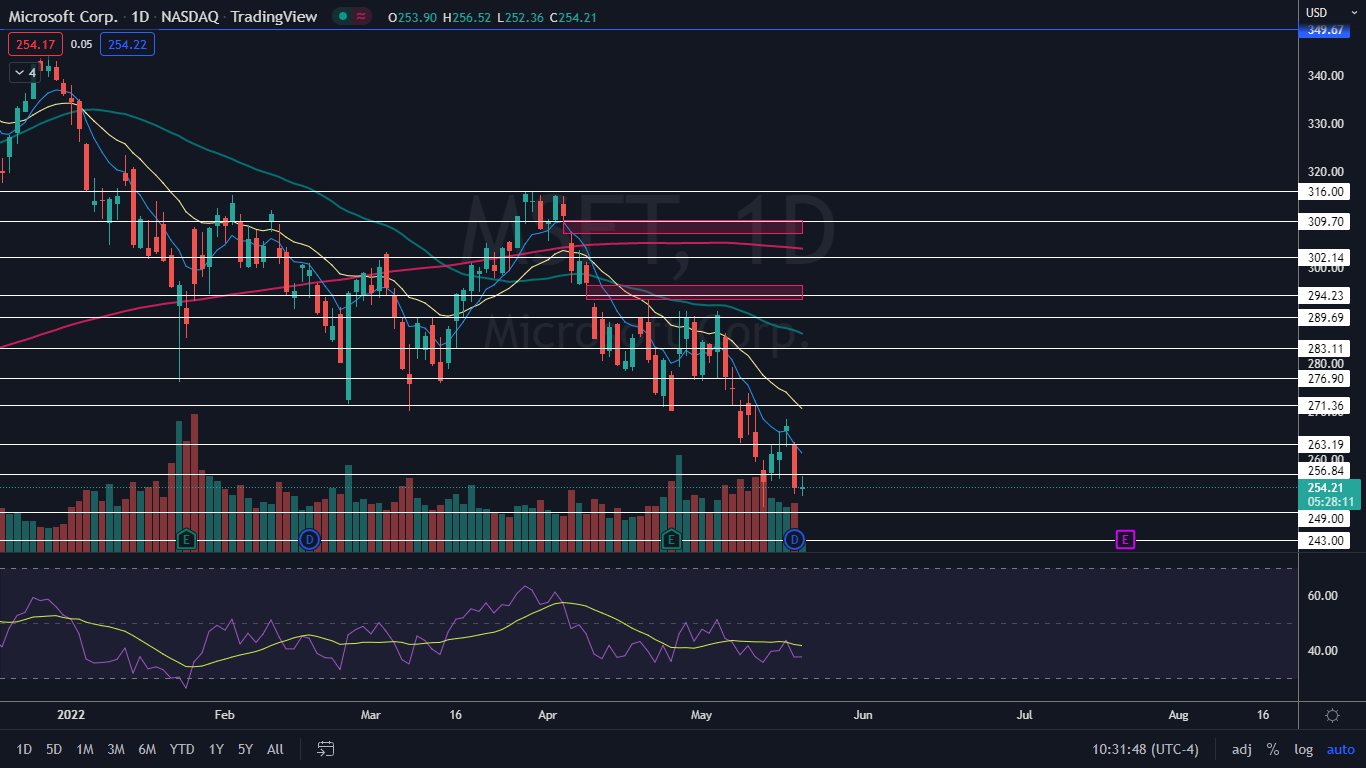

The Microsoft Chart: Microsoft has been trading in a steep downtrend since March 29, plummeting almost 20% since that date. The stock’s most recent lower high was printed on May 17 at $268.33 and the most recent confirmed lower low was formed at the $250.02 mark on May 12.

- On Thursday, the battle between the bulls and the bears had Microsoft working to print a doji candlestick on the daily chart. If the stock closes flat, creating a doji, it could signal a reversal to the upside is on the way. If the bulls win and Microsoft closes the trading session near its high-of-day, the stock will print a hammer candlestick, which could also signal more upside.

- If Microsoft closes the session near its low-of-day price, the bears will remain in control and the stock is likely to fall lower on Friday and continue in its downtrend. If the stock trades higher on Friday, Microsoft will have formed a higher low, which would be the first indication the downtrend is at least temporarily over.

- Microsoft has resistance above at $256.84 and $263.19 and support below at $249 and $243.