/Willis%20Towers%20Watson%20Public%20Limited%20Co%20phone-by%20viewimage%20by%20Shutterstock.jpg)

London-U.K.-based Willis Towers Watson Public Limited Company (WTW) is a leading global advisory, broking and solutions company. Its solutions include risk management, benefits optimization and capability expansion. Valued at $31.4 billion by market cap, WTW operates through Risk & Broking, and Health, Wealth & Career segments.

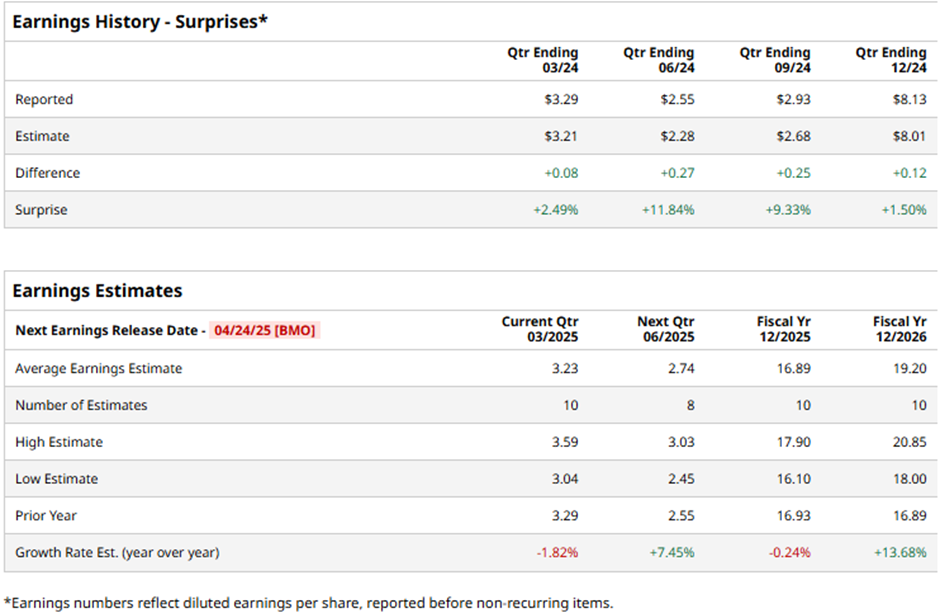

WTW is gearing up to release its first-quarter results before the markets open on Thursday, Apr. 24. Ahead of the event, analysts expect the firm to report a non-GAAP EPS of $3.23, down 1.8% from the year-ago quarter’s earnings of $3.29 per share. On a more positive note, WTW has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, analysts expect the insurance broker to report a non-GAAP EPS of $16.89, marginally down from $16.93 in fiscal 2024. While in fiscal 2026, its earnings are expected to rebound 13.7% year-over-year to $19.20 per share.

WTW stock has soared more than 20% over the past 52 weeks, significantly outpacing the S&P 500 Index’s ($SPX) 2.1% uptick and the Financial Select Sector SPDR Fund’s (XLF) 12.3% gains during the same time frame.

Willis Towers Watson’s stock dipped 3.1% after the release of its mixed Q4 results on Feb. 4. Driven by solid organic growth, the company’s topline increased 4.2% year-on-year to more than $3 billion, however, this figure fell short of Street’s expectations by a small margin. On the brighter side, due to the reduction in expenses, WTW’s non-GAAP operating margin expanded by 190 bps compared to the year-ago quarter, reaching 36.1%. This led to a solid 9.8% growth in non-GAAP operating profits to $1.1 billion and a 6.7% increase in non-GAAP net income to $827 million. Moreover, its non-GAAP EPS of $8.13 surpassed the consensus estimates by 1.5%.

The consensus opinion on WTW stock is cautiously optimistic, with a “Moderate Buy” rating overall. Out of the 20 analysts covering the stock, 13 recommend “Strong Buy,” one advises “Moderate Buy,” five suggest “Hold,” and one advocates a “Strong Sell” rating. Its mean price target of $363.50 represents a 14.8% upside potential from current price levels.