/Union%20Pacific%20Corp_%20logo%20on%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

With a market cap of $124.8 billion, Union Pacific Corporation (UNP) operates in the railroad business in the United States. Founded in 1862, the Omaha, Nebraska-based company offers transportation services for materials including grain and grain products, fertilizers, food and refrigerated products, and coal.

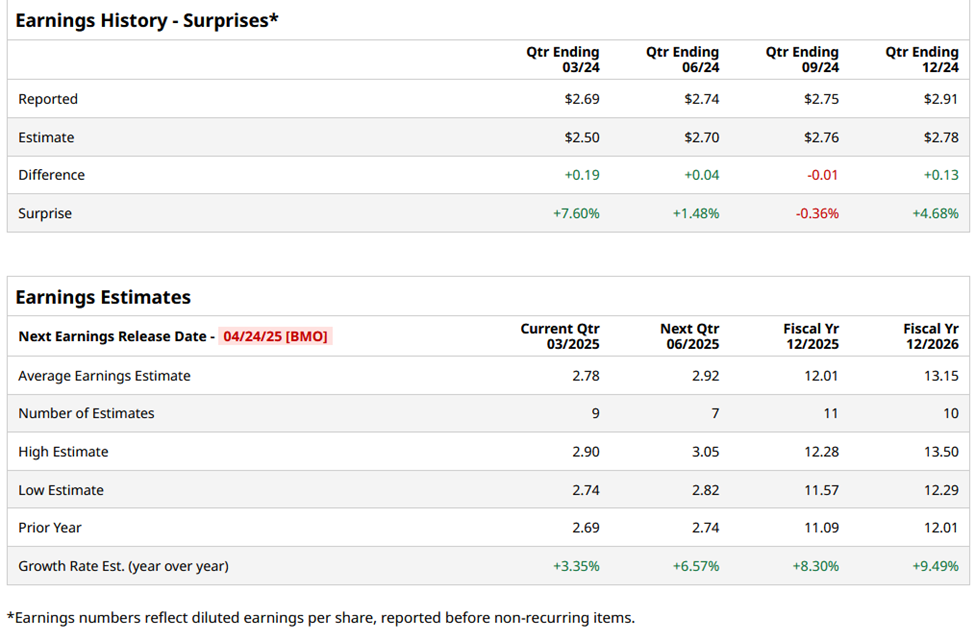

The railroad giant is set to announce its Q1 results before the market opens on Thursday, Apr. 24. Ahead of the event, analysts expect UNP to report a profit of $2.78 per share, up 3.4% from the year-ago quarter's profit of $2.69 per share. Furthermore, the company has surpassed analysts' consensus estimates in three of the last four quarters, while failing to surpass in only one quarter. In the previous quarter, it reported EPS of $2.91, which surpassed the consensus estimate by 4.7%.

For the full fiscal 2025, analysts expect UNP to report an EPS of $12.01, up a notable 8.3% from $11.09 in fiscal 2024. Looking ahead, analysts expect its earnings to further surge 9.5% year-over-year to $13.15 per share in fiscal 2026.

Over the past year, UNP shares have declined 7.2%, underperforming the S&P 500 Index’s ($SPX) 4.7% gains and the Industrial Select Sector SPDR Fund’s (XLI) 1.3% uptick over the same time frame.

UNP stock price surged 5.2% on Jan. 23 following the release of its mixed Q4 earnings. Due to a lower fuel surcharge and unfavorable business mix which was partially offset by increased volume and core pricing gains, the company's overall operating revenues experienced a marginal dip to $6.1 billion. However, Union Pacific delivered an impressive 220 basis points expansion in its operating ratio to 58.7%, and a 5% year-over-year growth in operating income to $2.5 billion. This helped the company to surpass Street's earnings estimates. Following the initial uptick, UNP stock maintained a positive momentum for the next two trading sessions.

Furthermore, analysts remain optimistic about the stock's prospects. The consensus opinion on UNP stock is moderately bullish, with a "Moderate Buy" rating overall. Among 26 analysts covering the stock, opinions include 16 "Strong Buys," one "Moderate Buy,” eight "Holds," and one “Strong Sell.” UNP's mean price of $262.50 implies a premium of 17.4% from its prevailing price level.