/Uber%20Technologies%20Inc%20logo%20on%20phone-by%20DenPhotos%20via%20Shutterstock.jpg)

With a market cap of $138.3 billion, Uber Technologies, Inc. (UBER) is a global technology company providing services in transportation, food delivery, and logistics through its Mobility, Delivery, and Freight segments. It connects consumers and businesses with ridesharing, delivery, and logistics solutions across multiple regions worldwide. The San Francisco, California-based company is expected to release its fiscal Q4 earnings results on Wednesday, Feb. 5.

Ahead of this event, analysts project the ride-hailing company to report a profit of $0.56 per share, reflecting a decrease of 15.2% from $0.66 per share in the year-ago quarter. The company holds a record of surpassing Wall Street's bottom-line estimates in three of the last four quarterly reports while missing on another occasion. In the most recent quarter, UBER exceeded the consensus EPS estimate by a significant margin of 192.7%.

For fiscal 2024, analysts forecast UBER to report EPS of $1.91 per share, up 119.5% from $0.87 per share in fiscal 2023.

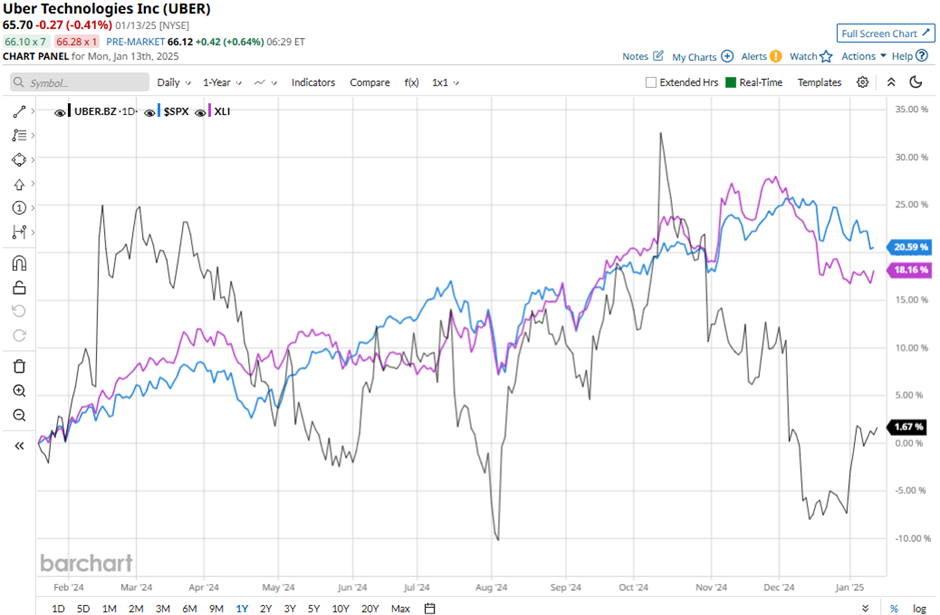

Uber Technologies has risen nearly 4% over the past 52 weeks, underperforming the broader S&P 500 Index's ($SPX) 22% gain and the Industrial Select Sector SPDR Fund's (XLI) 18.5% return over the same time frame.

Despite Uber's stronger-than-expected Q3 EPS of $1.20 and revenue of $11.2 billion, shares dropped 9.3% on Oct. 31 due to concerns about future growth. The company forecasted Q4 gross bookings of $42.8 billion - $44.3 billion below Wall Street estimates, signaling a slowdown in the core ride-hailing business, with bookings growth hitting a one-year low. This raised investor fears of weakening demand in the ride-hailing market, exacerbated by inflation and a shift to cheaper transportation options.

Moreover, the stock plunged 9.6% on Dec. 5 as concerns grew over increased competition from Waymo, which is expanding into Miami with autonomous ride-hailing services and partnering with Moove for fleet management, reducing Uber's role in future markets.

Analysts' consensus view on Uber Technologies stock is bullish, with a "Strong Buy" rating overall. Among 45 analysts covering the stock, 36 suggest a "Strong Buy," three give a "Moderate Buy," and six recommend a "Hold." This configuration is slightly less bullish than three months ago, with a 37 "Strong Buy" rating. As of writing, UBER is trading below the average analyst price target of $91.31.