/Tyler%20Technologies%2C%20Inc_%20logo%20on%20phone%20-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $22.5 billion, Tyler Technologies, Inc. (TYL) provides integrated software and technology solutions for the public sector across two segments: Enterprise Software and Platform Technologies. It offers cloud and on-premise solutions for financial management, public safety, courts, property appraisal and tax, K-12 education, regulatory management, cybersecurity, and data insights, with a cloud partnership with Amazon Web Services.

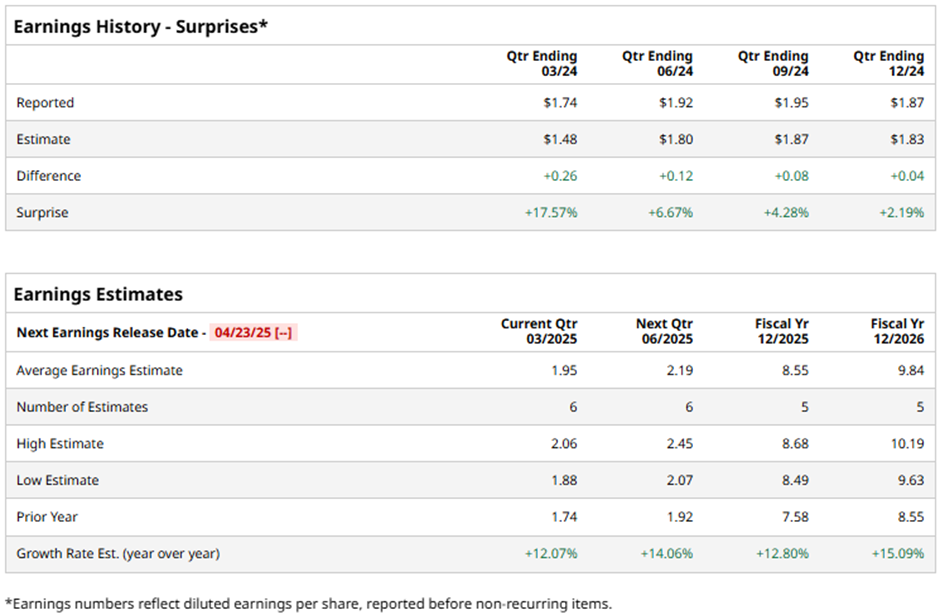

The Plano, Texas-based company is slated to announce its fiscal Q1 2025 earnings results on Wednesday, Apr. 23. Ahead of this event, analysts expect TYL to report a profit of $1.95 per share, a 12.1% growth from $1.74 per share in the year-ago quarter. TYL has exceeded Wall Street's earnings expectations in the past four quarters. In Q4 2024, TYL beat the consensus EPS estimate by 2.2%.

For fiscal 2025, analysts expect the information management software provider to report EPS of $8.55, up 12.8% from $7.58 in fiscal 2024. Moreover, EPS is anticipated to grow 15.1% year-over-year to $9.84 in fiscal 2026.

Shares of Tyler Technologies have gained 23.4% over the past 52 weeks, outperforming the broader S&P 500 Index's ($SPX) 4.5% decline and the Technology Select Sector SPDR Fund's (XLK) 12.7% dip over the same period.

Shares of Tyler Technologies climbed over 5.9% following its Q4 2024 earnings release on Feb. 12, driven by revenue of $541.1 million and a 28.6% year-over-year jump in adjusted EPS to $2.43. Investors were also encouraged by a 23.0% increase in SaaS revenues, a 14.9% rise in recurring revenue to $463.9 million, and a 60.7% surge in free cash flow to $216.0 million. Strong operational efficiencies and successful execution of the cloud-first strategy boosted confidence. Management’s 2025 guidance for total revenue and adjusted EPS of $10.90 - $11.15 further fueled optimism.

Analysts' consensus view on Tyler Technologies stock remains bullish, with a "Strong Buy" rating overall. Out of 17 analysts covering the stock, 12 recommend a "Strong Buy," one "Moderate Buys," and four "Holds." As of writing, TYL is trading below the average analyst price target of $708.12.