/NVR%20Inc_%20phone%20and%20website%20by-%20T_Schneider%20via%20Shutterstock.jpg)

Reston, Virginia-based NVR, Inc. (NVR) engages in the construction and sale of single-family detached homes, townhomes and condominium buildings, all of which are primarily constructed on a pre-sold basis. With a market cap of $22 billion, NVR operates through the Homebuilding and Mortgage Banking segments.

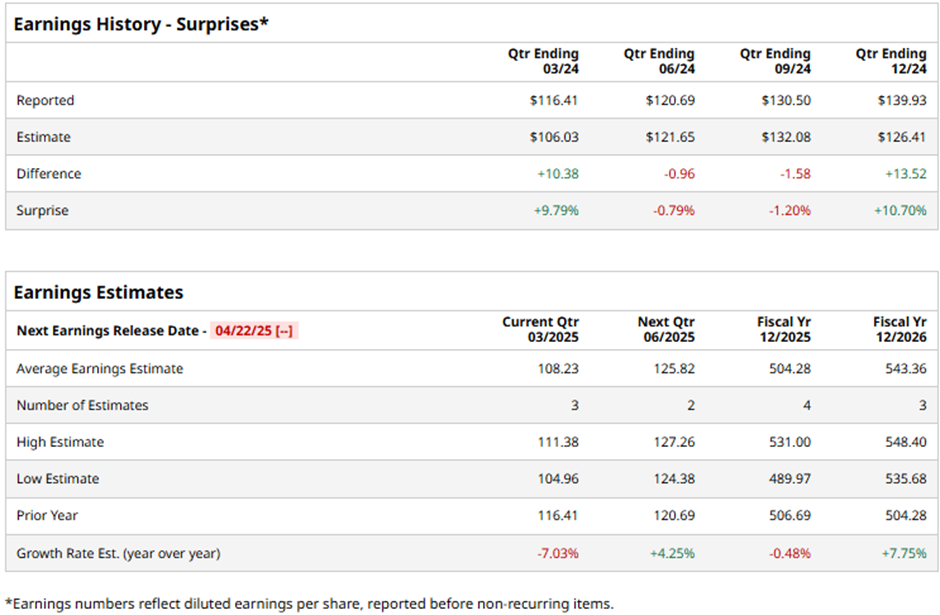

The residential construction giant is expected to announce its first-quarter results on Tuesday, Apr. 22. Ahead of the event, analysts expect NVR to report adjusted earnings of $108.23 per share, down 7% from $116.41 per share reported in the year-ago quarter. While the company has missed the Street’s bottom-line estimates twice over the past four quarters, it has surpassed the expectations on two other occasions.

For the full fiscal 2025, PKG’s earnings are expected to grow to $504.28 per share, marginally down from $506.69 per share in fiscal 2024. However, in fiscal 2026, NVR’s earnings are expected to rebound 7.8% year-over-year to $543.36 per share.

NVR’s stock prices have dropped 4.9% over the past 52 weeks, underperforming the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 2.8% gains and the S&P 500 Index’s ($SPX) 1.4% decline during the same time frame.

Despite reporting better-than-expected financials, NVR’s stock plunged 3.8% after the release of its Q4 results on Jan. 28. The company reported a robust 16.5% year-over-year growth in homebuilding revenues to $2.8 billion, exceeding the Street’s expectations by 3.3%. Alongside the company also observed significant growth in mortgage banking fees and income. Moreover, NVR’s earnings increased 15.1% year-over-year to $139.93 per share, beating the consensus estimates by 10.7%.

However, NVR’s new orders in the quarter decreased 7.6% year-over-year to 4,794 units, while the backlog of homes sold but not settled as of Dec. 31 decreased 3% year-over-year to 9,953 units and the cancellation rate for Q4 2024 increased to 17% up from 13% in Q4 2023. These updates unsettled investor’s confidence in NVR's growth prospects in the coming quarters.

Furthermore, analysts remain cautious about NVR’s prospects. The consensus opinion on the stock is neutral with an overall “Hold” rating. Out of the seven analysts covering the NVR stock, one advises “Strong Buy,” five suggest “Hold,” and one recommends a “Strong Sell” rating. Its mean price target of $8,917.50 represents a 20.3% premium to current price levels.