/Intel%20Corp_%20badge%20holder-by%20hasrul_rais%20via%20Shutterstock.jpg)

Valued at a market cap of $86.7 billion, Intel Corporation (INTC) is a global designer and manufacturer of semiconductor products that markets and sells computing and related products and services. The Santa Clara, California-based company operates through Intel Products, Intel Foundry, and All Other segments.

The chipmaker is set to unveil its fiscal Q1 2025 earnings after the market closes on Thursday, Apr. 24. Ahead of this event, analysts expect Intel to post an adjusted loss of $0.14 per share, representing a sharp decline of 133.3% from a loss of $0.06 per share in the same quarter last year. The company has surpassed Wall Street’s bottom-line estimates in one of the past four quarters while missing on three other occasions.

For fiscal 2025, analysts forecast INTC to report an adjusted loss of $0.13 per share, a significant improvement of 84.7% from the loss of $0.85 per share in fiscal 2024. Moreover, its earnings are expected to grow massively, 492.3% year-over-year, to $0.51 in fiscal 2026.

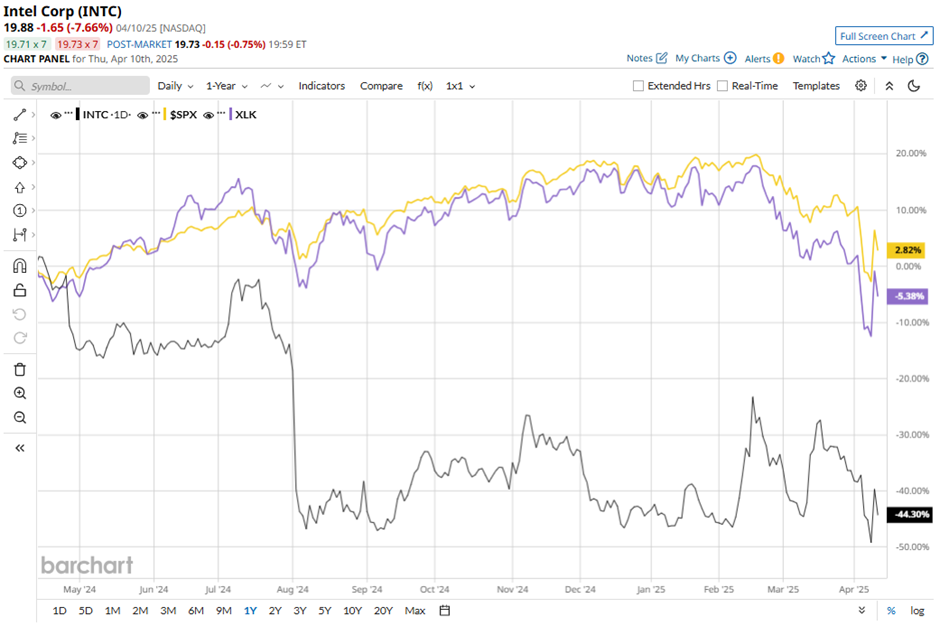

INTC's stock prices have plunged 46.6% over the past 52 weeks, notably underperforming both the S&P 500 Index's ($SPX) 2.1% gain and the Technology Select Sector SPDR Fund’s (XLK) 5.1% drop over the same time frame.

Despite exceeding the Wall Street expectations with Q4 2024 earnings results on Jan. 30, shares of INTC slid 2.9%. The company outperformed Wall Street expectations with an adjusted EPS of $0.13, surpassing the consensus estimate of $0.12. Revenue fell 7.1% year-over-year to $14.3 billion but still managed to beat Wall Street expectations. However, with companies shifting focus to specialized AI chips, Intel struggled to gain traction in the generative AI space, exposing its server chip segment to further declines.

Looking ahead, the company forecasts Q1 2025 revenue in the range of $11.7 billion to $12.7 billion, trailing analysts’ consensus estimate.

Analysts' consensus view on INTC is cautious, with a "Hold" rating overall. Among 36 analysts covering the stock, one suggests a "Strong Buy," 31 recommend a "Hold," and four give a "Strong Sell" rating. Its mean price target of $24.62 represents a 23.8% premium to the current price levels.

.jpg?w=600)