/Allegion%20plc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)

Allegion plc (ALLE) is a global provider of security products and solutions headquartered in Dublin, Ireland. Valued at a market capitalization of $10.2 billion, the company designs and manufactures a wide range of mechanical and electronic security offerings—including door controls, locks, access control systems, and time and attendance solutions, under well-known brands such as Schlage, CISA, and Von Duprin. Allegion is scheduled to report its fiscal first-quarter earnings on Thursday. Apr. 24.

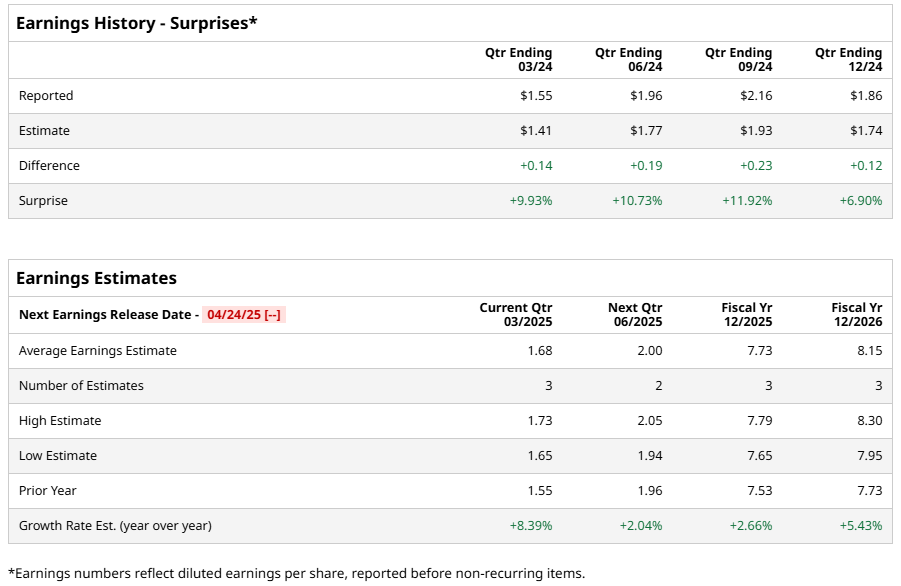

Ahead of the event, analysts expect ALLE to report a profit of $1.68 per share on a diluted basis, up 8.4% from $1.55 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports. Its adjusted EPS of $1.86 beat Wall Street’s expectations by 6.9%, which is attributed to solid demand across both non-residential and international markets, favorable pricing actions, and continued operational efficiency.

For the current year, analysts expect ALLE to report an adjusted EPS of $7.73, up 2.7% from $7.53 in fiscal 2024. Its adjusted EPS is expected to rise 5.4% year over year to $8.15 in fiscal 2026.

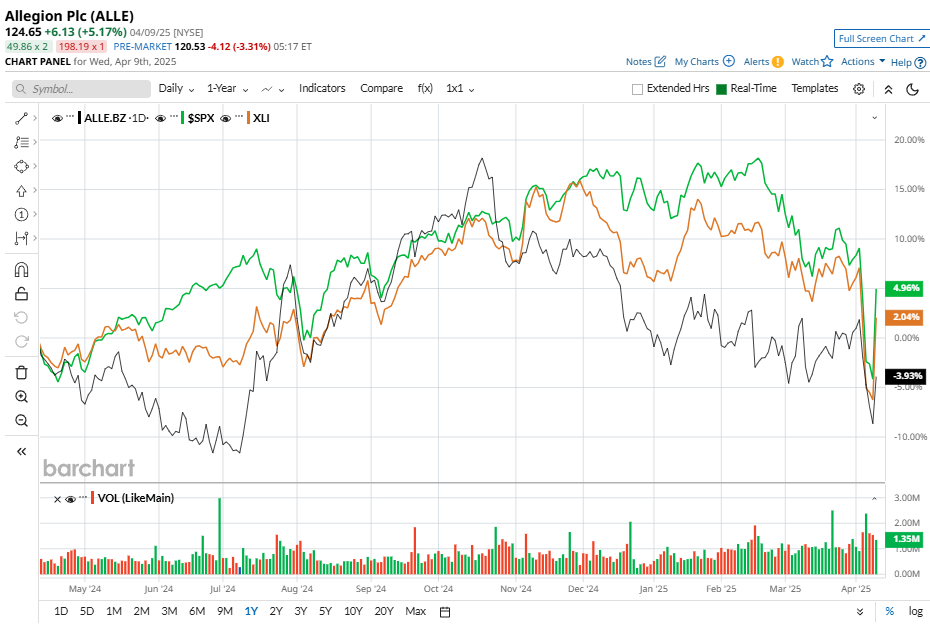

ALLE shares have trailed the broader market over the past 52 weeks, declining 6.9% compared to the S&P 500’s ($SPX) 4.7% gain. The stock has also underperformed the Industrial Select Sector SPDR Fund’s (XLI) 1.3% gain increase during the same period.

Allegion’s stock prices plunged 5.6% after the release of its Q4 results on Feb. 18. It reported net revenues of $945.6 million, marking a 5.4% increase compared to the same period in 2023. Additionally, the Americas segment experienced a 6.4% revenue growth, driven by price realization and volume increases in both non-residential and residential businesses. Its International segment saw a 1.5% revenue rise, attributed to robust demand for its electronics and software-enabled solutions.

Analysts’ consensus opinion on ALLE stock is cautious, with a “Hold” rating overall. Out of nine analysts covering the stock, two advise a “Strong Buy” rating, five give a “Hold,” one suggests a “Moderate Sell,” and one recommends a “Strong Sell.”

ALLE’s average analyst price target is $138.38, indicating a potential upside of 11% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.