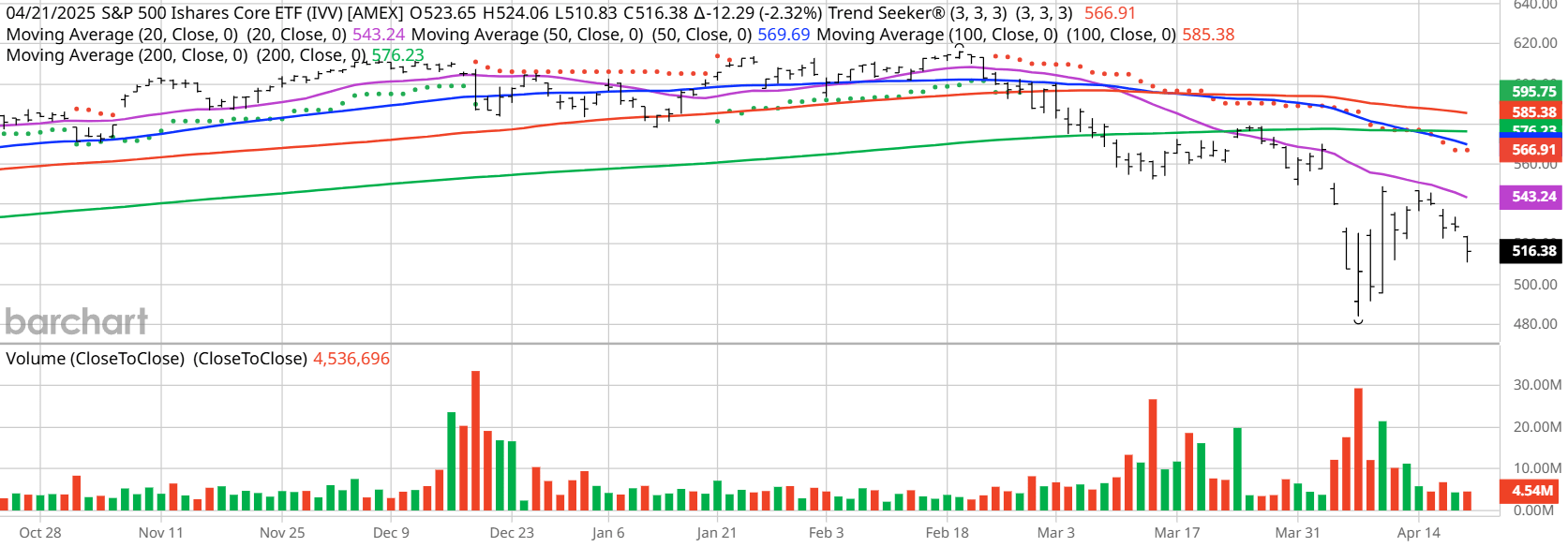

- Today I’m focusing on the charts and data associated with two popular benchmark ETFs: S&P 500 ETF (IVV) and NASDAQ 100 ETF (QQQ).

- IVV has a Trend Seeker “Sell” signal and an 88% “Strong Sell” from Barchart Opinion.

- QQQ has the same readings and is more than 20% below its 52-week high.

Normally I lead with “I found today’s Chart of the Day by using Barchart’s powerful screening functions. I sorted for stocks with the highest technical buy signals, superior current momentum in both strength and direction, and a Trend Seeker “buy” signal. I then used Barchart’s Flipchart feature to review the charts for consistent price appreciation.”

Well, today isn’t one of those days. I ran my screening functions and only five stocks came up – and I have covered all five over the last month. There is nothing positive to write about.

So instead, I’ll spend today showing you the charts and data associated with two of the most popular benchmark ETFs:

IVV Price vs. Daily Moving Averages:

Barchart Technical Indicators for IVV

- Trend Seeker “Sell” signal.

- 88% “Strong Sell” Barchart Technical Opinion.

- -6.58 Weighted Alpha.

- IVV is trading 16.42% below its last 52-week high.

QQQ Price vs. Daily Moving Averages:

Barchart Technical Indicators for QQQ

- Trend Seeker “Sell” signal.

- 88% “Strong Sell” Barchart Technical Opinion.

- -8.34 Weighted Alpha.

- QQQ is trading 20.16% below its last 52-week high

So What Am I Doing Here?

If these charts and data points aren’t telling you to sit tight and let your predetermined stop losses trigger, then just sit on a pile of cash until the Trend Seeker gives you some comfort that the market has bottomed and is finally in recovery, then I’m not doing my job.

Please be careful!

Additional disclosure: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance and reevaluate your stop losses at least on a weekly basis.

On the date of publication, Jim Van Meerten had a position in: IVV , QQQ . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.