With an interesting first quarter in the books, let's take a look at how the charts are setting up.

In the final week of March, equities enjoyed a robust rally. Early in that week, weakness in tech was quickly gobbled up, helping drive both the Nasdaq and the S&P 500 higher.

For the quarter, the SPDR S&P 500 ETF Trust (SPY) ended about 7% higher, while the Invesco QQQ Trust Series 1 (QQQ) climbed more than 20%.

Don't Miss: Tesla Stock Dip: Here's Where the Shares Find Support

The Nasdaq generated the best first-quarter return of the major U.S. market indexes. For what it’s worth, the Dow industrials were the worst performer, eking out a 0.4% gain in the quarter.

That said, the Nasdaq remains the worst-performing index over the past 12 months, while the Dow remains the best-performing index.

Let’s take an updated look at the charts as we head into the second quarter.

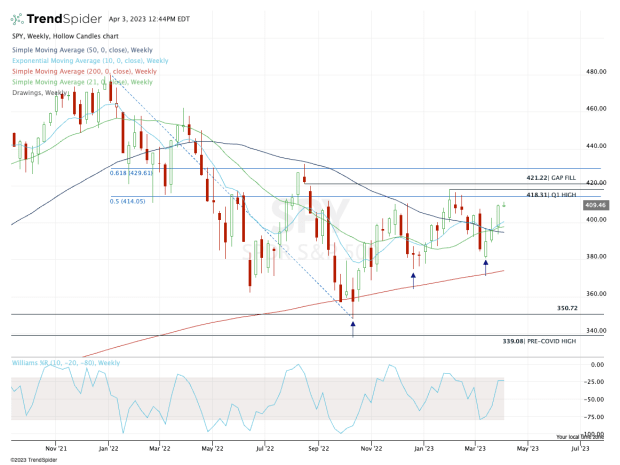

Buy or Sell the SPY in Q2?

Chart courtesy of TrendSpider.com

In the short term, the bulls need to clear $410 to $411 on the upside and hold $400 to $402.50 on the downside.

In the bigger picture, the bulls want to see the SPY clear the March high of $409.70 and push into the $415 area, which was resistance earlier in the quarter. Further, it’s the 50% retracement from the 2022 low up to the all-time high.

Ultimately, the first-quarter high of $418.31 and the gap-fill level at $421.22 create a key zone for the bulls to clear.

Don't Miss: Betting on Wynn Resorts Stock as Breakout Looms

During a pullback, the shares need to hold the $395 to $400 zone. If they can’t do so, it opens the door down to the March low near $380.

On the plus side, the SPY continues to put in a series of higher lows. If the March low is broken, this streak will end, potentially putting the 200-week moving average in play.

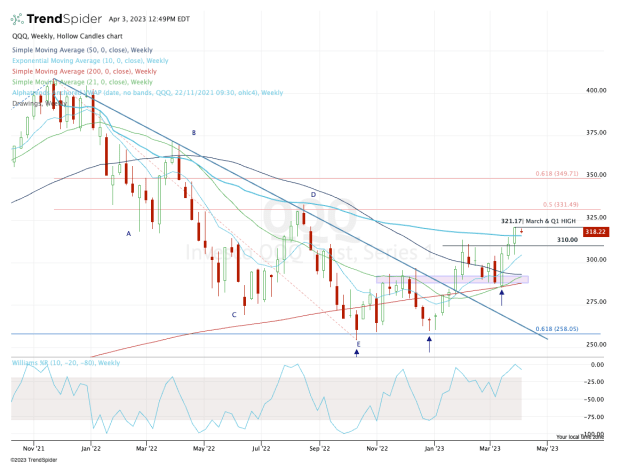

Trading the QQQ ETF in Q2

Chart courtesy of TrendSpider.com

Of the four major U.S. stock market ETFs, the QQQ was hit the hardest, suffering a peak-to-trough decline of 38% from the all-time high. Now it's riding a three-week win streak with a total rally of more than 12%, and the QQQ bulls are looking to recoup more of their 2022 losses.

From here, the bulls want to see the QQQ hold the $310 level and the 10-week moving average, keeping its uptrend firmly intact.

If it loses these levels, the $288 to $293 zone could be in play, where a bevy of weekly moving averages currently reside.

Don't Miss: Buy Johnson & Johnson Stock and Its 3% Dividend Yield?

Ideally, the QQQ will be able to hold the VWAP measure, which is anchored back to the all-time high. This measure had been resistance on every QQQ rally in the bear market. So it's far holding above this measure, and the bulls are hopeful that it will act as another feather in their cap.

If the QQQ can clear the March and first-quarter high of $321.17 and stay above it, it opens the door back into the low-$330s, then potentially puts $350 in play. The latter is the 61.8% retracement from the 2022 low to the all-time high.

In short, keep the VWAP measure in mind on the downside, followed by $310 and the 10-week moving average. On the upside, watch $321, then $330.