Financial giants have made a conspicuous bullish move on Lowe's Companies. Our analysis of options history for Lowe's Companies (NYSE:LOW) revealed 9 unusual trades.

Delving into the details, we found 66% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 7 were puts, with a value of $359,168, and 2 were calls, valued at $55,000.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $250.0 to $270.0 for Lowe's Companies over the recent three months.

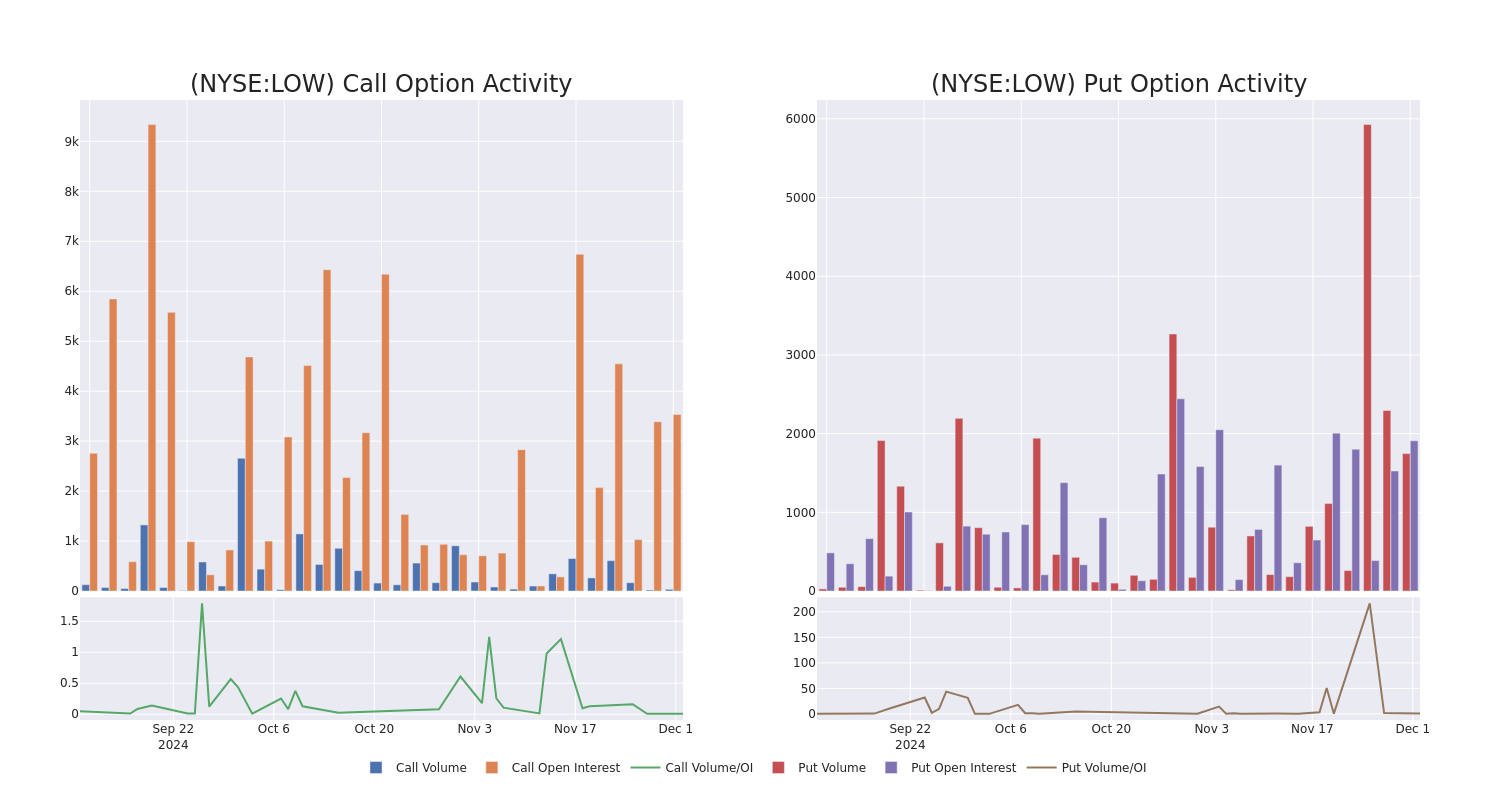

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Lowe's Companies's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Lowe's Companies's substantial trades, within a strike price spectrum from $250.0 to $270.0 over the preceding 30 days.

Lowe's Companies Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LOW | PUT | SWEEP | BULLISH | 01/17/25 | $7.2 | $7.15 | $7.15 | $270.00 | $128.7K | 1.9K | 646 |

| LOW | PUT | TRADE | BULLISH | 01/17/25 | $7.45 | $6.95 | $7.15 | $270.00 | $39.3K | 1.9K | 356 |

| LOW | PUT | TRADE | BULLISH | 01/17/25 | $7.7 | $6.9 | $7.15 | $270.00 | $39.3K | 1.9K | 301 |

| LOW | PUT | TRADE | BULLISH | 01/17/25 | $7.4 | $6.65 | $6.9 | $270.00 | $37.9K | 1.9K | 221 |

| LOW | PUT | TRADE | BEARISH | 01/17/25 | $6.9 | $6.75 | $6.9 | $270.00 | $37.9K | 1.9K | 221 |

About Lowe's Companies

Lowe's is the second-largest home improvement retailer in the world, operating more than 1,700 stores in the United States, after the 2023 divestiture of its Canadian locations (RONA, Lowe's Canada, Réno-Dépôt, and Dick's Lumber). The firm's stores offer products and services for home decorating, maintenance, repair, and remodeling, with maintenance and repair accounting for two thirds of products sold. Lowe's primarily targets retail do-it-yourself (around 75% of sales) and do-it-for-me customers, but has expanded its commercial and professional business clients to 25% from less than 20% in the past six years. We estimate Lowe's captures a high-single-digit share of the domestic home improvement market, based on US Census data and management's market size estimates.

After a thorough review of the options trading surrounding Lowe's Companies, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Lowe's Companies

- Currently trading with a volume of 541,140, the LOW's price is down by -0.45%, now at $271.2.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 85 days.

Expert Opinions on Lowe's Companies

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $293.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Telsey Advisory Group persists with their Outperform rating on Lowe's Companies, maintaining a target price of $305. * Maintaining their stance, an analyst from Mizuho continues to hold a Outperform rating for Lowe's Companies, targeting a price of $282. * Consistent in their evaluation, an analyst from Bernstein keeps a Outperform rating on Lowe's Companies with a target price of $301. * An analyst from Truist Securities persists with their Buy rating on Lowe's Companies, maintaining a target price of $310. * Consistent in their evaluation, an analyst from DA Davidson keeps a Neutral rating on Lowe's Companies with a target price of $270.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Lowe's Companies options trades with real-time alerts from Benzinga Pro.