Video game retailer GameStop Corp. (GME), much-favored among the meme stock traders, remains a stock I would refrain from advising to add to your portfolio, considering its unclear business strategy.

"We remain convinced that GameStop is doomed, with declining physical software sales and a shift of sales to subscription services and digital downloads sealing its fate," Wedbush analysts Michael Pachter and Nick McKay said.

While GME has been venturing into the crypto, unveiling a new wallet, it recently announced its plans to discontinue it, citing the “regulatory uncertainty of the crypto space.”

Given no indications of a corporate turnaround in the foreseeable future, it seems wise to maintain a distance from GME stock. Outlined below are various crucial metrics that align with my bearish perspective.

GameStop's Financial Rollercoaster: Reviewing Fluctuations in Net Income, Revenue and Gross Margin (2020-2023)

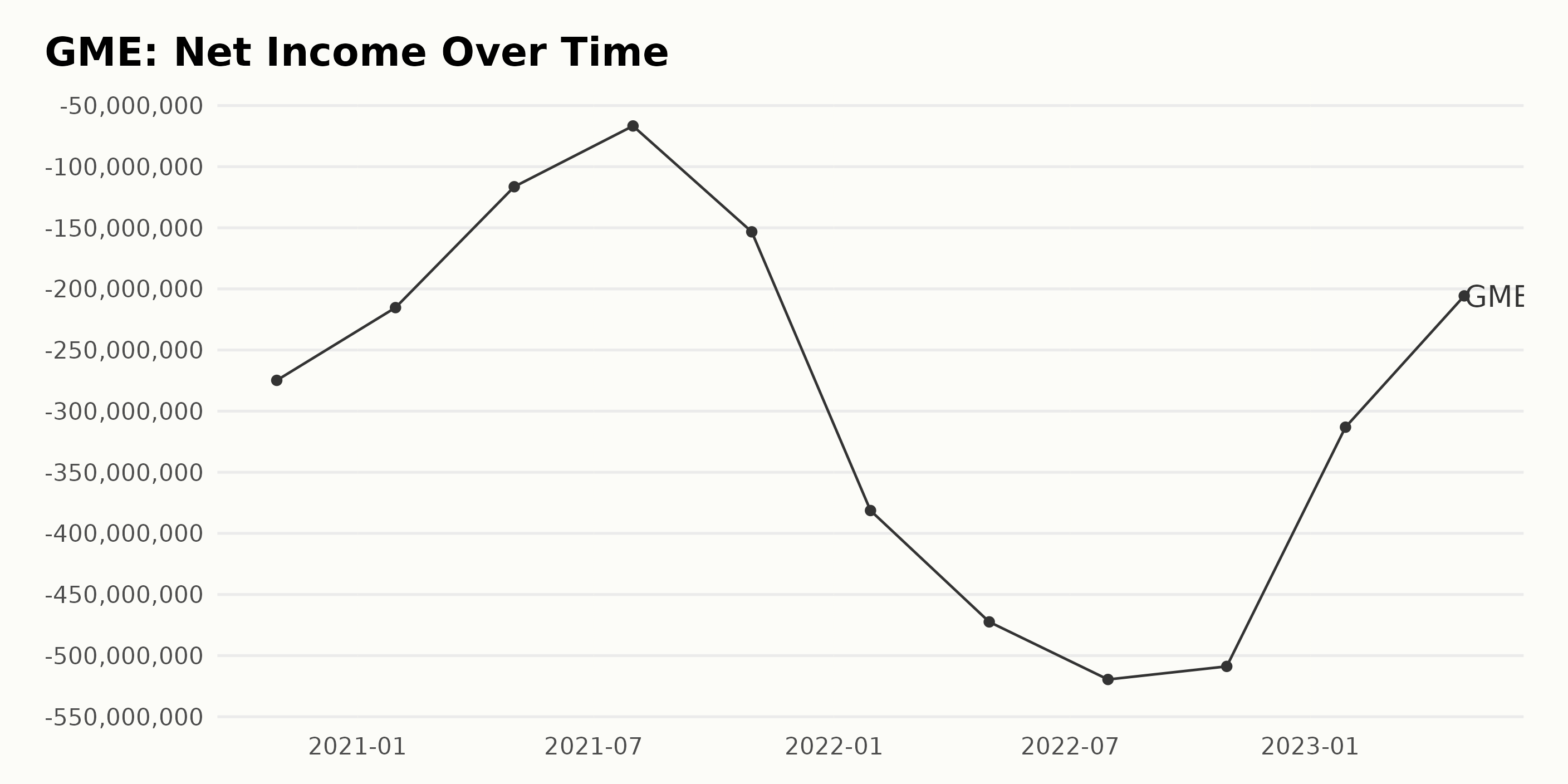

The trailing-12-month net income of GME has fluctuated from October 2020 to April 2023. The data reveals a negative growth pattern with several ups and downs.

- As of October 2020, the company reported a net income of -$274.8 million.

- In the first quarter of 2021, there was a slight improvement in net income to -$215.3 million in January, which further improved to -$116.4 million by May 2021. However, by July 2021, it was -$66.7 million.

- Unfortunately, the end of 2021 to the beginning of 2022 saw an increased loss, with GME recording its net income at -$153.3 million in October 2021, -$381.3 million by January, and -$472.4 million by April 2022.

- The highest loss for the corporation came in July 2022 at -$519.5 million before reducing marginally to -$508.8 million by October 2022.

- There was a notable reduction in the loss for the first quarter of 2023, with the net income recorded at -$313.1 million in January, followed by an impressive pullback to -$205.7 million by April 2023.

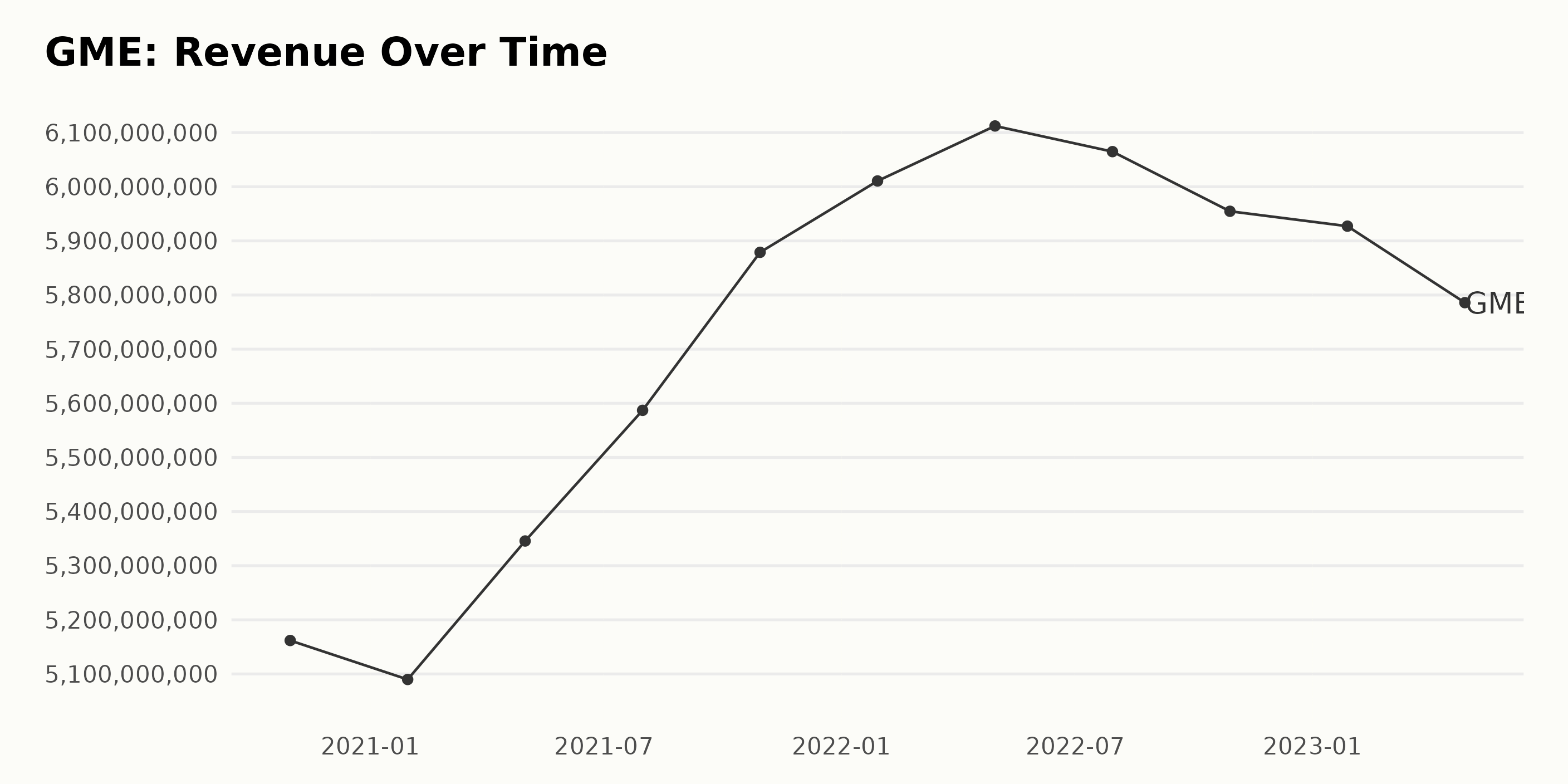

The trailing-12-month revenue trends for GME witnessed different fluctuations from October 2020 to April 2023.

- In October 2020, the revenue stood at $5.16 billion.

- There was a slight decrease to $5.09 billion by January 2021.

- A rise was observed from May 2021 to July 2022, peaking at $6.11 billion in April 2022.

- After this peak, a downward trend ensued, declining to $5.95 billion in October 2022 recovering slightly to $6.07 billion in July 2022.

- Post-July 2022, the revenue continued to slide down, finishing at $5.79 billion in April 2023.

The most recent figures from April 2023 show a significant downturn from the previous year's peak. Although there were periods of growth and decline during this series, the overall trajectory from the first value of $5.16 billion in October 2020 to the last value of $5.79 billion in April 2023 suggests an increase of approximately 12.22%. However, the focus on more recent data indicates that GME is currently experiencing a downturn in its revenue.

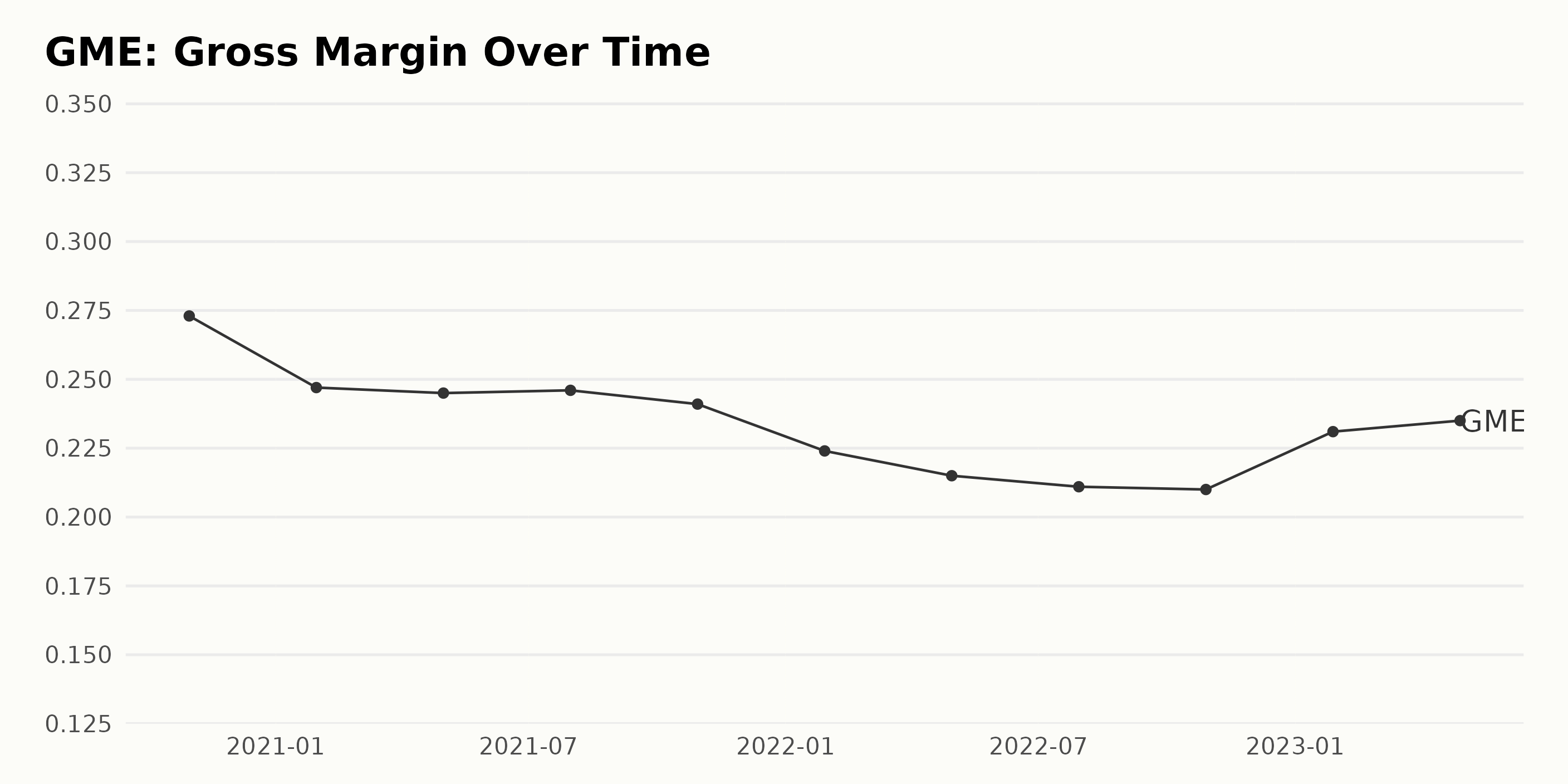

The gross margin for GME has seen significant fluctuations over the analyzed period. Notably:

- In October 2020, the gross margin stood at 27.3%.

- Over the next year, a clear downward trend was evident. By October 2021, it had dropped to 24.1%, representing an approximate reduction of 3.2 percentage points.

- This downward trend continued into 2022, with gross margin falling to 21% by October 2022.

- There was a subsequent rebound in 2023, with the gross margin improving to 23.5% by April 2023.

From the first value in October 2020 to the last in April 2023, there is an overall decrease of approximately 3.8 percentage points, indicating a negative growth rate for this period.

A more recent analysis reveals a pattern of fluctuation with slumps followed by recovery. Following the dip to 21% in October 2022, the gross margin increased to 23.1% by January 2023 and rose to 23.5% by April 2023. This suggests a reversal in the previous downward trend in gross margin, as the company experienced a growth rate of 2.5 percentage points within this five-month period.

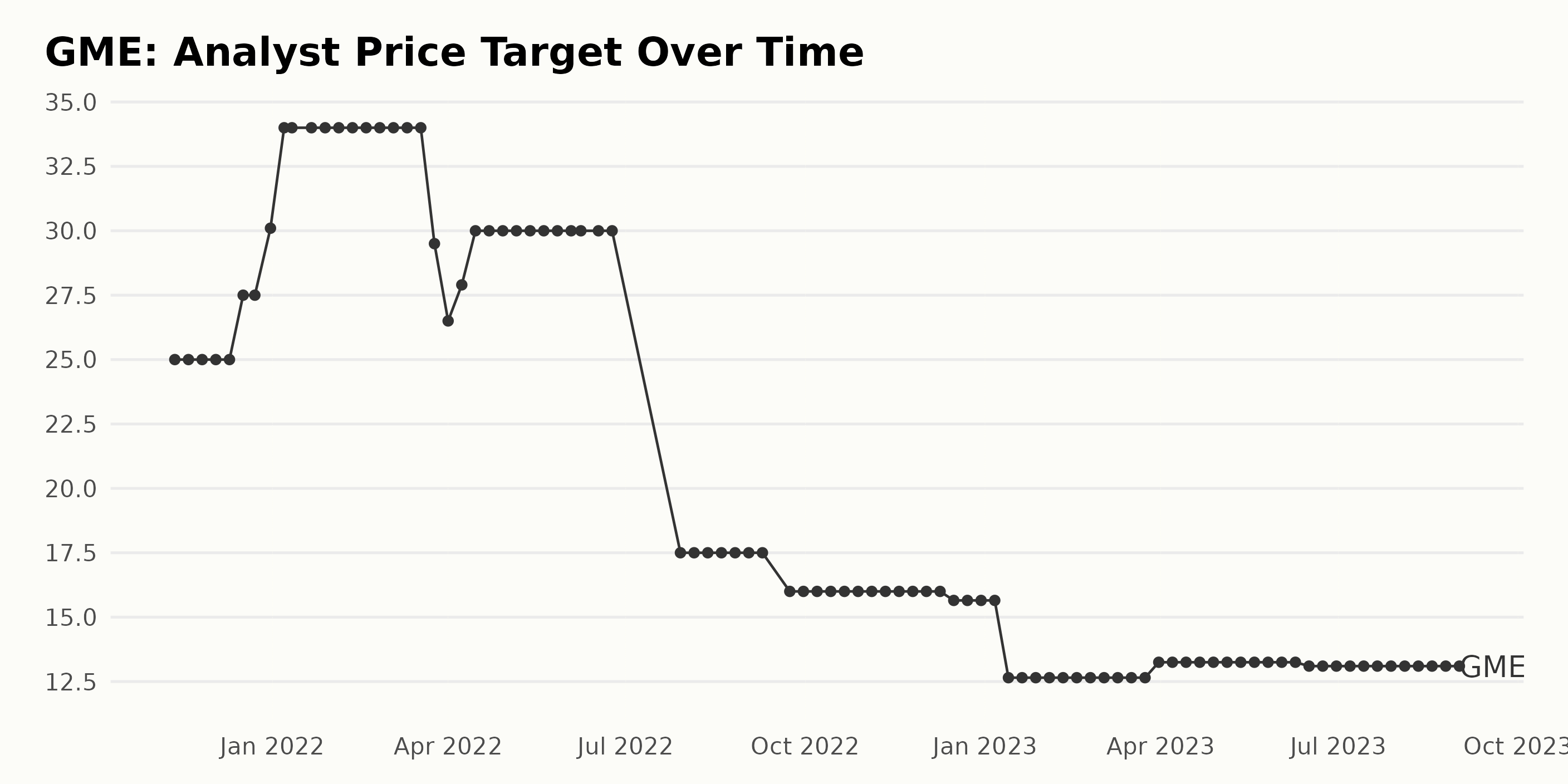

Analyzing the Analyst Price Target predictions for GME from November 2021 to September 2023, the following trends and fluctuations can be ascertained:

- Between November 2021 and December 2021, the Analysts Price Target remained stable at $25, then showed a gradual increase, reaching up to $34 by the start of February 2022.

- The subsequent months from February to June 2022 saw the target being maintained at $34 without much variation.

- Towards the end part of March 2022, there was a minor decline to $29.5, after which it steadily climbed back to reach $30 by April.

- From May until the end of June 2022, Analysts set a stable price target of $30.

- A significant drop occurred in July 2022, with the Analyst Price Target slowing down to $17.5 and continuing at the same level till September 2022.

- Post-September 2022, there was a slight decrease in the Price Target to $16, which persisted till mid-December.

- Subsequently, the Price Target further dropped to $15.65 in the last weeks of December 2022 and remained the same into the early weeks of January 2023.

- There's a notable decline in mid-January 2023, where the Price Target came down to $12.65 and changed nominally to $13.25 at the end of March 2023.

- The remaining period, from April to September 2023, saw a relatively stable Analysis Price Target that fluctuated between $13.1 and $13.25.

Overall, from the initial value of $25 in November 2021 to the latest value of $13.1 in September 2023, the Analyst Price Target for GME depicts a relative decrease or negative growth rate.

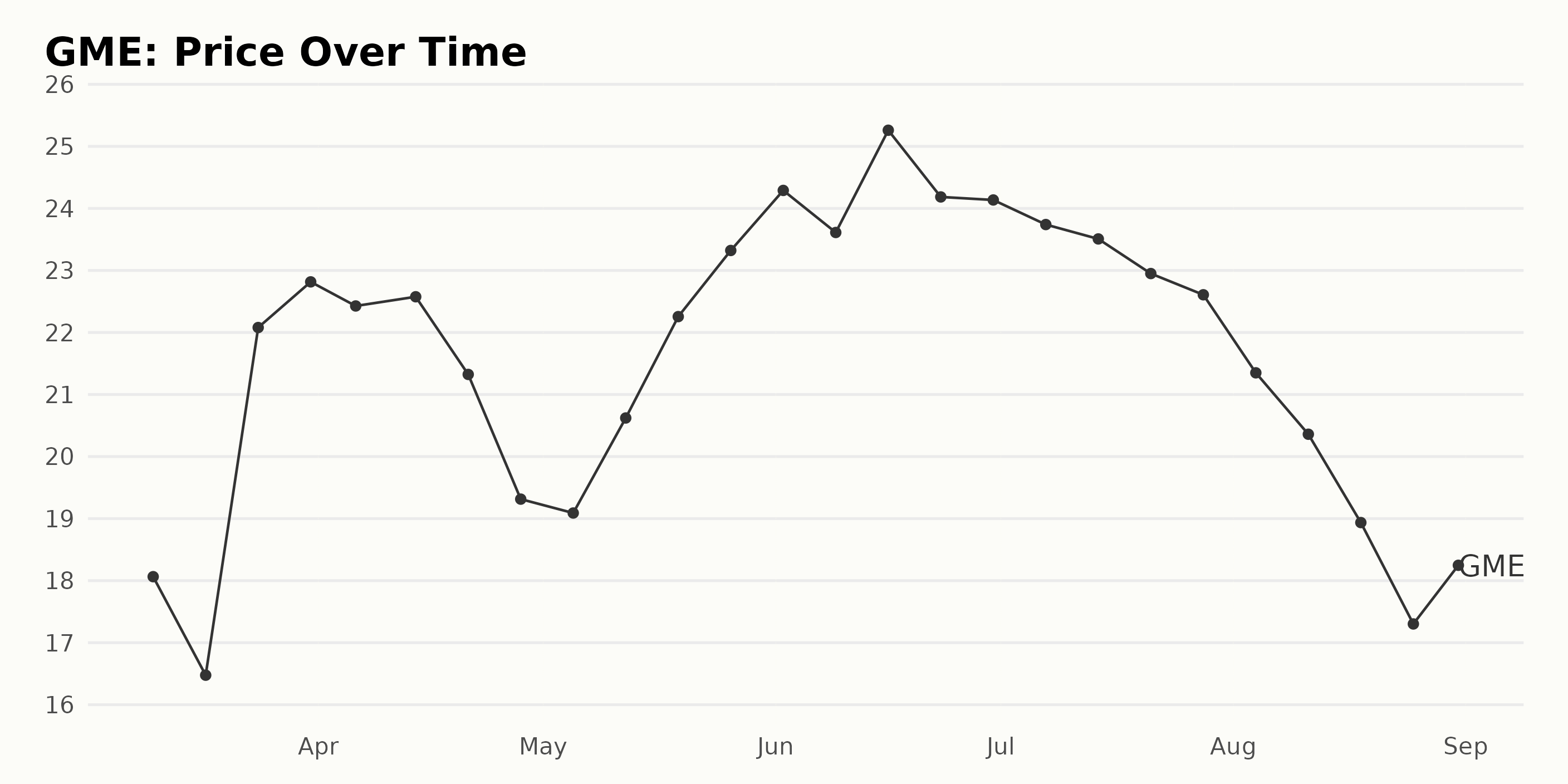

GameStop Stock: A Rollercoaster Ride from March to August 2023

Based on the provided data for the share prices of GME from March to August 2023, the following trends and growth rates are observed:

- On March 10, 2023, the share price was at $18.06. Over the course of a week, by March 17, 2023, it decreased to $16.48.

- There was a significant increase between March 17, 2023, and March 31, 2023, where the price rose from $16.48 to $22.82.

- During April 2023, there was a fluctuation as the price initially decreased slightly to $22.43 on April 6, 2023, then experienced a slight peak at $22.58 by April 14, 2023, before eventually falling to $19.31 at the end of the month.

- In May 2023, there was an overall upward trend, with the price rising from $19.09 at the beginning of the month to $23.32 by the end of the month.

- In June 2023, a similar pattern continued, with the price experiencing fluctuations but overall ascending from $24.29 to $25.26 in mid-June before decelerating to $24.14 by the end of the month.

- From July to August 2023, there was a clear decelerating trend as prices consistently decreased from $23.74 at the start of July to $18.25 at the end of August.

In summary, the overall trend of GME stock prices was first rising during March to June 2023, followed by a slowdown and eventual decline in the months of July and August 2023. The growth rate seems to be somewhat inconsistent within these periods but still indicates an initial period of acceleration followed by a clear deceleration. Here is a chart of GME's price over the past 180 days.

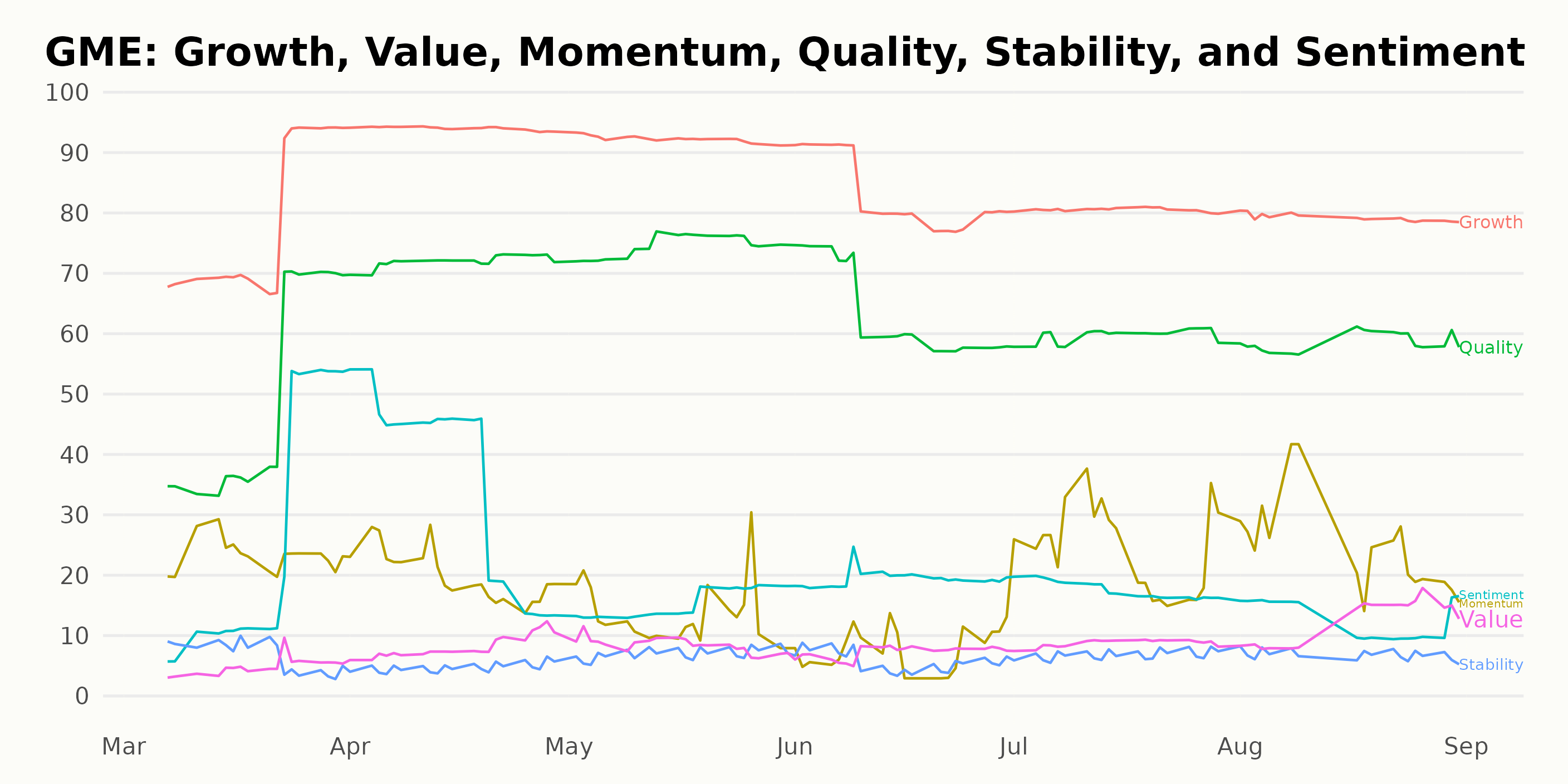

Analyzing GME’s Growth, Quality, and Momentum

GME has an overall D rating, translating to a Sell in our POWR Ratings system. It is ranked #41 out of the 44 stocks in the Specialty Retailers category.

In the analysis of GME’s POWR ratings, it is clear that these three dimensions - Growth, Quality, and Momentum - consistently show the most noteworthiness.

- Growth

On March 31, 2023, GME's Growth rating stands at 79. This score experienced a steady rise in the following months, reaching its peak at 94 in April 2023. Following this, there's been a gradual decrease, with the latest figure being 79 in August 2023. Despite this decline, the Growth rating has remained relatively high throughout.

- Quality

For the Quality dimension, the rating was 50 in March 2023. It showed a significant increase, hitting a high of 75 in May 2023, before it started slowly decreasing again. The rate sat at 59 in August 2023, indicating a slight downward trend over the course of the five months.

- Momentum

The Momentum dimension saw fluctuations throughout the observed period. Starting at 23 in March 2023, it dropped to 20 in April but increased to 24 by July 2023 before slightly rising to its highest at 25 in August 2023. While the magnitude of change was not as pronounced as other dimensions, the upward trend in recent months is worth noting.

Overall, GME demonstrated the highest ratings in terms of Growth, followed by Quality and Momentum, which all exhibited interesting trends over the selected timeframe.

Stocks to Consider Instead of GameStop Corporation (GME)

Other stocks in the Specialty Retailers sector that may be worth considering are Betterware de Mexico, S.A.B. de C.V. (BWMX), Aaron's Inc. (AAN), and Aeon Co. Ltd. (AONNY) -- they have better POWR Ratings. For exploring more A and B-rated Specialty Retailers stocks, click here.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

GME shares were trading at $18.39 per share on Friday morning, down $0.16 (-0.86%). Year-to-date, GME has declined -0.38%, versus a 18.84% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

What's the September 2023 Gameplan for GameStop (GME)? StockNews.com